TimelessBeing

No content yet

TimelessBeing

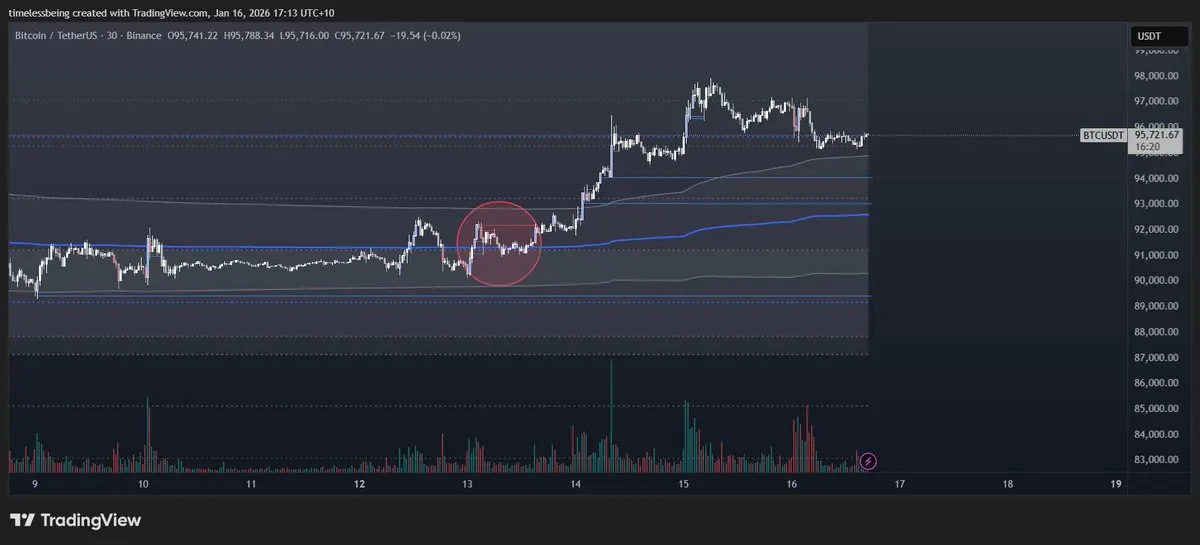

Sweep the 90 and the range low and Im going to get levered out of my tits and long the most valuable asset in the land

- Reward

- like

- Comment

- Repost

- Share

Per system this is a very big zone here as we come into 2024 value You want to see a reclaim of the 24 VAH as steadfast as possibleThe longer we hang around here the higher the chance of hitting the 24 vwap at mid 65 k Big start to a new month #BTC

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

Global macro has held upIndices across the world posted double digit gainsPrecious metals gone parabolicSmall caps having a hell of a rotationEmerging markets doing splendid $BTC roundtripped an entire year of pa and alas our beloved shitcoins have managed to post multi year lowsGot to love this game

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

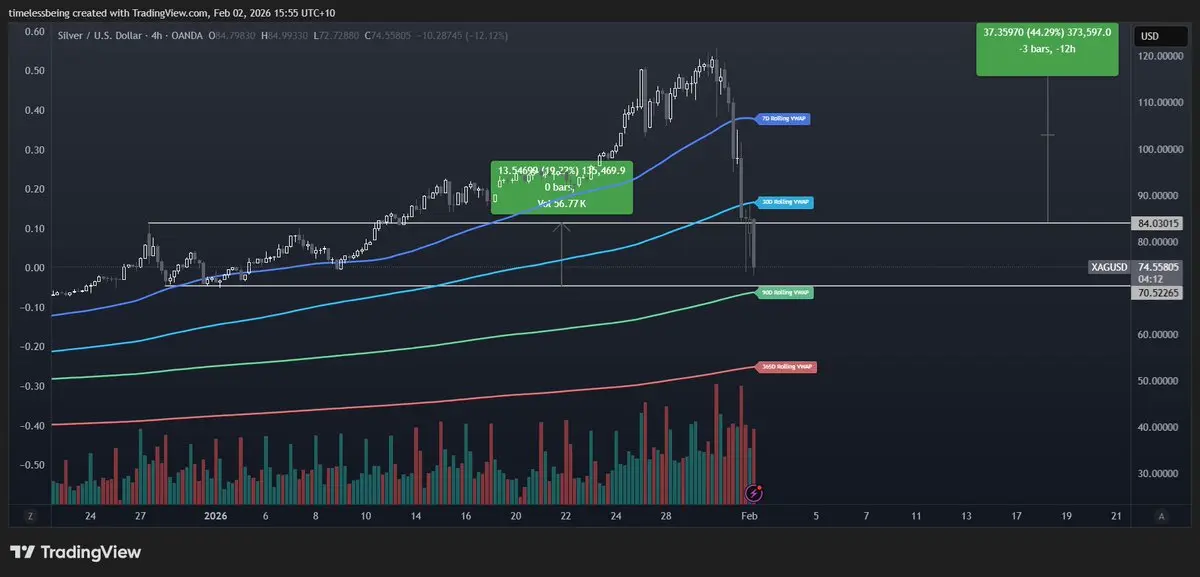

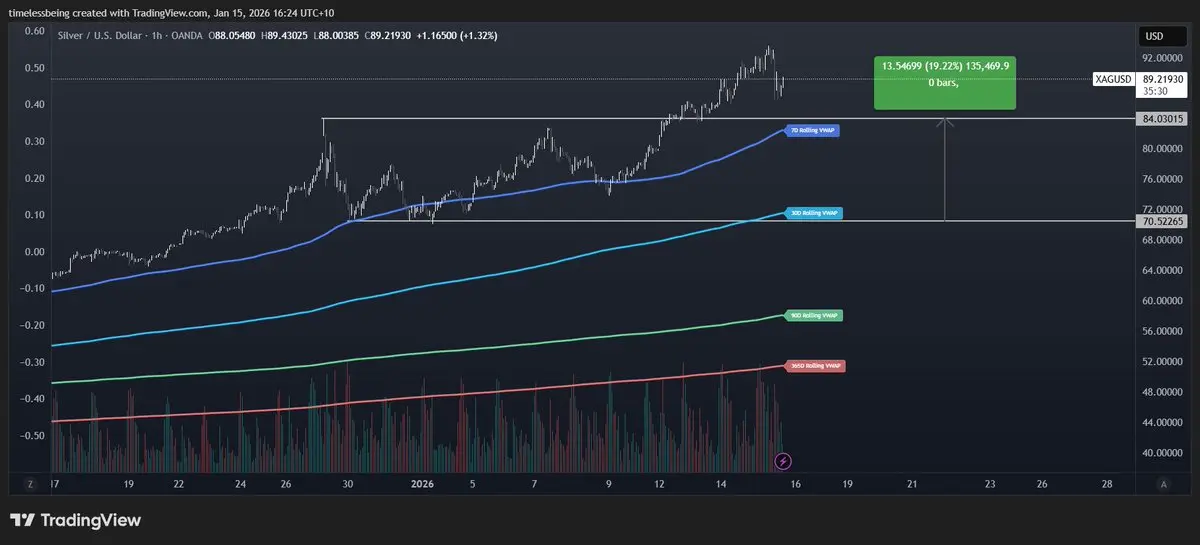

Study elite paThey will talk about this for decades to comeThe greatest asset to ever tradeThe 7 commands respectBeauty

- Reward

- 1

- Comment

- Repost

- Share

Study elite paThey will talk about this for in decades to comeThe greatest asset to ever tradeThe 7 commands respectBeauty

- Reward

- like

- Comment

- Repost

- Share

Going to be watching this chart pretty closely over coming monthsI think this is the canary in coal mine if we are to see continued relative underperformance from $NVDA and the Mag 10This flattens or shows softness, expect it to trickle into the nasdaq and spooz

- Reward

- like

- Comment

- Repost

- Share

#BTC at previous Yearly VAL \n\nThis is a higher time frame zone to watch for a reversal \n\nA wick here would be ideal for our bullish brethren

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

I think distinguishing time horizon is difficult for most to grasp (higher time frame, mid time frame, local pa)

Articulating disinction and nuance is even harder

I will strive to do this better in 2026

Articulating disinction and nuance is even harder

I will strive to do this better in 2026

- Reward

- like

- Comment

- Repost

- Share

Big picture for me I think $BTC is bottoming versus equities

Per system I got a bunch of flashing warning signals on the mag 10 this week

Genuinely think we are seeing a rotation out of tech and beta exposure to AI trade in real time

RSP, small caps and certains sectors still holding weight which shows breadth and broad strength in other areas of market

But I do think we could see some turbulence in Q1 if the big boys like $NVDA start to show weakness on concerns of delivery, expectations of the future etc.

In a vacuum though, I think $BTC will do better than the nasdq during this period

Per system I got a bunch of flashing warning signals on the mag 10 this week

Genuinely think we are seeing a rotation out of tech and beta exposure to AI trade in real time

RSP, small caps and certains sectors still holding weight which shows breadth and broad strength in other areas of market

But I do think we could see some turbulence in Q1 if the big boys like $NVDA start to show weakness on concerns of delivery, expectations of the future etc.

In a vacuum though, I think $BTC will do better than the nasdq during this period

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

Interesting to see these bid-ask dynamics on the weekend

Pretty substantial floor being put in here

Is it indicative of direction

Or does market put in a base here?

To pull or not to pull, this is the question

Stay tuned

#BTC

Pretty substantial floor being put in here

Is it indicative of direction

Or does market put in a base here?

To pull or not to pull, this is the question

Stay tuned

#BTC

BTC1.9%

- Reward

- 1

- Comment

- Repost

- Share

#BTC trying to establish value within November Vwap (2025)

Crucial zone

Show strength here and 102s are next

Failure to sustain momentum then opens up an auction back to where it came from (see red)

As mentioned I hedged up yday with an invalidation around the rolling 365

Will observe and react as price materialises in the last day of trade

#BTC

Crucial zone

Show strength here and 102s are next

Failure to sustain momentum then opens up an auction back to where it came from (see red)

As mentioned I hedged up yday with an invalidation around the rolling 365

Will observe and react as price materialises in the last day of trade

#BTC

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

Palladium is next major catch up play

Look at the chart

This has a lot of runway

Do research but pretty compelling need in defense, robotics, EV adoption

It is cheaper than platinum and can be used a replacement

Also being a byproduct of other mining this could face a pretty substantial supply crunch in the coming years

I like the odds of a rotation here

I am a precious metal bull in general. A long decade of prosperity ahead

Send it

Look at the chart

This has a lot of runway

Do research but pretty compelling need in defense, robotics, EV adoption

It is cheaper than platinum and can be used a replacement

Also being a byproduct of other mining this could face a pretty substantial supply crunch in the coming years

I like the odds of a rotation here

I am a precious metal bull in general. A long decade of prosperity ahead

Send it

- Reward

- like

- Comment

- Repost

- Share

Genuinly don't see a reason to pigeon hole yourself into any one market

I've spent the majority of my time in crypto

I watch $BTC more than anything else

But you have to understand there is a bull market everywhere somewhere

An abundance mindset will allow you to follow flows and play whatever narrative is being parroted

Im personally watching emerging markets, proxies on metal plays (specialised miners), energy (Evs, uranium) and defense spending as potential plays

The list can go on and on

Your job is to filter the narrative and jump on to what you think will be the next "mega trend"

I've spent the majority of my time in crypto

I watch $BTC more than anything else

But you have to understand there is a bull market everywhere somewhere

An abundance mindset will allow you to follow flows and play whatever narrative is being parroted

Im personally watching emerging markets, proxies on metal plays (specialised miners), energy (Evs, uranium) and defense spending as potential plays

The list can go on and on

Your job is to filter the narrative and jump on to what you think will be the next "mega trend"

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

I seldom talk about my tradfi port but last year I was telling the lads that silver was going to continue to rip

I was fortunate to get into this during covid and i am fortunate that side of my book is very inactive

That said, i have been trading silver more actively this year and it is pretty clear why

The ranges are clean, volatility is rife and it is in a clear as day trend

For now 7 day is the first tap region to play

if we get 30 that is a size up moment

Trail stops around the 90

The rise of the SILVERBACK

150 this year imo and that is conservative

I was fortunate to get into this during covid and i am fortunate that side of my book is very inactive

That said, i have been trading silver more actively this year and it is pretty clear why

The ranges are clean, volatility is rife and it is in a clear as day trend

For now 7 day is the first tap region to play

if we get 30 that is a size up moment

Trail stops around the 90

The rise of the SILVERBACK

150 this year imo and that is conservative

- Reward

- like

- Comment

- Repost

- Share

Finally got @timelessbeing from the X Handle Marketplace!

Been a long time coming, happy with this

Been a long time coming, happy with this

- Reward

- like

- Comment

- Repost

- Share

Finally t got @timelessbeing from the X Handle Marketplace!

Been a long time coming, happy with this

Been a long time coming, happy with this

- Reward

- like

- Comment

- Repost

- Share

Nice move yday especially with relative strength to broader market

but this is pretty much as low as it should go for continuation

It is a hunch, but I am leaning towards this being a fakeout from here

Im hedging up for a larger mean reversion flush

Invalidation: yearly 365

Target: low 90s mid 80s (will dynamically adjust)

thanks

#BTC

but this is pretty much as low as it should go for continuation

It is a hunch, but I am leaning towards this being a fakeout from here

Im hedging up for a larger mean reversion flush

Invalidation: yearly 365

Target: low 90s mid 80s (will dynamically adjust)

thanks

#BTC

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share