# BitcoinSix-DayRally

49.39K

BTC has climbed for six straight days, nearing $94,000, supported by strong ETF inflows and rising spot volume. Do you see this as a real bull-market move or a short squeeze? Buy now or wait for a pullback?

StylishKuri

#BitcoinSix-DayRally Consolidation or Ignition? Reading the Next Phase of BTC Momentum

As of early January 2026, Bitcoin is locked in a high-pressure equilibrium. Price action over the last six days reflects more than short-term speculation — it represents a recalibration phase after the turbulent close of 2025. The market is currently balancing institutional accumulation, technical exhaustion, and psychological resistance clustered around the $94,000–$95,000 region. This zone has become the defining battleground for Bitcoin’s next directional move.

What makes this rally structurally different

As of early January 2026, Bitcoin is locked in a high-pressure equilibrium. Price action over the last six days reflects more than short-term speculation — it represents a recalibration phase after the turbulent close of 2025. The market is currently balancing institutional accumulation, technical exhaustion, and psychological resistance clustered around the $94,000–$95,000 region. This zone has become the defining battleground for Bitcoin’s next directional move.

What makes this rally structurally different

BTC4,35%

- Reward

- 4

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

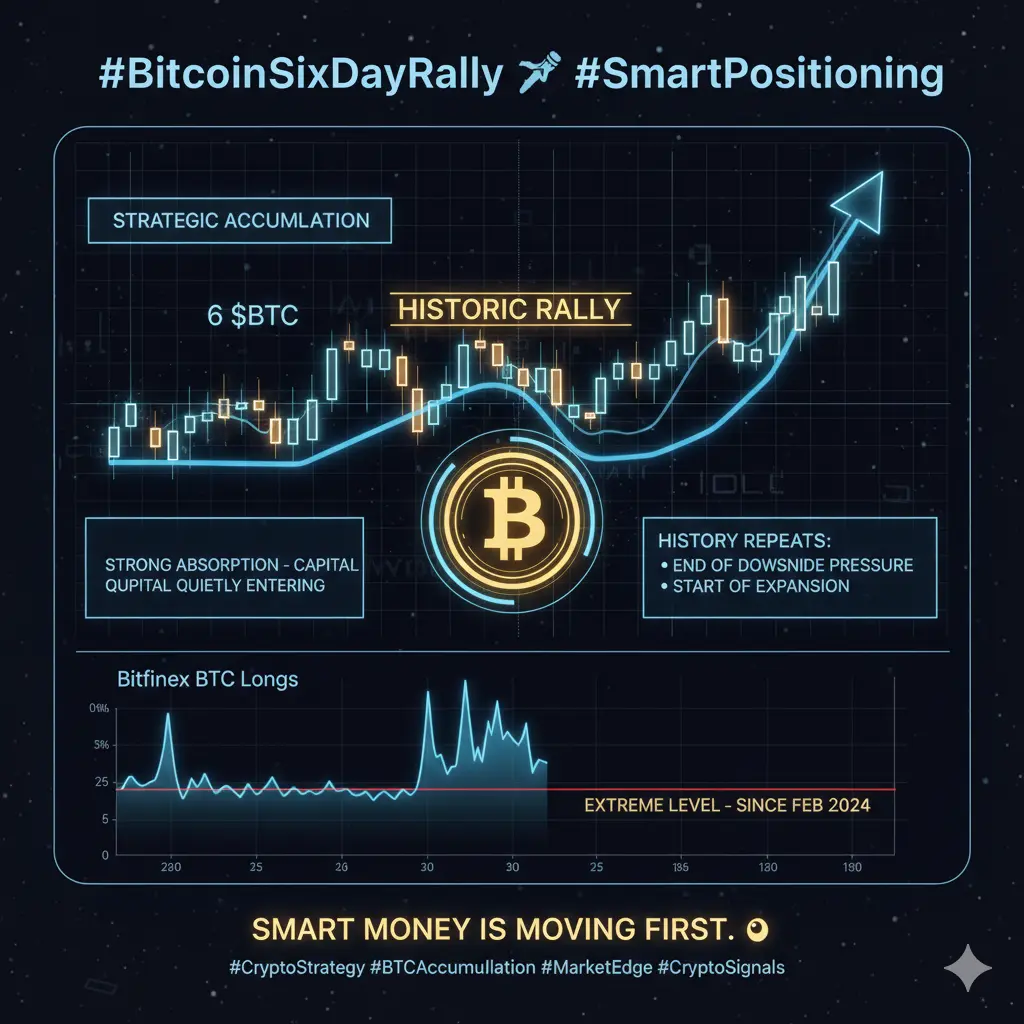

#BitcoinSix-DayRally #BitcoinSixDayRally 🚀 #SmartPositioning

Something historic is unfolding in Bitcoin markets. $BTC longs on Bitfinex have just reached levels we haven’t seen since February 2024 — an extreme so rare it commands attention.

But let’s be clear: this isn’t FOMO. This is strategic accumulation — smart positioning by those who understand that when sentiment is weak and prices are heavy, opportunity is quietly building.

Here’s what history tells us: every prior time this extreme was reached, it marked:

The end of downside pressure – sellers exhausted, buyers absorbing.

Strong abs

Something historic is unfolding in Bitcoin markets. $BTC longs on Bitfinex have just reached levels we haven’t seen since February 2024 — an extreme so rare it commands attention.

But let’s be clear: this isn’t FOMO. This is strategic accumulation — smart positioning by those who understand that when sentiment is weak and prices are heavy, opportunity is quietly building.

Here’s what history tells us: every prior time this extreme was reached, it marked:

The end of downside pressure – sellers exhausted, buyers absorbing.

Strong abs

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinSix-DayRally

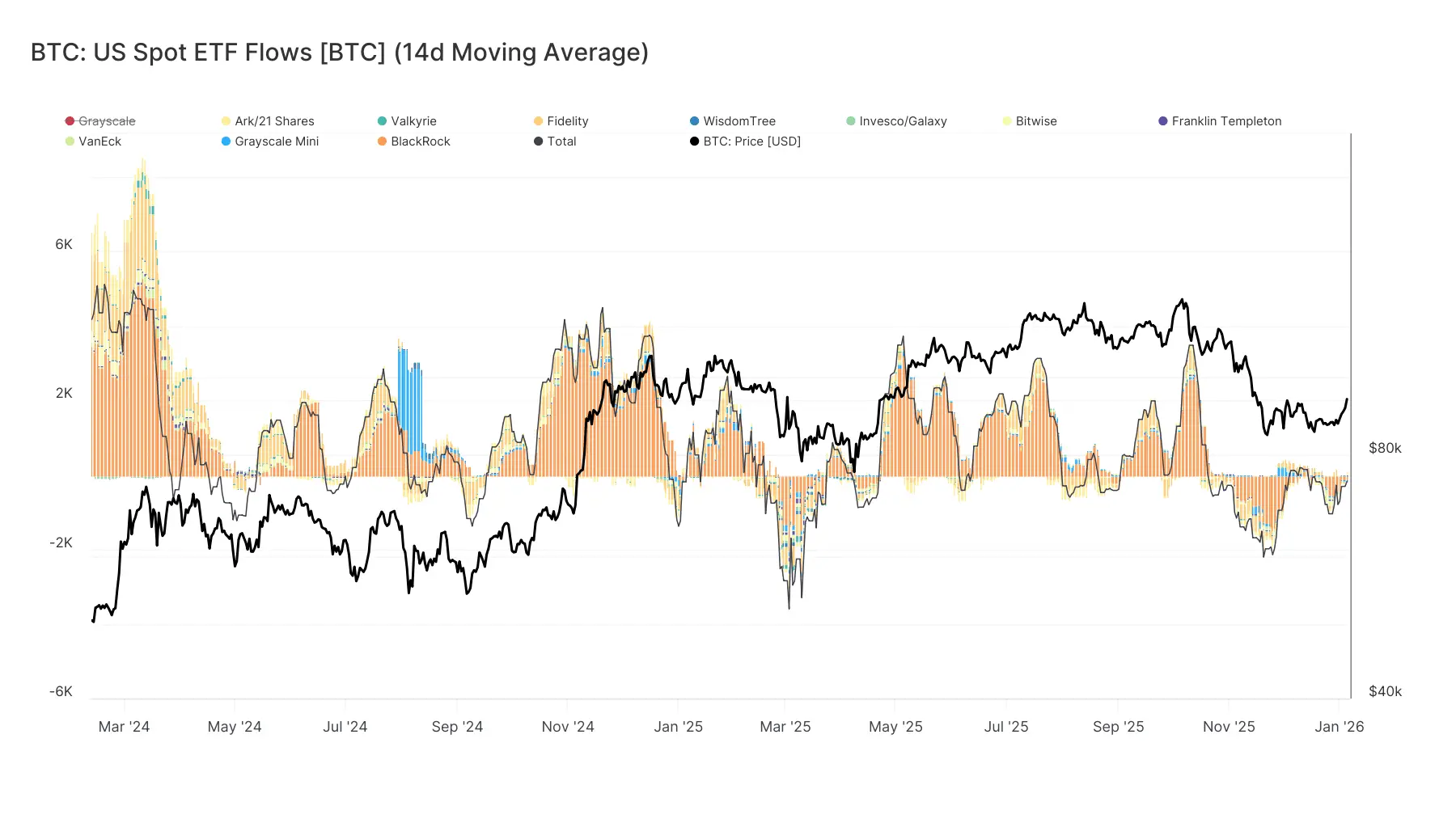

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 6

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#BitcoinSix-DayRally

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 15

- 17

- Repost

- Share

PrincessOfBitcoin :

:

Buy To Earn 💎View More

#BitcoinSix-DayRally Smart Positioning Is Happening $BTC

Bitcoin longs on Bitfinex just hit a historic extreme, the highest since Feb 2024. $ZKP

This isn’t FOMO. This is what accumulation looks like when sentiment is weak and price is heavy. $BREV

Every prior occurrence marked:

• The end of downside

• Strong absorption

• The start of expansion

The crowd freezes here. The data is already moving.👀

Bitcoin longs on Bitfinex just hit a historic extreme, the highest since Feb 2024. $ZKP

This isn’t FOMO. This is what accumulation looks like when sentiment is weak and price is heavy. $BREV

Every prior occurrence marked:

• The end of downside

• Strong absorption

• The start of expansion

The crowd freezes here. The data is already moving.👀

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinSix-DayRally

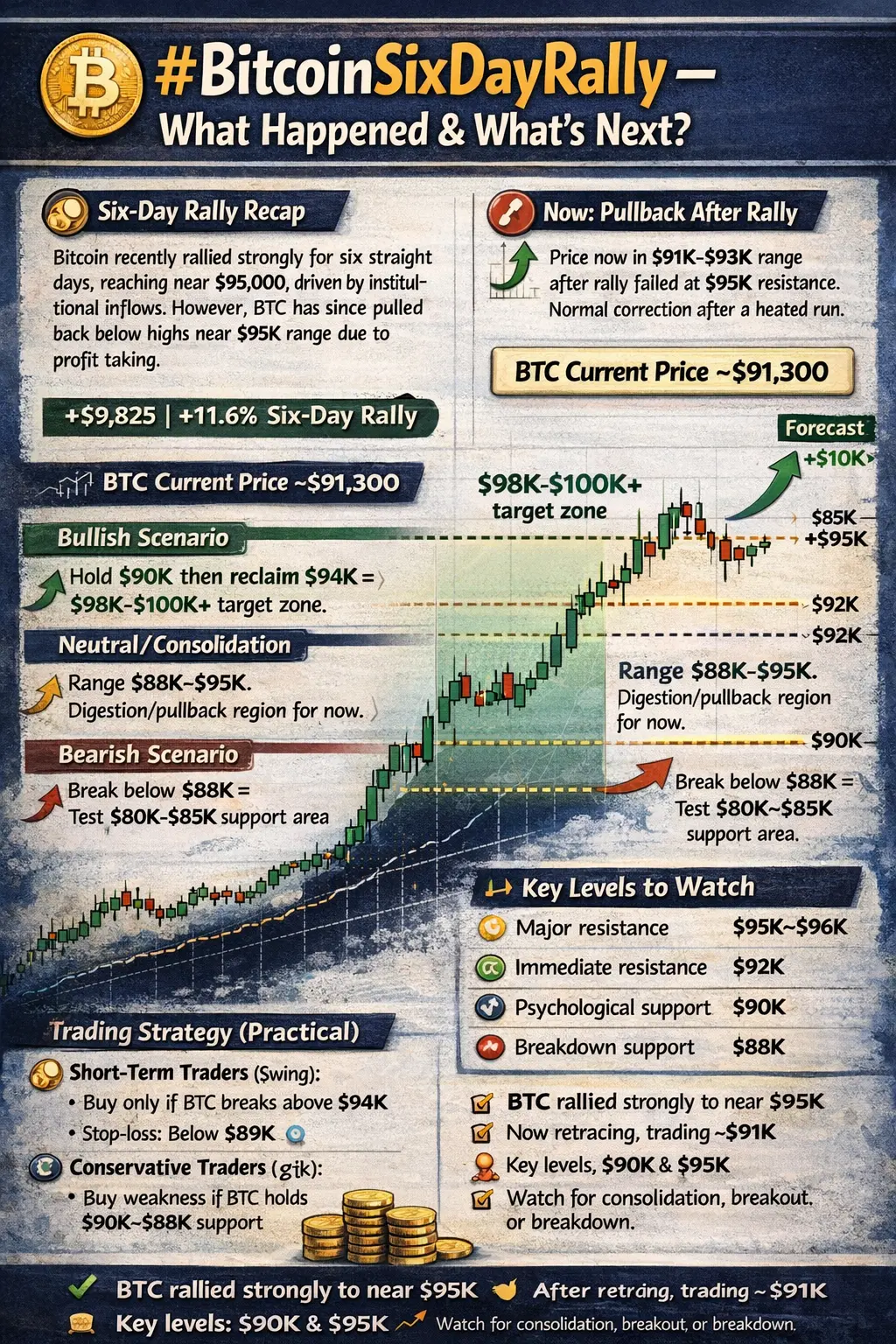

Bitcoin's Six-Day Rally: A Genuine Bull Market Move or Just a Short Squeeze?

January 7, 2026 – Bitcoin (BTC) has posted impressive gains in the opening week of 2026, climbing for six consecutive days from around $87,000–$88,000 at the start of the year to a high near $94,700 before pulling back slightly. As of today, BTC is trading around $92,500–$93,000, supported by robust spot Bitcoin ETF inflows and increasing on-chain volume. The rally has sparked debate: Is this the start of a sustained bull market, or primarily a short squeeze fueled by liquidations? Should investo

Bitcoin's Six-Day Rally: A Genuine Bull Market Move or Just a Short Squeeze?

January 7, 2026 – Bitcoin (BTC) has posted impressive gains in the opening week of 2026, climbing for six consecutive days from around $87,000–$88,000 at the start of the year to a high near $94,700 before pulling back slightly. As of today, BTC is trading around $92,500–$93,000, supported by robust spot Bitcoin ETF inflows and increasing on-chain volume. The rally has sparked debate: Is this the start of a sustained bull market, or primarily a short squeeze fueled by liquidations? Should investo

BTC4,35%

- Reward

- 128

- 82

- Repost

- Share

Bab谋_Ali :

:

Happy New Year! 🤑View More

#BitcoinSix-DayRally

Bitcoin's Six-Day Rally Excites Markets. Bitcoin has shown remarkable performance in the first week of 2026, rising for six consecutive days. The leading cryptocurrency has gained approximately 11-12% since the beginning of the year, surpassing the $94,000 level.

This rally is supported by institutional ETF inflows, New Year's optimism, and geopolitical developments. Analysts note that the "January effect" has come into play, and positions are increasing in options markets for targets above $100,000.

Market experts emphasize that the $90,000 support level is critical for

Bitcoin's Six-Day Rally Excites Markets. Bitcoin has shown remarkable performance in the first week of 2026, rising for six consecutive days. The leading cryptocurrency has gained approximately 11-12% since the beginning of the year, surpassing the $94,000 level.

This rally is supported by institutional ETF inflows, New Year's optimism, and geopolitical developments. Analysts note that the "January effect" has come into play, and positions are increasing in options markets for targets above $100,000.

Market experts emphasize that the $90,000 support level is critical for

BTC4,35%

- Reward

- 44

- 29

- Repost

- Share

CryptoAlice :

:

Happy New Year! 🤑View More

#BitcoinSix-DayRally

Consolidation or Ignition? Interpreting Bitcoin’s Next Decisive Phase

As January 2026 unfolds, Bitcoin finds itself in a tightly compressed equilibrium a phase I have learned to respect deeply over multiple market cycles. After a volatile and emotionally charged close to 2025, the last six days of price action are not random noise or simple momentum chasing. They reflect a deliberate recalibration process, where capital, conviction, and caution are all competing near the same price levels. The $94,000–$95,000 zone has emerged as the focal point of this tension, acting as

Consolidation or Ignition? Interpreting Bitcoin’s Next Decisive Phase

As January 2026 unfolds, Bitcoin finds itself in a tightly compressed equilibrium a phase I have learned to respect deeply over multiple market cycles. After a volatile and emotionally charged close to 2025, the last six days of price action are not random noise or simple momentum chasing. They reflect a deliberate recalibration process, where capital, conviction, and caution are all competing near the same price levels. The $94,000–$95,000 zone has emerged as the focal point of this tension, acting as

BTC4,35%

- Reward

- 6

- 4

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🙌 “Solid analysis, thanks for sharing this!”View More

#BitcoinSix-DayRally

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

In the first week of January 2026, the cryptocurrency markets are rising from the ashes thanks to the "January Effect" and institutional cash flow. Bitcoin, which started its journey on January 1st, has been showing green candles for 6 consecutive days, bringing the #BitcoinSixDayRally hashtag to the world's trending topics.

The $94,000 Barrier and ETF Power

Bitcoin made a rapid entry into 2026 from the $87,400 levels, surpassing the $94,000 mark in six days. This rise is not just a technical correction, but the result of a deep liquidity wave.

ETF Wind: Spot Bitcoin ETFs

- Reward

- 115

- 150

- Repost

- Share

User_any :

:

Buy To Earn 💎View More

#BitcoinSix-DayRally

#BitcoinSixDayRally — What Happened & What’s Next?

📈 Six-Day Rally Recap

Bitcoin recently rallied strongly for about six consecutive trading sessions, climbing from lower levels up toward the $94,000–$95,000 zone. This upward move was driven by renewed institutional demand, ETF inflows, and improved market sentiment heading into 2026.

During this stretch:

• BTC rose each day for nearly six sessions — a sign of sustained bullish momentum.

• Price tested recently strong resistance near $95,000, the highest level seen since late 2025.

• This was partially supported by te

#BitcoinSixDayRally — What Happened & What’s Next?

📈 Six-Day Rally Recap

Bitcoin recently rallied strongly for about six consecutive trading sessions, climbing from lower levels up toward the $94,000–$95,000 zone. This upward move was driven by renewed institutional demand, ETF inflows, and improved market sentiment heading into 2026.

During this stretch:

• BTC rose each day for nearly six sessions — a sign of sustained bullish momentum.

• Price tested recently strong resistance near $95,000, the highest level seen since late 2025.

• This was partially supported by te

BTC4,35%

- Reward

- 31

- 20

- Repost

- Share

BeautifulDay :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

349.51K Popularity

100.8K Popularity

182.21K Popularity

10.96M Popularity

16.12K Popularity

2.94K Popularity

27.46K Popularity

544.19K Popularity

19.28K Popularity

379.98K Popularity

54.66K Popularity

83.82K Popularity

13.46K Popularity

31.08K Popularity

18.96K Popularity

News

View MoreData: If BTC drops below $65,668, the total long liquidation strength on mainstream CEXs will reach $1.679 billion.

11 m

Data: If ETH falls below $1,931, the total long liquidation strength on mainstream CEXs will reach $1.135 billion.

12 m

ETH 15-minute sharp decline of 1.23%: leveraged long liquidations and on-chain capital outflows resonate, intensifying volatility

55 m

BTC short-term decline of 0.81%: Futures long liquidation wave triggers passive selling and liquidity resonance, intensifying volatility

55 m

BTC drops below 69,000 USDT

59 m

Pin