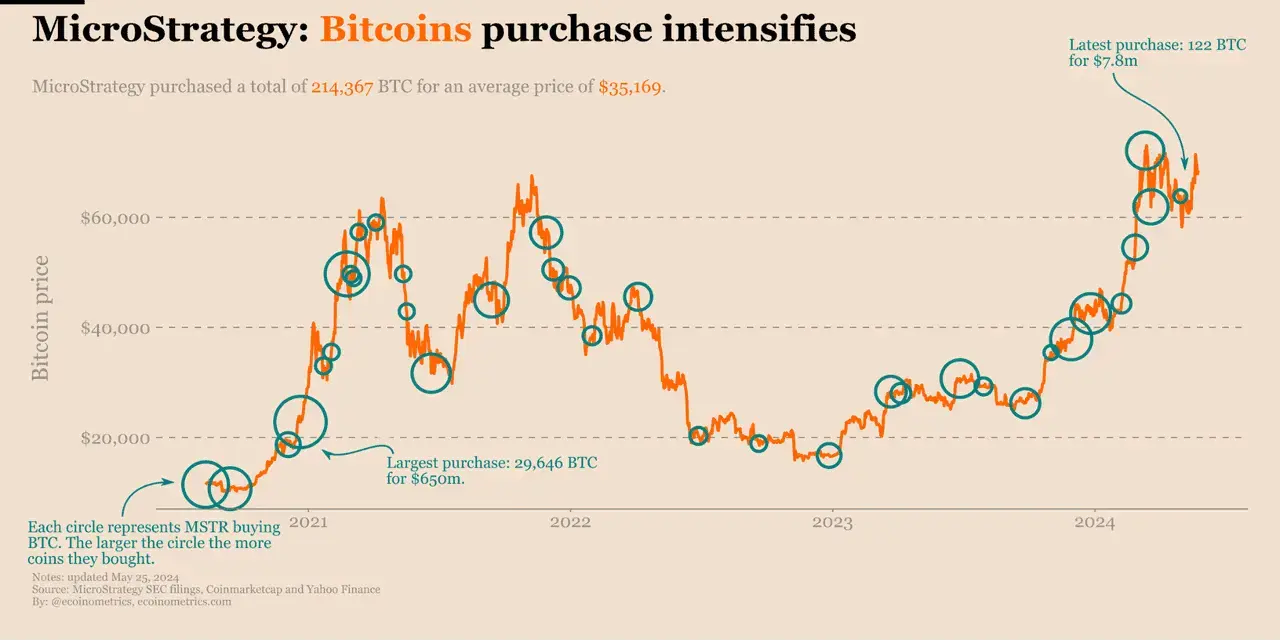

Strategy, led by Michael Saylor, continued its dip buying during the sharp decline in the Bitcoin market (when BTC fell to around $60,000). The company purchased another 1,142 BTC, increasing its total Bitcoin holdings to 714,644 BTC.

🔹Purchase cost: Approximately $90 million

🔹Average purchase price: ~$78,815 / BTC

🔹Total accumulation cost: ~$54.35 billion (average ~$76,056/BTC)

Saylor officially announced this purchase, emphasizing that the company will not abandon its Bitcoin strategy and will remain committed to its long-term HODL and accumulation policy despite volatility. Strategy's continued purchases despite the panic selling in the market are being interpreted as a "legendary dip buy" in the crypto community.

🔹Purchase cost: Approximately $90 million

🔹Average purchase price: ~$78,815 / BTC

🔹Total accumulation cost: ~$54.35 billion (average ~$76,056/BTC)

Saylor officially announced this purchase, emphasizing that the company will not abandon its Bitcoin strategy and will remain committed to its long-term HODL and accumulation policy despite volatility. Strategy's continued purchases despite the panic selling in the market are being interpreted as a "legendary dip buy" in the crypto community.