INVESTERCLUB

No content yet

INVESTERCLUB

$SOL $SOL SOL/USDT charts across multiple timeframes, here is the professional analysis and trade plan.

1. 4H Chart - Identify Direction & Higher Timeframe Structure

Trend: Bullish Consolidation. Price is holding well above the significant daily low of 113.01 and is consolidating near the 118.50 area after a strong move up.

· Key Level (Resistance): 119.12 (24h High). A sustained break above this level confirms bullish continuation.

· Key Level (Support): 115.85 - 116.12 (Recent 1H swing low & 4H Bollinger Lower Band from earlier chart).

· Market Structure: Higher highs and higher lows rem

1. 4H Chart - Identify Direction & Higher Timeframe Structure

Trend: Bullish Consolidation. Price is holding well above the significant daily low of 113.01 and is consolidating near the 118.50 area after a strong move up.

· Key Level (Resistance): 119.12 (24h High). A sustained break above this level confirms bullish continuation.

· Key Level (Support): 115.85 - 116.12 (Recent 1H swing low & 4H Bollinger Lower Band from earlier chart).

· Market Structure: Higher highs and higher lows rem

SOL-11,21%

- Reward

- 1

- Comment

- Repost

- Share

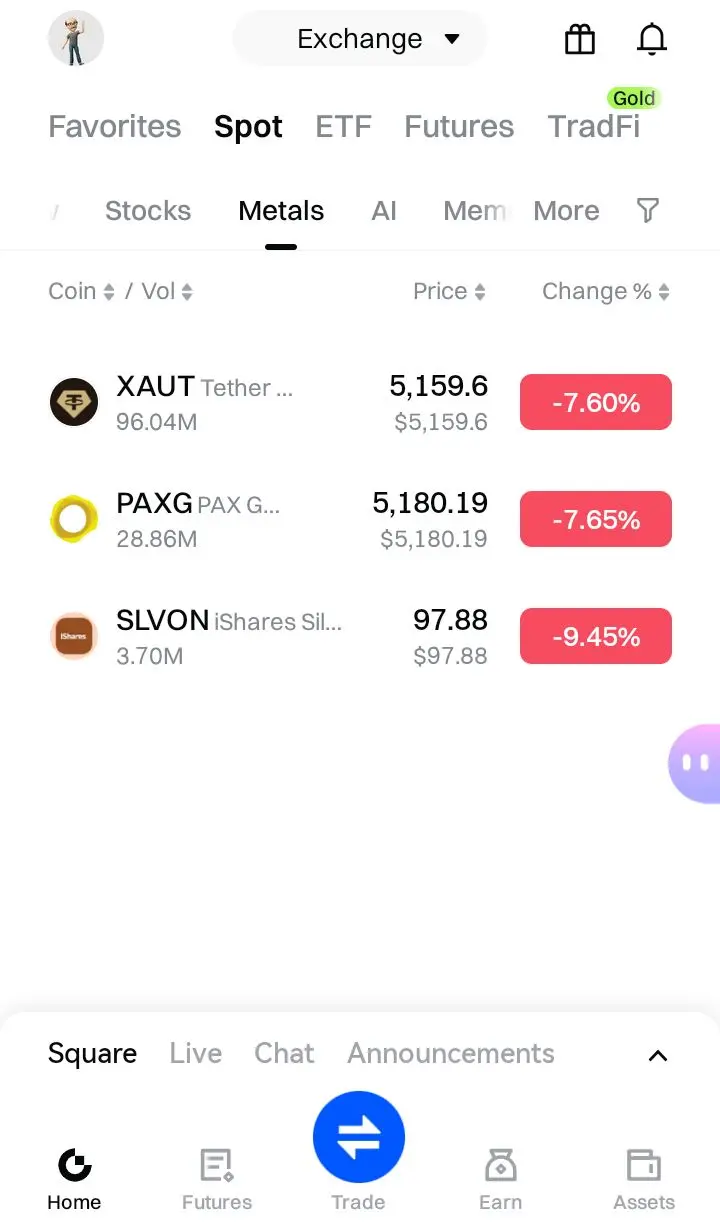

$XAUT XAUT/USDT (Tether Gold) shows a sharp bearish move in the very short term, with the price at approximately $4,918.1 (down -5.54% in the last 24 hours, and the perp slightly lower at -5.83%).

Key Price Levels from the Chart

Current price: ~$4,918.1 (marked with a green cross at the bottom of a strong red candle).

24h High: $5,208.9.

24h Low: $4,714.2 (recent swing low, tested just before the current level).

Visible prior peaks around ~$5,610.6 (local high in the visible range), with the price having broken down from a consolidation/peak area near $5,478–$5,764.

The chart appears to be on

Key Price Levels from the Chart

Current price: ~$4,918.1 (marked with a green cross at the bottom of a strong red candle).

24h High: $5,208.9.

24h Low: $4,714.2 (recent swing low, tested just before the current level).

Visible prior peaks around ~$5,610.6 (local high in the visible range), with the price having broken down from a consolidation/peak area near $5,478–$5,764.

The chart appears to be on

XAUT-1,6%

- Reward

- 3

- Comment

- Repost

- Share

$XRP H#GateLiveMiningProgramPublicBeta ere is a technical analysis:

Current Overview

· Current Price: 1.737 USDT

· 24h Change: -1.75%

· Market Sentiment: Bearish in the short term

Key Price Levels

· Resistance:

· Immediate: 1.795 (SAR level)

· Upper Bollinger Band: 1.972

· Recent Highs: 1.946 (chart annotation)

· Support:

· Lower Bollinger Band: 1.683

· Recent Low: 1.712 (24h low & annotation)

Indicator Analysis

1. Bollinger Bands (20,2):

· Price is currently near the Lower Band (1.683), indicating potential oversold conditions.

· Middle Band (1.828) is above the current price

Current Overview

· Current Price: 1.737 USDT

· 24h Change: -1.75%

· Market Sentiment: Bearish in the short term

Key Price Levels

· Resistance:

· Immediate: 1.795 (SAR level)

· Upper Bollinger Band: 1.972

· Recent Highs: 1.946 (chart annotation)

· Support:

· Lower Bollinger Band: 1.683

· Recent Low: 1.712 (24h low & annotation)

Indicator Analysis

1. Bollinger Bands (20,2):

· Price is currently near the Lower Band (1.683), indicating potential oversold conditions.

· Middle Band (1.828) is above the current price

XRP-4,36%

- Reward

- 2

- 3

- Repost

- Share

Hoki168 :

:

Buy To Earn 💎View More

$ETH Here is a technical analysis for ETH/USDT:

1. Trend & Price Action:

· Current Price: 2,698.66 USDT

· Trend: Bearish in the short term. Price is trading well below the Bollinger Band midline (2,859.43) and the SAR resistance (2,755.20).

· Recent Movement: Price has fallen from the 24h high of 2,769.03 and is hovering just above the 24h low of 2,636.50.

2. Key Technical Indicators:

· Bollinger Bands (20,2):

· Upper Band (UB): 3,112.17 → Strong resistance.

· Middle Band (BOLL): 2,859.43 → Dynamic resistance.

· Lower Band (LB): 2,606.69 → Immediate support.

· Price is currently tradin

1. Trend & Price Action:

· Current Price: 2,698.66 USDT

· Trend: Bearish in the short term. Price is trading well below the Bollinger Band midline (2,859.43) and the SAR resistance (2,755.20).

· Recent Movement: Price has fallen from the 24h high of 2,769.03 and is hovering just above the 24h low of 2,636.50.

2. Key Technical Indicators:

· Bollinger Bands (20,2):

· Upper Band (UB): 3,112.17 → Strong resistance.

· Middle Band (BOLL): 2,859.43 → Dynamic resistance.

· Lower Band (LB): 2,606.69 → Immediate support.

· Price is currently tradin

ETH-9,25%

- Reward

- 3

- 1

- Repost

- Share

Karik254 :

:

I do business, I deal on deals if you have a good deal you get it to me if I like it i buy your deal if you have money to buy my own i give you my deal you pay that's business 😂$GT GT/USDT, here is a technical analysis:

1. Current Price & Trend

· Current Price: ~9.40 USDT

· Short-term trend: Slightly bearish (down -0.53% in 24h)

· Price is trading between the 24h High (9.46) and Low (9.20), suggesting consolidation.

2. Key Indicators

Bollinger Bands (20,2)

· Middle Band (BOLL): 9.34

· Upper Band (UB): 9.45

· Lower Band (LB): 9.24

· Price (~9.40) is hovering near the middle band, indicating a neutral to slightly bearish momentum.

· The bands are relatively narrow, suggesting low volatility and possible consolidation.

Parabolic SAR (0.02,0.02,0.2)

· SAR Value: 9.32

· S

1. Current Price & Trend

· Current Price: ~9.40 USDT

· Short-term trend: Slightly bearish (down -0.53% in 24h)

· Price is trading between the 24h High (9.46) and Low (9.20), suggesting consolidation.

2. Key Indicators

Bollinger Bands (20,2)

· Middle Band (BOLL): 9.34

· Upper Band (UB): 9.45

· Lower Band (LB): 9.24

· Price (~9.40) is hovering near the middle band, indicating a neutral to slightly bearish momentum.

· The bands are relatively narrow, suggesting low volatility and possible consolidation.

Parabolic SAR (0.02,0.02,0.2)

· SAR Value: 9.32

· S

GT-9,46%

- Reward

- 1

- 1

- Repost

- Share

ThisYearIWillHaveSm :

:

The trash that must be broken at 9$BTC BTC/USDT, here’s a technical analysis:

Current Overview

· Price: ~$84,052.4 (+1.12%)

· Perp Price: 84,016.1 (+1.15%)

· Market Position: Strong, trading near 24-hour high (84,631.5)

Indicators & Key Levels

1. Bollinger Bands (20,2)

· Midline (BOLL): 83,630.8

· Upper Band (UB): 84,781.6

· Lower Band (LB): 82,480.0

· Analysis: Price is currently above the midline, indicating bullish momentum. It is approaching the Upper Band, which could act as resistance. If it breaks above, it may signal continued upward movement.

2. Parabolic SAR (0.02, 0.02, 0.2)

· SAR Value: 83,424.0

· Analysis: SAR dot

Current Overview

· Price: ~$84,052.4 (+1.12%)

· Perp Price: 84,016.1 (+1.15%)

· Market Position: Strong, trading near 24-hour high (84,631.5)

Indicators & Key Levels

1. Bollinger Bands (20,2)

· Midline (BOLL): 83,630.8

· Upper Band (UB): 84,781.6

· Lower Band (LB): 82,480.0

· Analysis: Price is currently above the midline, indicating bullish momentum. It is approaching the Upper Band, which could act as resistance. If it breaks above, it may signal continued upward movement.

2. Parabolic SAR (0.02, 0.02, 0.2)

· SAR Value: 83,424.0

· Analysis: SAR dot

BTC-6,07%

- Reward

- 1

- Comment

- Repost

- Share

#PreciousMetalsPullBack The January 29-30, 2026 Market Rout: A Sharp Correction Amid Geopolitical Heat and Leverage Unwind

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

On January 30, 2026, global risk assets endured a violent flush, with an estimated $8 trillion in paper wealth erased across equities, crypto, and commodities in under 24 hours.

This was not a full-blown crash but a high-velocity deleveraging event triggered by escalating U.S.-Iran tensions, aggressive CME margin increases, persistent Fed hawkishness, and looming tariff risks.

Key Price Action (as of late January 30, 2026):

Bitcoin (BTC): Closed around $82,000–$82,350 aft

- Reward

- 2

- Comment

- Repost

- Share

$BNB #GateLiveMiningProgramPublicBeta

BNB/USDT charts across multiple timeframes, Here is the professional analysis and trade plan.

1. 4H Chart - Identify Direction (Primary Trend)

Direction: Bearish.

· Price Action: Price at 889.6 is trading significantly below the 4H Bollinger Band midline (BOLL: 891.3), indicating bearish momentum.

· Structure: The chart shows a sequence of lower highs. The current price is near the 24h low (889.0), testing a key level.

· Key Level: The Parabolic SAR (SAR: 906.4) is well above price, confirming the downtrend. The Lower Bollinger Band (LB: 868.7) is the nex

BNB/USDT charts across multiple timeframes, Here is the professional analysis and trade plan.

1. 4H Chart - Identify Direction (Primary Trend)

Direction: Bearish.

· Price Action: Price at 889.6 is trading significantly below the 4H Bollinger Band midline (BOLL: 891.3), indicating bearish momentum.

· Structure: The chart shows a sequence of lower highs. The current price is near the 24h low (889.0), testing a key level.

· Key Level: The Parabolic SAR (SAR: 906.4) is well above price, confirming the downtrend. The Lower Bollinger Band (LB: 868.7) is the nex

BNB-8,15%

- Reward

- 2

- 3

- Repost

- Share

GateUser-77bdaf4a :

:

Hold on tight, we're about to take off 🛫View More

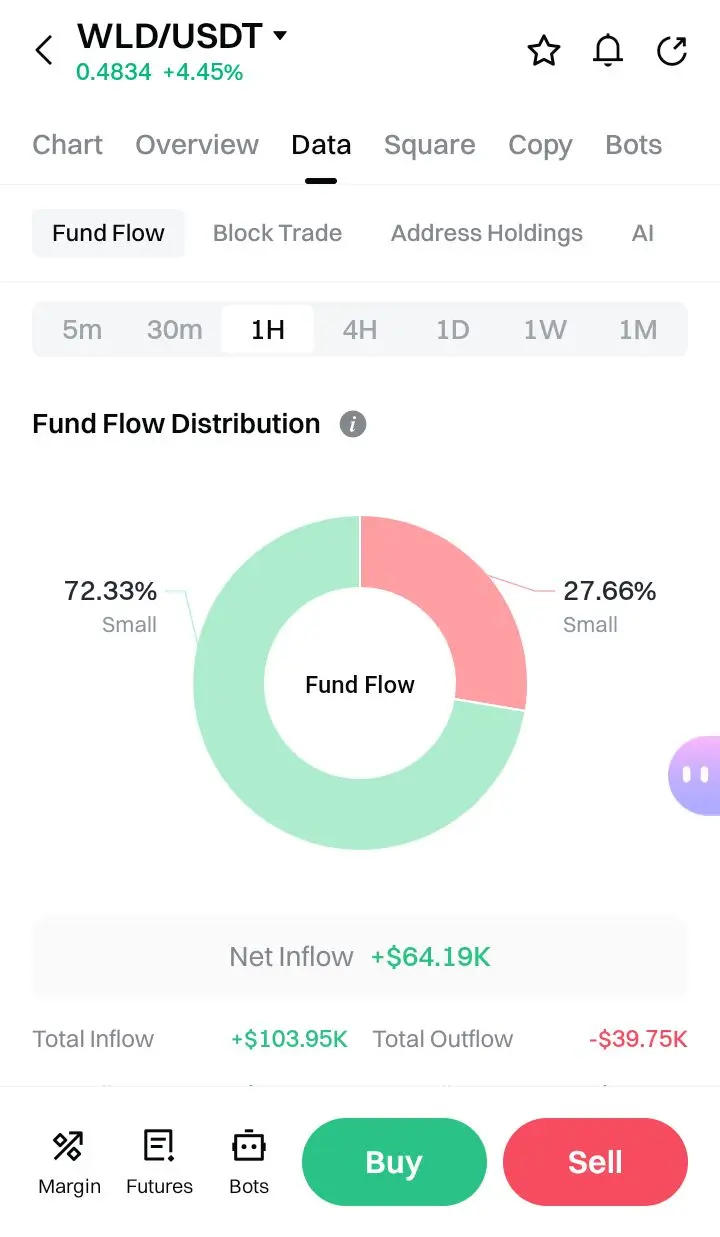

$WLD Here is a comprehensive K-line analysis for WLD/USDT:

1. Immediate Price Action & Context

· Current Price: $0.4848, showing significant short-term strength (+4.75%).

· Trading Range: The price is trading much closer to the 24h Low ($0.4543)** than the **24h High ($0.6542), indicating the current bounce is occurring within a broader daily downtrend or a deep correction from the high.

· Key Reference: The Parabolic SAR (0.5694) is well above the current price. This confirms the short-term trend is still bearish, and the SAR will act as a dynamic resistance target.

2. Support & Resistance Zo

1. Immediate Price Action & Context

· Current Price: $0.4848, showing significant short-term strength (+4.75%).

· Trading Range: The price is trading much closer to the 24h Low ($0.4543)** than the **24h High ($0.6542), indicating the current bounce is occurring within a broader daily downtrend or a deep correction from the high.

· Key Reference: The Parabolic SAR (0.5694) is well above the current price. This confirms the short-term trend is still bearish, and the SAR will act as a dynamic resistance target.

2. Support & Resistance Zo

WLD-9,59%

- Reward

- 1

- Comment

- Repost

- Share

$GT GT/USDT chart data, Here is a complete in-depth K-line analysis focusing on key technical levels, zones, and market structure for the 1-hour timeframe.

1. Current Market Context & Structure

· Current Price: 9.723 USDT

· Trend: Short-term bearish (price is below the Bollinger Middle Band and Parabolic SAR)

· 24h Range: 9.71 (Low) — 10.03 (High)

· Key Observation: Price is trading near the lower Bollinger Band and just above the 24h low, indicating oversold conditions in the very short term.

2. Key Technical Indicators Analysis

Bollinger Bands (20,2)

· Middle Band (BB): 9.83 — acts as immed

1. Current Market Context & Structure

· Current Price: 9.723 USDT

· Trend: Short-term bearish (price is below the Bollinger Middle Band and Parabolic SAR)

· 24h Range: 9.71 (Low) — 10.03 (High)

· Key Observation: Price is trading near the lower Bollinger Band and just above the 24h low, indicating oversold conditions in the very short term.

2. Key Technical Indicators Analysis

Bollinger Bands (20,2)

· Middle Band (BB): 9.83 — acts as immed

GT-9,46%

- Reward

- 1

- Comment

- Repost

- Share

$SOL Here is a structured technical breakdown:

📉 4-Hour Analysis

· Direction:

Downtrend intact. Price is trading below the BOLL middle band, and the SAR dots are above the price, indicating bearish control.

· Liquidity:

Recent low near 122.50 is a short-term liquidity zone. A break below could target 121.10 or lower.

· Supply & Demand:

· Supply zone: 127.84 – 128.35 (resistance)

· Demand zone: 122.50 – 121.84 (support)

⏳ 1-Hour Analysis

· Trend:

Bearish momentum persists. Price oscillates in the lower half of the BOLL band. MACD is below zero, with negative DIF and DEA.

· Bre

📉 4-Hour Analysis

· Direction:

Downtrend intact. Price is trading below the BOLL middle band, and the SAR dots are above the price, indicating bearish control.

· Liquidity:

Recent low near 122.50 is a short-term liquidity zone. A break below could target 121.10 or lower.

· Supply & Demand:

· Supply zone: 127.84 – 128.35 (resistance)

· Demand zone: 122.50 – 121.84 (support)

⏳ 1-Hour Analysis

· Trend:

Bearish momentum persists. Price oscillates in the lower half of the BOLL band. MACD is below zero, with negative DIF and DEA.

· Bre

SOL-11,21%

- Reward

- 1

- Comment

- Repost

- Share

$XRP XRP/USDT chart with technical indicators, here is a technical analysis:

1. Overall Trend and Price Action:

· Trend: The price is in a clear short-term downtrend. It has broken below the key moving average of the Bollinger Bands (BOLL: 1.914) and is trading near the lower band (LB: 1.881).

· Current Price: $1.879, which is a decline of -1.16%. The price is hovering just above the 24-hour low of 1.870 and well below the 24-hour high of 1.943.

· Support & Resistance:

· Immediate Support: The 24h Low at 1.870 and the Bollinger Lower Band at 1.881. A break below 1.870 could see a move toward

1. Overall Trend and Price Action:

· Trend: The price is in a clear short-term downtrend. It has broken below the key moving average of the Bollinger Bands (BOLL: 1.914) and is trading near the lower band (LB: 1.881).

· Current Price: $1.879, which is a decline of -1.16%. The price is hovering just above the 24-hour low of 1.870 and well below the 24-hour high of 1.943.

· Support & Resistance:

· Immediate Support: The 24h Low at 1.870 and the Bollinger Lower Band at 1.881. A break below 1.870 could see a move toward

XRP-4,36%

- Reward

- 4

- 3

- Repost

- Share

You :

:

a very informative and beautiful articleView More

#GoldBreaksAbove$5,200 The Precious Metals Surge: A Multi-Scenario Analysis of a New Financial Paradigm

The recent surge in precious metals, with spot gold reaching an unprecedented $5,535 and silver posting significant gains, is not merely a market fluctuation but a potent signal of profound global economic and geopolitical shifts.

This rally, fueled by safe-haven demand amidst uncertainty, presents a critical inflection point.

The future trajectory of this trend is not predetermined; instead, it branches into several distinct, plausible scenarios with wide-ranging implications for investor

The recent surge in precious metals, with spot gold reaching an unprecedented $5,535 and silver posting significant gains, is not merely a market fluctuation but a potent signal of profound global economic and geopolitical shifts.

This rally, fueled by safe-haven demand amidst uncertainty, presents a critical inflection point.

The future trajectory of this trend is not predetermined; instead, it branches into several distinct, plausible scenarios with wide-ranging implications for investor

XAUT-1,6%

- Reward

- 1

- Comment

- Repost

- Share

#ContentMiningRevampPublicBeta DNUSDT Perp Analysis & Trade Plan

$DN Coin Introduction

DNUSDT is a perpetual futures contract trading pair tracking the price of DN (likely a token) against USDT. Current price is $0.1737**, down **-3.93%**.

24h range: **$0.1641–$0.1905. Market shows moderate volatility with clear technical patterns emerging on lower timeframes.

Chart Analysis

1. 1H Chart Analysis (IRL / ERL)

· Trend Structure: The 1H chart shows price has broken below the EMA (20/50) cluster and is trading near the lower Bollinger Band (~$0.1730).

· Imbalance Reaction Level (IRL): Price recent

$DN Coin Introduction

DNUSDT is a perpetual futures contract trading pair tracking the price of DN (likely a token) against USDT. Current price is $0.1737**, down **-3.93%**.

24h range: **$0.1641–$0.1905. Market shows moderate volatility with clear technical patterns emerging on lower timeframes.

Chart Analysis

1. 1H Chart Analysis (IRL / ERL)

· Trend Structure: The 1H chart shows price has broken below the EMA (20/50) cluster and is trading near the lower Bollinger Band (~$0.1730).

· Imbalance Reaction Level (IRL): Price recent

DN-11,27%

- Reward

- 2

- 3

- Repost

- Share

Discovery :

:

Ape In 🚀View More

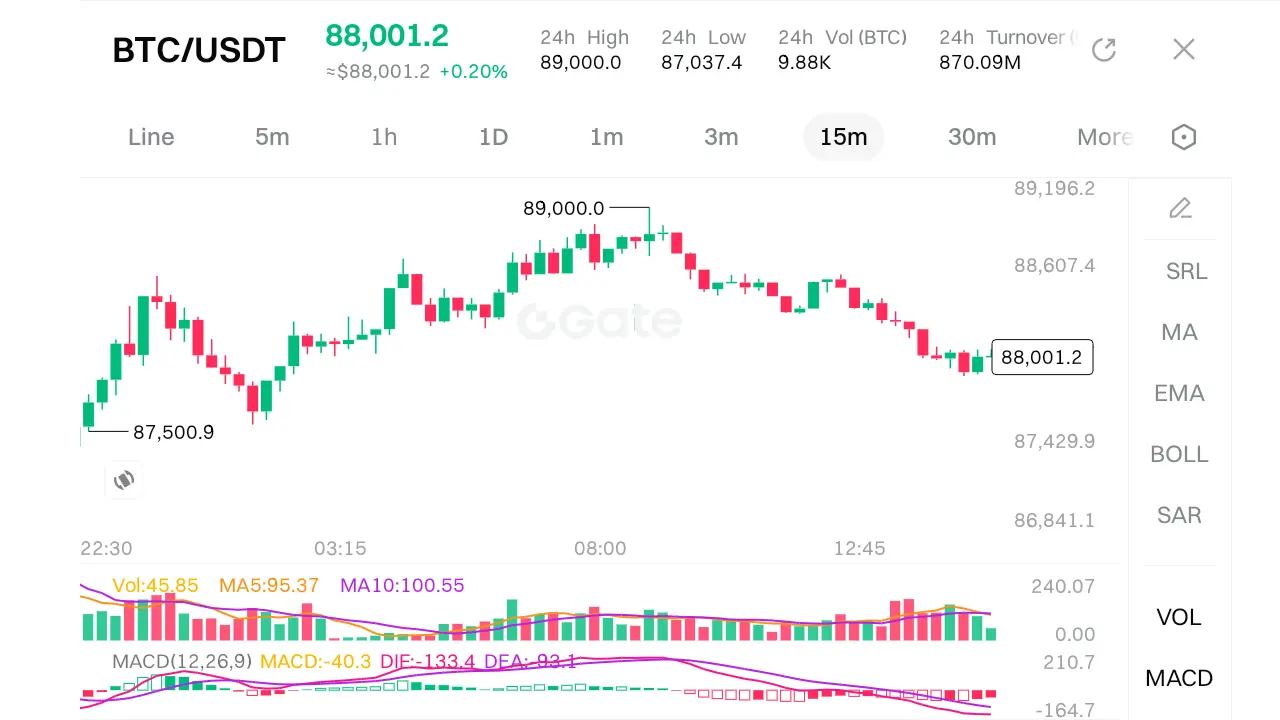

#ContentMiningRevampPublicBeta 📈 Trade Plan: BTC/USDT | Multi-Timeframe Liquidity Grab & FVG Play

Market Context & Psychology

· Current Price: ~$89,141.5

· 24H Range: $87,300.9 – $89,518.2

· Market State: Consolidation after a rally, with tightening Bollinger Bands across multiple timeframes, indicating a volatility contraction before an expansion.

· Psychology: Traders are watching for a break of the recent high ($89,518) or a failure from current levels. The lower timeframe shows indecision, while the daily chart suggests a bullish structure above $87,300.

Chart Pattern & Structure Analysis

Market Context & Psychology

· Current Price: ~$89,141.5

· 24H Range: $87,300.9 – $89,518.2

· Market State: Consolidation after a rally, with tightening Bollinger Bands across multiple timeframes, indicating a volatility contraction before an expansion.

· Psychology: Traders are watching for a break of the recent high ($89,518) or a failure from current levels. The lower timeframe shows indecision, while the daily chart suggests a bullish structure above $87,300.

Chart Pattern & Structure Analysis

BTC-6,07%

- Reward

- 5

- 1

- Repost

- Share

ybaser :

:

Happy New Year! 🤑#ContentMiningRevampPublicBeta DOGE/USDT TRADE PLAN: "THE SQUEEZE BEFORE THE SPRING"

Capital: $1,500 | **Risk per Trade:** 1.5% ($22.50) | Strategy: HTF-Confluent Breakout / Pullback

1. MARKET SITUATION & WHY THIS STRATEGY IS BEST

Current Context: DOGE is in a coiled consolidation after a recent rally. Key observations:

· Price: Trading at $0.12491, hovering near the daily middle Bollinger Band (BB).

· Volatility Compression: BB bands are tightening significantly across timeframes (4H, 1H, 15m), signaling impending volatility expansion.

· Liquidity Pools: Clear 24H High at $0.12664** and 24H L

Capital: $1,500 | **Risk per Trade:** 1.5% ($22.50) | Strategy: HTF-Confluent Breakout / Pullback

1. MARKET SITUATION & WHY THIS STRATEGY IS BEST

Current Context: DOGE is in a coiled consolidation after a recent rally. Key observations:

· Price: Trading at $0.12491, hovering near the daily middle Bollinger Band (BB).

· Volatility Compression: BB bands are tightening significantly across timeframes (4H, 1H, 15m), signaling impending volatility expansion.

· Liquidity Pools: Clear 24H High at $0.12664** and 24H L

DOGE-8,53%

- Reward

- 3

- 6

- Repost

- Share

XSEAM :

:

EU Forces Google to Open Android to Rival AI Tools - - #cryptocurrency #bitcoin #altcoinsView More

$BTC BTC/USDT Multi-Timeframe Technical Analysis & AMT Trade Plan

📈 Complete K-Line Analysis

Higher Timeframes (1D, 4H):

BTC is consolidating within a narrowing range after a strong uptrend. The 1D chart shows a previous high near $114,279 (November 2025) followed by a pullback. Price is currently trading around **$89,190**, struggling to break above the $90,000 psychological level. Recent candles show indecision small bodies with varying wicks, indicating equilibrium between buyers and sellers.

Lower Timeframes (1H, 15M, 5M):

Price is coiling within a tightening range, forming a potential sy

📈 Complete K-Line Analysis

Higher Timeframes (1D, 4H):

BTC is consolidating within a narrowing range after a strong uptrend. The 1D chart shows a previous high near $114,279 (November 2025) followed by a pullback. Price is currently trading around **$89,190**, struggling to break above the $90,000 psychological level. Recent candles show indecision small bodies with varying wicks, indicating equilibrium between buyers and sellers.

Lower Timeframes (1H, 15M, 5M):

Price is coiling within a tightening range, forming a potential sy

BTC-6,07%

- Reward

- 3

- 2

- Repost

- Share

Stoneblock332 :

:

hehehehehwyegwgwvhwuehehehwueidbrbeView More

$GT 🔥 GT/USDT Technical Analysis: The Double Purge Setup

📊 Market Structure & Key Levels

· Current Price: $9.79 (+0.10%)

· 24H Range: $9.73 (Low) – $9.90 (High)

· Key Swing High: $10.88 (Nov 21)

· Key Swing Low: $9.07 (Recent base)

· Immediate Resistance: $9.90

· Immediate Support: $9.73 → **$9.56** → $9.07

🧠 K-line & Psychology Analysis

The chart shows a clear bearish trend consolidation after a rejection from $10.88. Recent price action is compressing between $9.56–$9.90, indicating indecision before the next directional move.

Notable Candlestick Patterns:

· Multiple pinbars near $9.73–

📊 Market Structure & Key Levels

· Current Price: $9.79 (+0.10%)

· 24H Range: $9.73 (Low) – $9.90 (High)

· Key Swing High: $10.88 (Nov 21)

· Key Swing Low: $9.07 (Recent base)

· Immediate Resistance: $9.90

· Immediate Support: $9.73 → **$9.56** → $9.07

🧠 K-line & Psychology Analysis

The chart shows a clear bearish trend consolidation after a rejection from $10.88. Recent price action is compressing between $9.56–$9.90, indicating indecision before the next directional move.

Notable Candlestick Patterns:

· Multiple pinbars near $9.73–

GT-9,46%

- Reward

- 3

- Comment

- 1

- Share

Below is a comprehensive K-line (candlestick) analysis of the provided ETH/USDT chart.

#ContentMiningRevampPublicBeta

I'll structure the analysis as follows for clarity:

Overall Price Action and Market Structure

Candlestick Patterns and Key Levels

Technical Indicators Breakdown

Volume Analysis;$ETH

Potential Support/Resistance and Trends

Market Sentiment and Outlook

1. Overall Price Action and Market Structure

Current Price and Range: The current ETH/USDT price is $2,910.58, up +0.4% in the last 24 hours. The 24-hour high is $2,956.98, low is $2,875.76, with a trading volume of 186.38K ETH

#ContentMiningRevampPublicBeta

I'll structure the analysis as follows for clarity:

Overall Price Action and Market Structure

Candlestick Patterns and Key Levels

Technical Indicators Breakdown

Volume Analysis;$ETH

Potential Support/Resistance and Trends

Market Sentiment and Outlook

1. Overall Price Action and Market Structure

Current Price and Range: The current ETH/USDT price is $2,910.58, up +0.4% in the last 24 hours. The 24-hour high is $2,956.98, low is $2,875.76, with a trading volume of 186.38K ETH

ETH-9,25%

- Reward

- 3

- Comment

- Repost

- Share

$BTC Bitcoin (BTC/USDT) is currently trading around $88,000 (based on your Gate.io screenshots showing ~$88,001–$88,002.

This reflects a mild +0.2% change in the last 24 hours, with 24h highs near $89,000 and lows around $87,000–$87,037. Volume remains solid (~9.8K–14K BTC on Gate.io spot/perps), indicating sustained interest despite the consolidation phase.

charts (from Gate.io) cover multiple timeframes with indicators like MA, EMA, BOLL (Bollinger Bands), SAR, VOL, and MACD.

Here's a breakdown aligned with your requested focus areas: 4H (direction, liquidity, supply/demand), 1H (trend, brea

This reflects a mild +0.2% change in the last 24 hours, with 24h highs near $89,000 and lows around $87,000–$87,037. Volume remains solid (~9.8K–14K BTC on Gate.io spot/perps), indicating sustained interest despite the consolidation phase.

charts (from Gate.io) cover multiple timeframes with indicators like MA, EMA, BOLL (Bollinger Bands), SAR, VOL, and MACD.

Here's a breakdown aligned with your requested focus areas: 4H (direction, liquidity, supply/demand), 1H (trend, brea

BTC-6,07%

- Reward

- 4

- 3

- Repost

- Share

AhmadOnAlpha :

:

👀👀👀View More