- Trending TopicsView More

1.1K Popularity

13K Popularity

48.1K Popularity

167.2K Popularity

202.9K Popularity

- Hot Gate FunView More

- MC:$809.8KHolders:10607

- MC:$9.3MHolders:1099

- MC:$177.2KHolders:3289

- MC:$729.4KHolders:137

- MC:$705.1KHolders:22757

- Pin

- Are you a true GT Holder? 😎

Take a look — which one is the real GT? 💎

💰 Join the fun! 5 lucky users will each win a $10 Position Voucher!

👉 How to participate:

1️⃣ Follow Gate_Square

2️⃣ Like this post

3️⃣ Comment with your answer

🗓️ Deadline: October 31, 2025, 24:00 (UTC+8) - 📣 Creators, Exciting News!

Gate Square Certified Creator Application Is Now Live!

How to apply:

1️⃣ Open App → Tap [Square] at the bottom → Click your avatar in the top right

2️⃣ Tap [Get Certified] under your avatar

3️⃣ Once approved, you’ll get an exclusive verified badge that highlights your credibility and expertise!

Note: You need to update App to version 7.25.0 or above to apply.

The application channel is now open to KOLs, project teams, media, and business partners!

Super low threshold, just 500 followers + active posting to apply!

At Gate Square, everyone can be a community leader! � - 🚀 #GateNewbieVillageEpisode3 ✖️ @CryptoSelf

📈 Share your trading journey | 💡 Discuss market insights | 🤝 Be part of the Gate Family

⏰ Event Date: Oct 17 04:00 – Oct 24 16:00 UTC

How to Join:

1️⃣ Follow Gate_Square + @CryptoSelf

2️⃣ Post on Gate Square with the hashtag #GateNewbieVillageEpisode3

3️⃣ Share your learning journey, trading insights, or personal growth stories

— The more genuine and inspiring your post, the higher your chance to win!

🎁 Rewards

3 lucky winners → $50 Futures Trial Voucher

✨ Every lesson counts—join us on Gate Square and grow smarter together! - Dear Gate Square users, we’re excited to announce a brand-new upgrade to our user interface! The new version is simpler, smoother, and packed with many thoughtful new features. Update now and explore what's new! What do you think of the new Gate Square experience? Which features do you like most? Have you noticed any surprises or improvements? Share your experience now to split a $100 prize pool!

🎁 We'll select 10 lucky users, each winning $10 Futures Voucher!

How to participate:

1⃣️ Follow Gate_Square;

2⃣️ Create a post with the hashtag #MyGateSquareUpgradeExperience, sharing your feedback a - 💥 Gate Square Event: #PostToWinFLK 💥

Post original content on Gate Square related to FLK, the HODLer Airdrop, or Launchpool, and get a chance to share 200 FLK rewards!

📅 Event Period: Oct 15, 2025, 10:00 – Oct 24, 2025, 16:00 UTC

📌 Related Campaigns:

HODLer Airdrop 👉 https://www.gate.com/announcements/article/47573

Launchpool 👉 https://www.gate.com/announcements/article/47592

FLK Campaign Collection 👉 https://www.gate.com/announcements/article/47586

📌 How to Participate:

1️⃣ Post original content related to FLK or one of the above campaigns (HODLer Airdrop / Launchpool).

2️⃣ Content mu

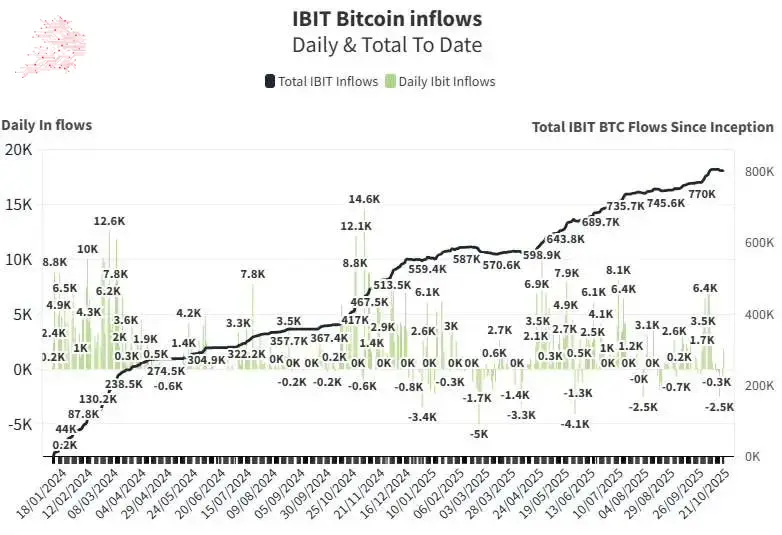

BlackRock now holds $86.5 billion worth of Bitcoin

Blackrock is once again directing its attention to the world’s largest cryptocurrency, buying another 1,884 Bitcoin (BTC) on Tuesday, October 21.

The transaction, worth some $200 million, has pushed the fund’s total holdings to 803,200 BTC, valued at approximately $86.5 billion, according to data shared by HeyApollo ETF tracker co-founder Thomas Fahrer.

HeyApollo BlackRock BTC inflows. Source: Thomas Fahrer (@thomas_fahrer)Interestingly, the fresh inflows came as Bitcoin’s price continued to face selling pressure

BlackRock BTC inflows. Source: Thomas Fahrer (@thomas_fahrer)Interestingly, the fresh inflows came as Bitcoin’s price continued to face selling pressure

The asset had been crashing prior to the inflows, dropping nearly 3% to an intraday low of $107,552 as it wiped out its weekend gains. The move came alongside a broader crypto market pullback, with total capitalization slipping over 2% to $3.67 trillion.

U.S. spot Bitcoin ETFs outflows contributed to the correction, as BlackRock itself witnessed a $101 million redemption the day prior. In the evening hours, the crypto recuperated past the $113,000 mark, but it has since lost its momentum again.

At the time of publication, Bitcoin is trading at $107,890, down 0.14% on the 24-hour chart and more than 4% on the week.

The current crypto cycle is becoming “nearly impossible to read,” according to trading expert Ted Pillows, who cited insider trading controversies and macroeconomic tensions as key culprits.

Bitcoin’s ongoing drop, however, is potentially the result of recent whale activity as well

Indeed, the $10 billion HyperUnit whale who made $200 million shorting the China tariff crash earlier this month has once again shorted $234 million worth of BTC with a liquidation price at $123,000.

THE $10B HYPERUNIT WHALE JUST DOUBLED DOWN SHORTING $BTC

The $10B Hyperunit Whale who made $200M shorting the China Tariff Crash just DOUBLED DOWN on his BTC short position.

He is now short $234M of BTC with a liquidation price at $123K. pic.twitter.com/8nrKbDUZFQ

Whether this whale is just lucky or prescient, his trades could signal that the market’s biggest players are still betting against the digital gold’s short-term comeback.

Featured image via Shutterstock

Featured image via ShutterstockFeatured image via Shutterstock