Mr. Beast’s Financial Gamble

In October 2025, MrBeast filed a trademark application for “MrBeast Financial” with the United States Patent and Trademark Office.

The 27-year-old, known for being buried alive as part of his video content and commanding 450 million fans in the digital world, is planning to expand his business empire from fast food and snacks into banking, investments, and even cryptocurrency trading platforms.

According to the filing, he envisions a SaaS platform offering cryptocurrency payment processing, microloans, and investment management services. MrBeast and his $5 billion business empire are preparing to enter a sector defined by trust, risk, and regulation: finance.

This isn’t a sudden leap. He already owns the Feastables snack brand and the virtual restaurant chain MrBeast Burger. But financial services are fundamentally different—they strike at society’s most sensitive core.

More tellingly, just a year ago, he was at the center of controversy over crypto investments. Blockchain researchers accused him of using his influence to “pump and dump” several projects, earning over $10 million.

Now, this polarizing traffic magnet is set to bring his predominantly Gen Z fanbase into the highly regulated financial world.

The stakes are high. His reputation is on the line, and a generation’s trust is at play. The outcome could redefine the dynamics between influence, finance, and trust.

Gen Z’s Banking “Exodus”

Traditional banks are losing their future.

Young people no longer walk into the marble and glass-walled branches. They switch banks two to three times more often than their parents—not for better deposit rates, but for better digital experiences. Only 16% of Gen Z say they “strongly trust” traditional banks—millennials are nearly twice as trusting, and baby boomers almost three times as much.

To a generation raised on algorithms and screens, a suit-and-tie bank teller is far less trustworthy than a smooth app interface.

Traditional banks have spent a century building trust: physical branches represent “accessibility,” brand history signals “resilience,” government backing means “security,” and marble counters with suited staff convey “professionalism” and “stability.” These symbols and systems worked in the past.

Bank of America | Source: BloomBeag

But for Gen Z, living in a high-frequency, instant-feedback world, what’s needed isn’t static, institutional proof of trust but dynamic, tangible trust experiences. A bank’s century-old legacy matters less than a user-friendly app, responsive support, and products tailored to individual needs.

The deeper issue is Gen Z’s entrenched dissatisfaction with traditional finance. They grew up after the 2008 financial crisis, watching big banks get bailed out while ordinary people faced unemployment and lost wealth. They’ve seen repeated data breaches and Wall Street elites abandon ethics for profit. These experiences have hardwired their skepticism toward the financial system.

The majority of Gen Z are influenced by financial influencers, discovering new financial products on social media, learning investment tips on Xiaohongshu, and following creators on TikTok. This behavior reflects a collapse—and rebuild—of the foundations of trust.

Gen Z isn’t searching for “better banks”—they’re seeking something fundamentally different: an ecosystem that merges financial services, social experience, and personal values. They want finance to go beyond cold numbers, to understand, respond to, and even represent their ideals.

This is exactly the opportunity MrBeast recognizes.

His connection with fans goes beyond a brand-consumer relationship; it’s a quasi-social bond. Social media scholars call this “parasocial interaction,” where viewers develop a strong, one-way emotional connection to a media personality, as if they’re friends.

MrBeast is a master of this dynamic.

His weekly videos are elaborate performances of wealth redistribution: 100 kids challenge the world’s strongest man, strangers survive in a nuclear bunker for 100 days to win $500,000, or MrBeast himself is buried alive for 50 hours—each extreme challenge comes with ongoing cash giveaways.

The cash, cars, and homes he’s given away total tens of millions of dollars. These giveaways aren’t just marketing—they are the content, and the ongoing fulfillment of a trust contract with his fans.

MrBeast’s 50-hour burial challenge | Source: Instagram

Each giveaway proves he’s true to his word, his promises are real, and he’s willing to share his earnings. This “tangible generosity” is more persuasive to Gen Z than any brand declaration.

In 2024, MrBeast partnered with fintech company MoneyLion for a $4.2 million giveaway. Young users downloaded MoneyLion’s app out of trust for MrBeast—not because they chose a financial product, but because they followed someone they believe in.

The campaign’s success showed MrBeast a bigger opportunity: if he can convert his influence directly into financial services—cutting out the middlemen—he can achieve unprecedented monetization efficiency.

Traditional banks say, “We have a century of history, we survived the Great Depression and financial crises, and we’re backed by the government.”

MrBeast says, “I just gave 100 people $100,000 each.”

The former builds trust on legacy; the latter on present action. One relies on institutional endorsement, the other on amplification through digital channels. One is static and abstract, the other dynamic and visible.

But the paradox is, Gen Z’s distrust of finance stems from the latter’s transparency and ethical issues. Financial services have long ranked low in global trust, and young people’s dissatisfaction often comes from the industry’s moral lapses under profit pressure.

So, how can MrBeast—a celebrity with a controversial crypto record—become their financial savior?

From “Scythe” to “House”: The Thin Line

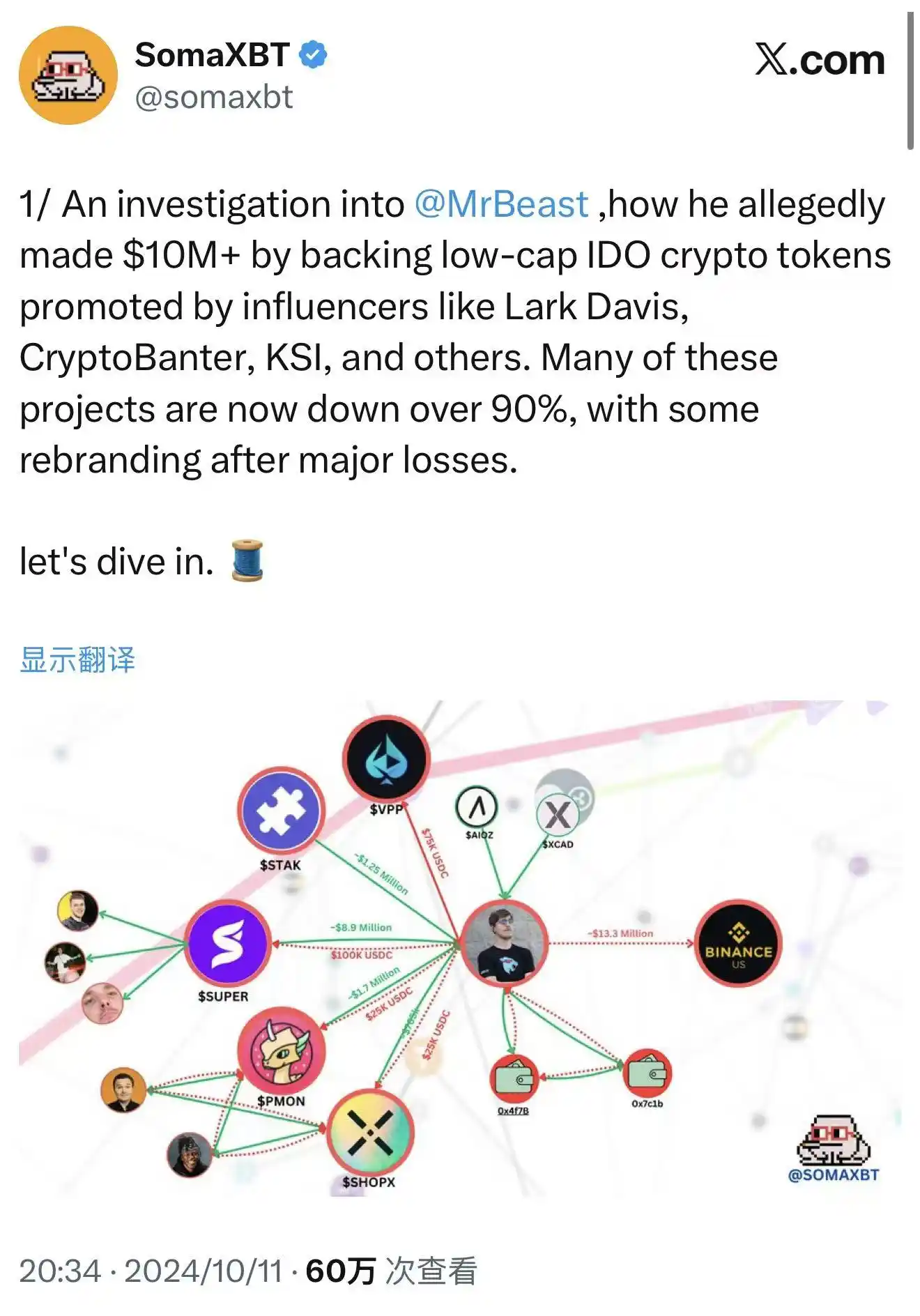

In October 2024, blockchain sleuth SomaXBT published a detailed exposé on X, dissecting MrBeast’s crypto dealings.

The report tracked wallets linked to MrBeast, alleging his involvement in multiple pump-and-dump schemes. These claims are backed by transparent blockchain records—every transaction is permanent and undeniable.

SomaXBT exposes MrBeast | Source: X

The most notable case: SuperFarmDAO. MrBeast invested $100,000 at presale, receiving one million SUPER tokens, then used his massive influence to promote the project. Token prices soared, and then he sold.

His $100,000 investment netted millions, while countless retail investors lost out. Many bought in, thinking his involvement meant safety—only to be left holding the bag when prices collapsed.

Similar tactics appeared in Polychain Monsters, STAK, VPP, SHOPX, and more. SomaXBT estimates MrBeast’s total profits exceeded $10 million.

Legally, these actions may not have crossed the line. MrBeast didn’t promise to hold long-term or break explicit securities laws. Crypto was a regulatory gray area, and traditional rules didn’t fully apply. In the stock market, this might be market manipulation—but those rules didn’t govern crypto.

Ethically, the controversy is real. Many in crypto argue that leveraging influence to pump and dump tokens exploits fan trust and damages industry credibility. When top influencers use their reach to profit from retail investors, the market resembles Wall Street’s worst games.

MrBeast’s team denies direct involvement, claiming investments were managed by third parties. But even if true, his name and influence attracted retail investors.

When he mentions a project or features it in a video, fans perceive it as endorsement. The trigger may be elsewhere, but the bullet bears his name.

Now, in October 2025—less than a year after SomaXBT’s exposé—MrBeast files the “MrBeast Financial” trademark. His proposed services include “cryptocurrency exchange” and “decentralized exchange operation”—the very areas where controversy erupted.

He seems to be signaling: yesterday’s “scythe” is now seeking to become a compliant “house.”

Two business logics are in play, possibly at once.

First, commercial “whitewashing”: by building a compliant platform, he seeks to rewrite his speculative past and rebrand as a responsible financial provider. It’s a classic move—many former speculators became establishment bankers by founding legitimate institutions. J.P. Morgan’s founder was once a radical speculator before earning Wall Street’s respect.

Second, a deeper logic: he sees a more efficient way to monetize influence as financial capital. Instead of relying on third-party platforms, he can build his own and control the ecosystem—earning from content, every transaction, every loan, every investment.

This is the creator economy’s endgame: content becomes finance, influence becomes capital, fans become clients. If he succeeds, MrBeast will pioneer the influencer-banker model.

Whatever the logic, he faces a central challenge: finance runs on trust, and broken trust is costly to rebuild. He must convince regulators that he now has the systems, capacity, and intent to protect consumers after exploiting retail investors in crypto.

And regulatory risk remains ever-present.

Navigating Regulatory Uncertainty

In 2025, U.S. crypto regulation is shifting.

On July 31, SEC Chair Paul Atkins launched “Project Crypto” to reform securities law and encourage crypto innovation. It’s a major signal. The SEC had cracked down on Coinbase, Binance, and others, seeking to bring crypto under securities rules. But by 2025, the tone changed.

On September 29, the SEC and CFTC held a landmark joint roundtable on spot crypto trading—the first ever. It marked a move from “crackdown” to “clear rules.”

SEC & CFTC roundtable | Source: YouTube

For would-be crypto finance entrants, this is a rare regulatory window. Agencies are signaling openness, balancing consumer protection and innovation. The USPTO timeline suggests the “MrBeast Financial” trademark will be reviewed mid-2026, with final approval or rejection by late 2026. So even in the best case, the platform won’t launch before 2027.

But a window isn’t a free pass. “MrBeast Financial” faces complex, multi-layered regulatory hurdles.

Federally, the SEC will review securities involvement. If his platform offers investment products classified as securities, it must register as a broker or investment adviser and meet stringent oversight. The CFTC will regulate derivatives and commodities, policing manipulation and fraud. FinCEN will require robust AML and KYC compliance—meaning strong ID systems, suspicious activity monitoring, and reporting.

If the platform promotes cryptocurrency payments and trading, it may be considered a Money Services Business (MSB), triggering further compliance: registration, regular reports, and audits. Each requirement demands major investments in staff, tech, and resources.

On the state level, things get more complicated. U.S. financial regulation is a dual federal-state system; operating crypto exchanges or mobile banks means securing dozens of state money transmitter licenses (MTLs). Each state has its own rules and processes, with high costs and long timelines.

MrBeast’s direct appeal to young retail investors puts his business under the regulatory microscope. Regulators will ask: does a creator whose brand is built on extreme content possess the “prudence” to manage consumer deposits and investments?

It’s about more than compliance—it’s reputational risk. Regulators assess not just technical and financial capacity, but “risk culture” and governance. They review company history, management integrity, professionalism, and whether the business can protect consumers long-term.

Just before the trademark filing, MrBeast’s video “Would You Risk Your Life for $500,000?” caused a stir. A stuntman escaped a simulated burning building for prize money. MrBeast defended safety as “stricter than anyone imagines,” with professional teams and controlled risk.

Critics argue that such high-risk content promotes the idea of exchanging personal safety for financial reward. Even if risks are low, the presentation suggests “risking your life for cash.” Young viewers may be influenced negatively.

Such controversy can be negative evidence for financial license applications. Regulators may see it as “risk culture.” Would a creator willing to risk lives for cash also design high-risk, high-reward financial products that harm consumers?

This concern is justified. Financial product design requires extreme caution; speculative or risky features can cause major losses. Celebrity status doesn’t outweigh financial compliance and ethics.

Financial product design demands expertise and genuine concern for consumers, not just brand power. Agencies and consumer groups scrutinize celebrity financial products more intensely; any questionable fees or risk structures are magnified.

MrBeast’s challenge is complex. He must prove compliance and fairness, and rebuild his ethical reputation after crypto controversy. Within the regulatory window, he must balance his “Beast” persona, which attracts youth, with enough “prudence” to satisfy regulators.

This is a delicate balancing act. One misstep could doom the project; success could reshape the model, converting the trust of 445 million fans into financial capital.

An Ultimate Experiment in Trust

MrBeast’s financial wager is less a business adventure than an ultimate experiment in the nature of trust in our era.

It’s the convergence of three forces: the financialization of influencer economy, Gen Z’s revolt against traditional finance, and crypto’s regulatory evolution.

In 2025, these forces create a unique window—and immense risks.

If he succeeds, it will show that trust can be built quickly via personal charisma and digital channels, not just via institutional legacy. Traditional banks may find their century-old reputations mean little to Gen Z.

Banks will have to rethink youth strategies—how to build trust in a digital, algorithm-driven world. They may need to embrace influencer language, social media logic, and partnerships to reach younger users.

Other influencers will see a new path for monetization. The creator economy will shift: content creators can become financial service providers. We may see more “influencer banks,” “influencer funds,” and “influencer insurance.” The boundary between influence and trust will be redrawn.

If he fails, it reaffirms a timeless lesson: influence can create spectacle, but not genuine trust—especially in finance, where ethics and compliance can swallow any fanbase. Attention isn’t enough to earn the financial world’s most valuable asset: responsibility.

It will remind regulators that influencer-driven financial innovation needs stricter rules. As financial services merge with content creation and fandom, old frameworks may not work. Regulators must consider whether an influencer with hundreds of millions of fans poses systemic risk, and how to protect consumers when fan relationships become financial relationships.

MrBeast’s brand is built on spectacle and extremes—burials, bunkers, challenges, all about breaking conventions and creating surprise.

But finance requires stability and prudence—predictability, safety, and longevity.

Can he maintain his entertainment edge and build a trustworthy financial brand? It’s not just commercial—it’s about identity. When a creator famous for “crazy” stunts asks you to trust him with your money, is he expanding his brand, or diluting its core?

This paradox has no easy answer. Maybe MrBeast will create a new hybrid financial brand, combining entertainment and professionalism. Or perhaps he’ll discover the two are incompatible and be forced to choose.

Whatever happens, the wager has begun. It forces everyone to reconsider, in a media-saturated era: who deserves our trust—the suited institutions speaking jargon, or the influencer who brings us joy on screen?

When the first transaction occurs on MrBeast Financial—be it a buy or sell—that user casts a vote, answering the trust question for our time. Millions of young people will use real money to write the outcome of this experiment.

Statement:

- This article is reprinted from [BlockBeats] and is copyright of the original author [Sleepy]. If you object to this reprint, please contact the Gate Learn team for prompt handling according to relevant procedures.

- Disclaimer: The views and opinions in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless referencing Gate, copying, distributing, or plagiarizing the translated article is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?