ICNews

No content yet

ICNews

Tokenization doesn’t create liquidity.\nGovernance creates liquidity.\nTokens are just the transport layer.\n#Tokenization #Governance #RWA

- Reward

- like

- Comment

- Repost

- Share

Most crypto confusion disappears once you separate:value, governance, and transfer.#Crypto #Infrastructure #Tokenization #Web3Thinking

- Reward

- like

- Comment

- Repost

- Share

If tokenization alone created value, every token would succeed.Structure still matters.#Crypto #Infrastructure #Tokenization #Web3Thinking

- Reward

- like

- Comment

- Repost

- Share

Most crypto confusion comes from mixing tools with outcomes.Tokens are tools.#Tokenization #Blockchain #DigitalAssets #Web3 #Finance

- Reward

- like

- Comment

- Repost

- Share

🔥 News: 🔥Big Tech is set to pour $650B into AI this year, spending on data centers, chips, and infrastructure.

- Reward

- like

- Comment

- Repost

- Share

Governance added late is governance ignored.And ignored governance always reappears, as legal risk.#Tokenization #RealWorldAssets #Governance #BlockchainInfrastructure #RWA #Web3

- Reward

- like

- Comment

- Repost

- Share

Most “real estate tokenization” projects freeze capital instead of unlocking it.Why?Because of ownership ≠ rights ≠ enforcement.Markets price that risk instantly.#RealEstate #Governance #Blockchain

- Reward

- like

- Comment

- Repost

- Share

Liquidity is not innovation.Predictability under stress is. #MarketStructure

- Reward

- like

- Comment

- Repost

- Share

Real estate doesn’t become investable because it’s tokenized. It becomes investable when data, governance, and enforceable rights are ready before liquidity. #RealEstate #Web3Infrastructure

- Reward

- like

- Comment

- Repost

- Share

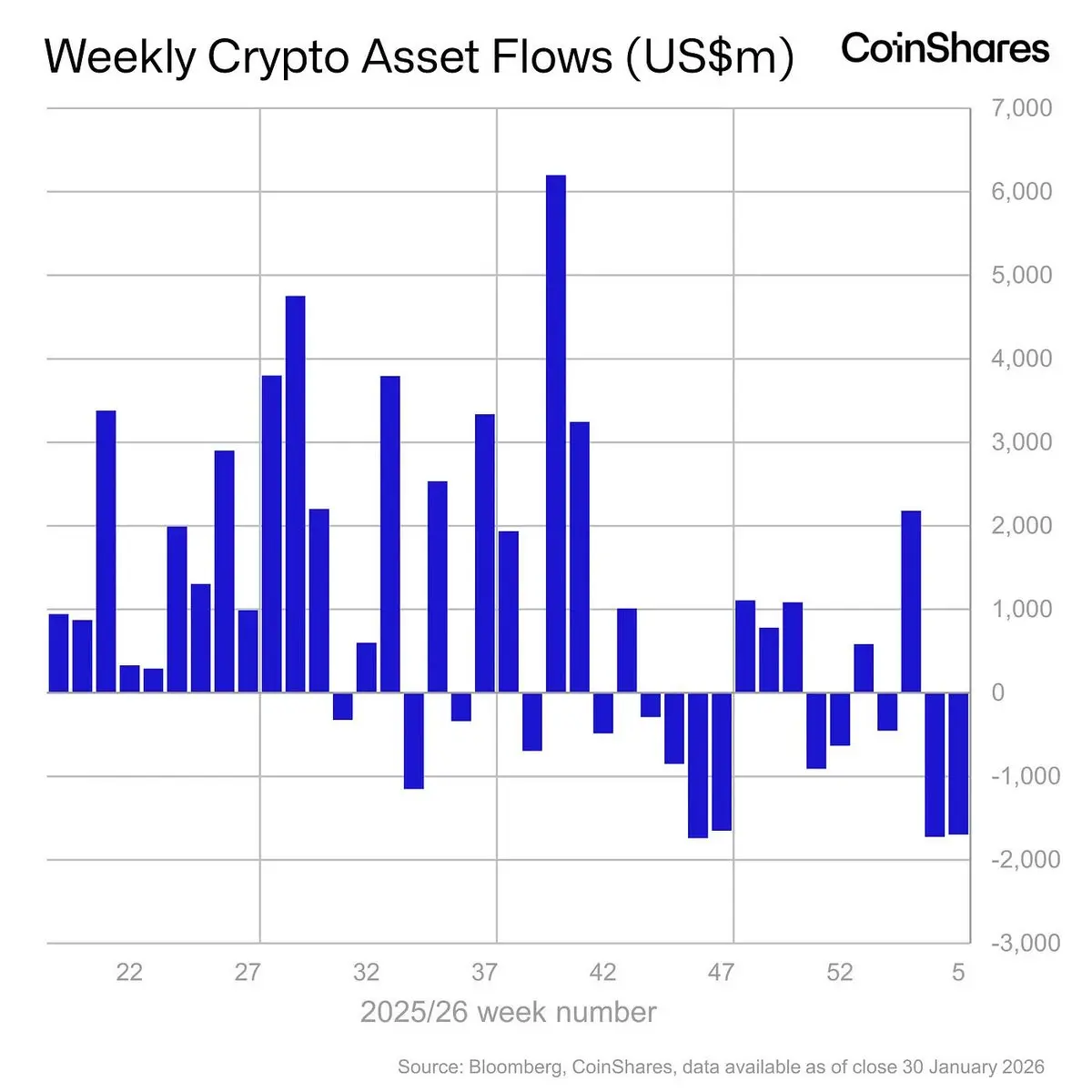

🚨 Breaking: 🚨Digital asset investment products saw a massive $1.73B outflow last week.

- Reward

- like

- Comment

- Repost

- Share

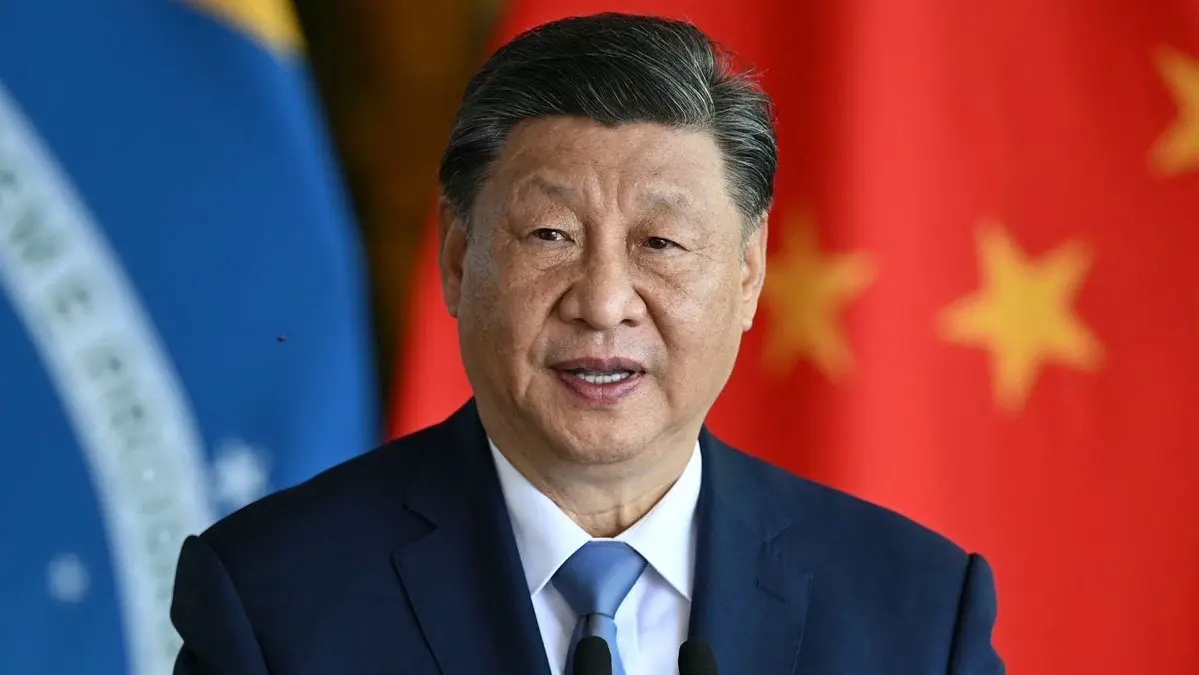

🔥 News: 🔥 🇨🇳 Chinese President Xi Jinping calls for the yuan to become a global reserve currency.

- Reward

- 2

- Comment

- Repost

- Share

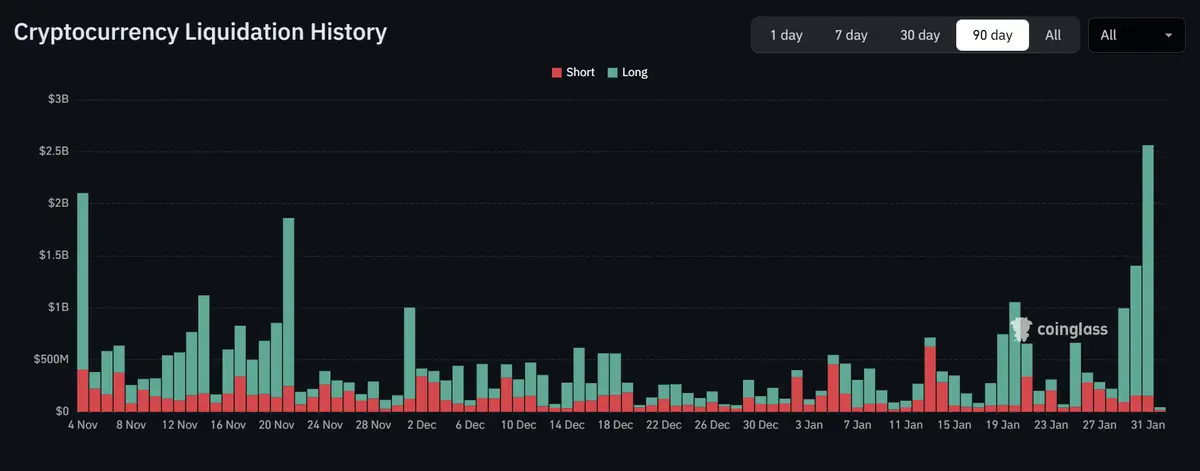

🔥 News: 🔥Yesterday saw the highest single-day liquidations since October 10th.

- Reward

- like

- Comment

- Repost

- Share

🚨 Breaking: 🚨Over $400M in longs were liquidated in the past 4 hours.

- Reward

- like

- Comment

- Repost

- Share