Jace

No content yet

- Reward

- like

- 1

- Repost

- Share

DrinkingAloneUnderTheMoon666 :

:

New Year Wealth Explosion 🤑- Reward

- like

- 1

- Repost

- Share

StarStepping :

:

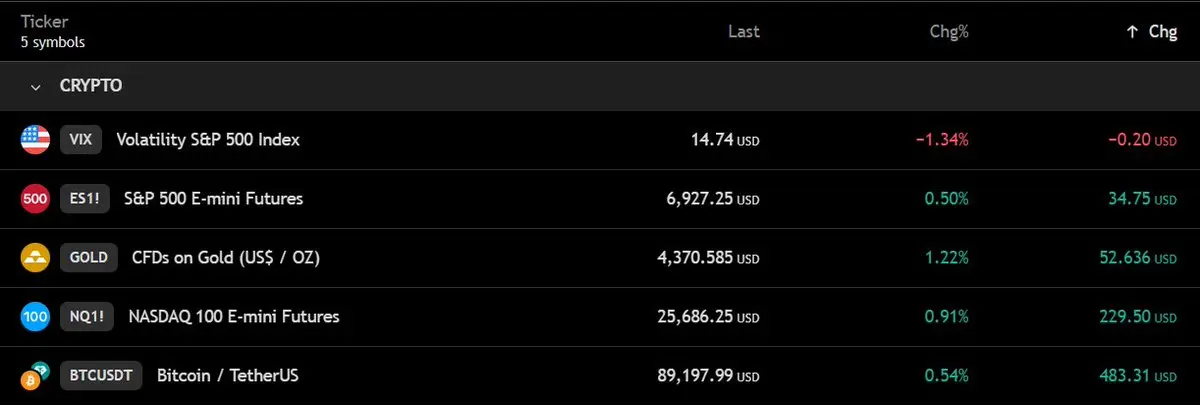

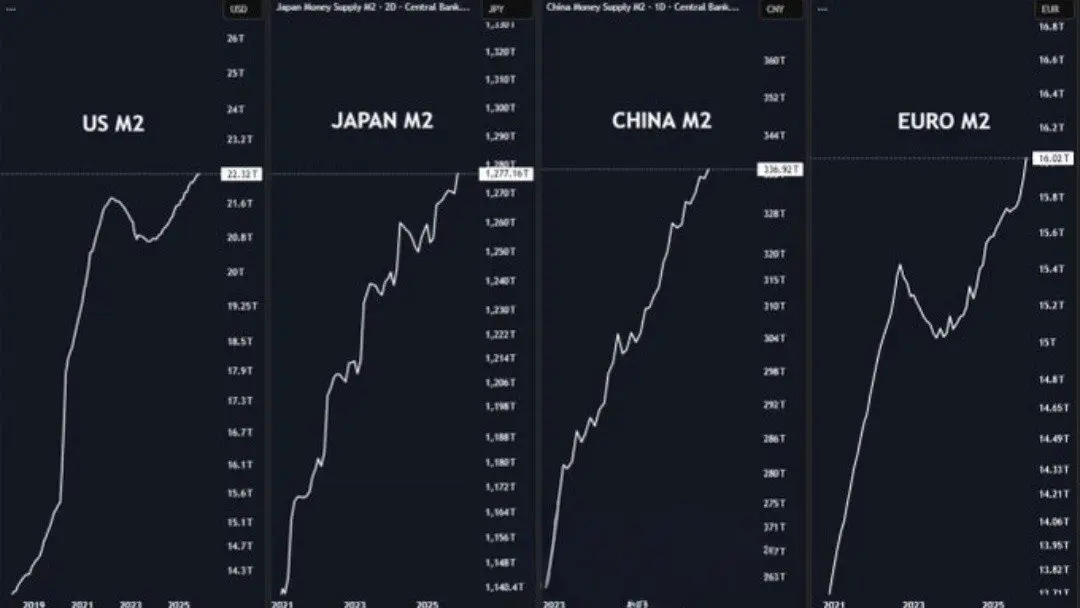

Hold on tight, we're about to take off 🛫Global liquidity is at record highs.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

• US M2: ATH

• Japan M2: ATH

• China M2: ATH

• Eurozone M2: ATH

Equities and precious metals are also trading at all-time highs.

In contrast, the crypto market remains well below its previous peak.

In my view, this valuation gap is hard for institutions to ignore and could drive fresh capital allocation into Bitcoin and select altcoins in Q1 2026.

BTC0.55%

- Reward

- like

- Comment

- Repost

- Share

Solana had one of the strongest fundamentals in 2025.

$1.3B in revenue.

Massive on-chain activity. Real usage.

But price doesn’t care about narratives, it cares about structure.

$SOL is still trapped below key resistance.

$120 = demand zone

$130 = decision level

No breakout yet, no trend yet.

Smart money waits.

Swing traders don’t predict, they react.

Break above $128 and momentum flips.

Until then, patience > hopium.

$1.3B in revenue.

Massive on-chain activity. Real usage.

But price doesn’t care about narratives, it cares about structure.

$SOL is still trapped below key resistance.

$120 = demand zone

$130 = decision level

No breakout yet, no trend yet.

Smart money waits.

Swing traders don’t predict, they react.

Break above $128 and momentum flips.

Until then, patience > hopium.

SOL2.82%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Welcoming 2026 with clarity, discipline, and a forward-looking perspective.

May the year ahead bring stability to markets, meaningful innovation across the crypto space, and consistent progress toward long-term goals.

May decisions be driven by data, risk managed with precision, and growth achieved sustainably.

Wishing you a successful, focused, and prosperous 2026.

#HappyNewYear2026

May the year ahead bring stability to markets, meaningful innovation across the crypto space, and consistent progress toward long-term goals.

May decisions be driven by data, risk managed with precision, and growth achieved sustainably.

Wishing you a successful, focused, and prosperous 2026.

#HappyNewYear2026

- Reward

- like

- Comment

- Repost

- Share

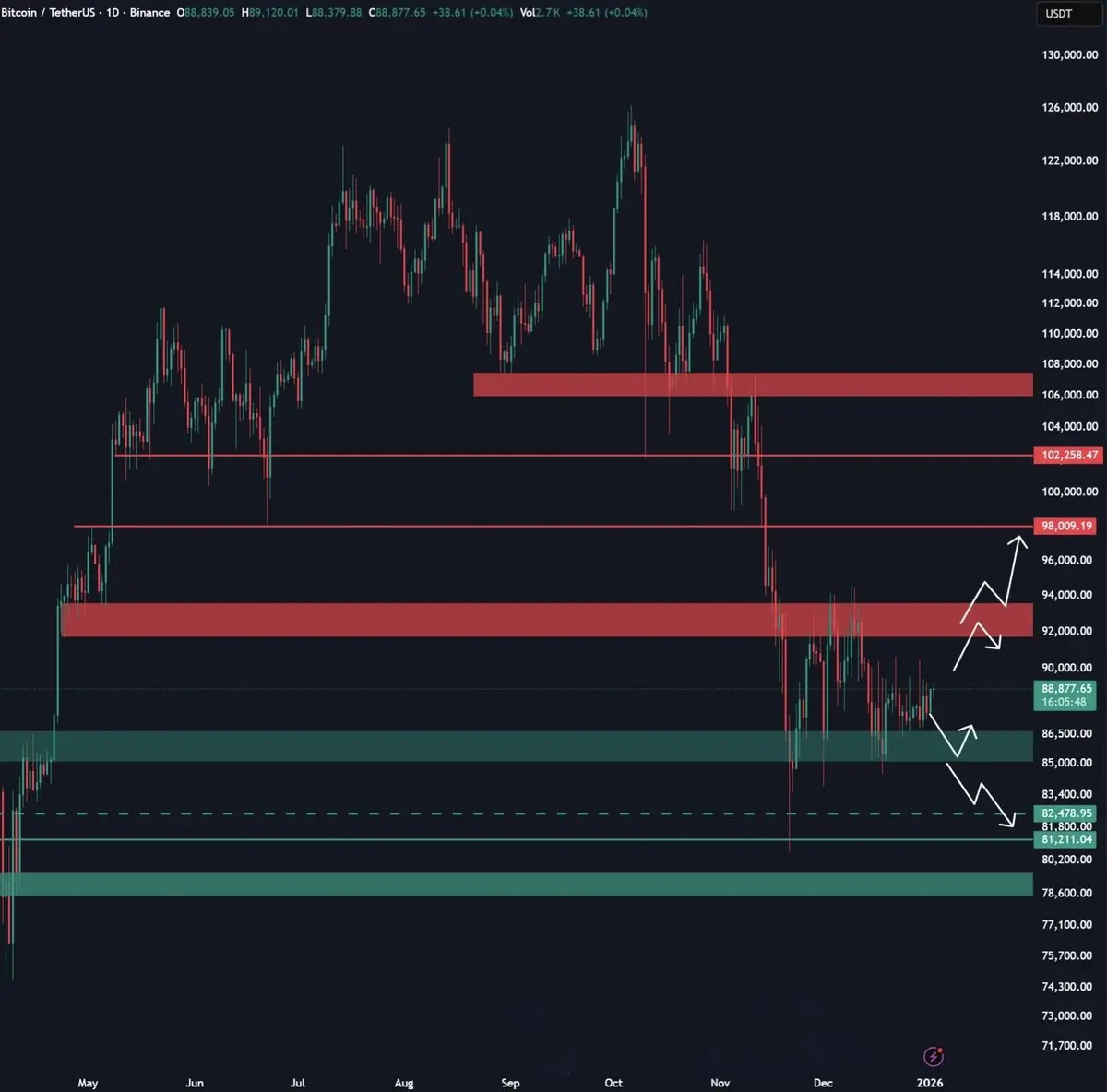

TOTAL Crypto Market Cap

The market is back at a critical structural level, a former macro resistance now acting as support.

As long as this zone holds on a weekly basis, the broader uptrend remains intact and conditions favor continuation.

A clean loss of this level would signal a deeper corrective phase before the next leg higher.

This weekly close matters. Patience and discipline here.

The market is back at a critical structural level, a former macro resistance now acting as support.

As long as this zone holds on a weekly basis, the broader uptrend remains intact and conditions favor continuation.

A clean loss of this level would signal a deeper corrective phase before the next leg higher.

This weekly close matters. Patience and discipline here.

- Reward

- like

- Comment

- Repost

- Share

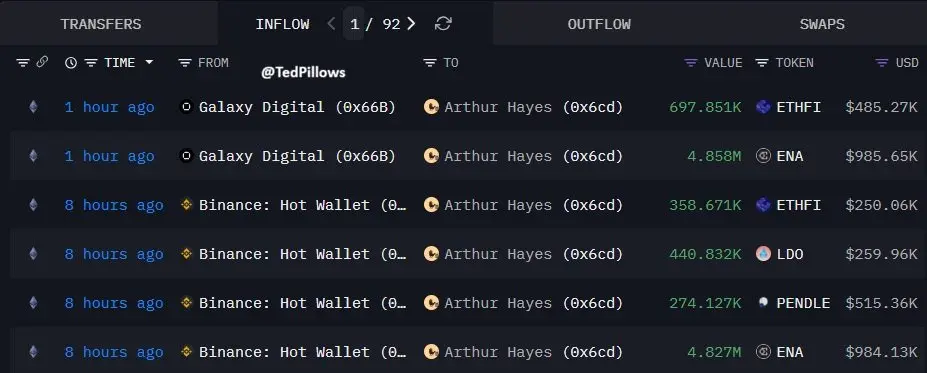

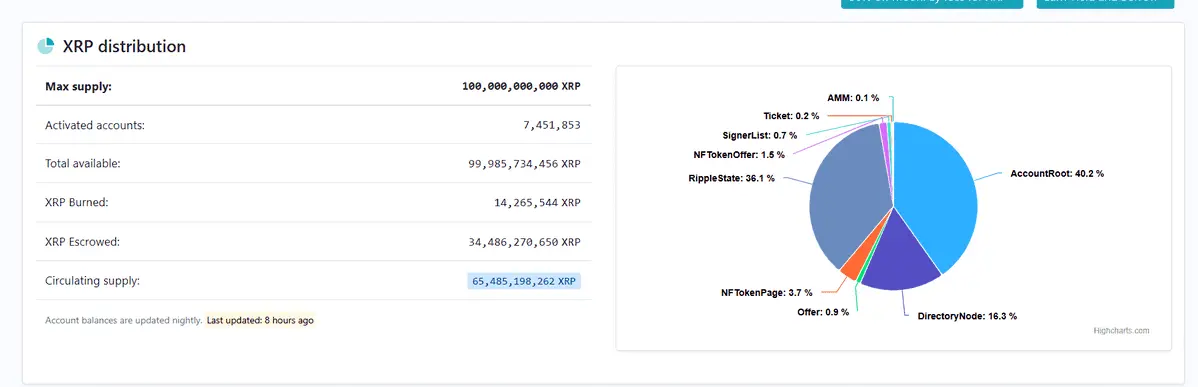

$XRP price isn’t the real story right now, distribution is.

Millions of wallets hold crumbs, while a small group controls what actually moves the market.

Exchange supply keeps shrinking, retail is priced out, and liquidity is tighter than it looks.

When demand returns, this setup can move fast. Smart money knows.

Millions of wallets hold crumbs, while a small group controls what actually moves the market.

Exchange supply keeps shrinking, retail is priced out, and liquidity is tighter than it looks.

When demand returns, this setup can move fast. Smart money knows.

XRP0.86%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More1.8K Popularity

24.67K Popularity

2.63K Popularity

3.51K Popularity

19K Popularity

Pin

Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889Your First Words Matter!

Share your first post on and split $10,000 in New Year rewards.

Post with #My2026FirstPost to share your New Year wish

2026U Position Voucher, Gate New Year boxes, F1 Red Bull merch await you!

Ends on Jan 15, 2026, 16:00 UTC

2026 starts with this post!Gate 2025 Year-End Gala Square TOP50 List Announced!

The final ranking phase is now live.

Earn Votes by watching live streams and posting.

30 Votes = 1 chance — support your favorite creators now!

👉 https://www.gate.com/activities/community-vote-2025

iPhone 17 Pro Max, JD gift cards, Mi Band, Gate merch await you!

Creators are welcome to rally fans to climb the rankings and win rewards!

Voting ends: Jan 20, 02:00 UTC

Details: https://www.gate.com/announcements/article/48693