IntoTheBlock

No content yet

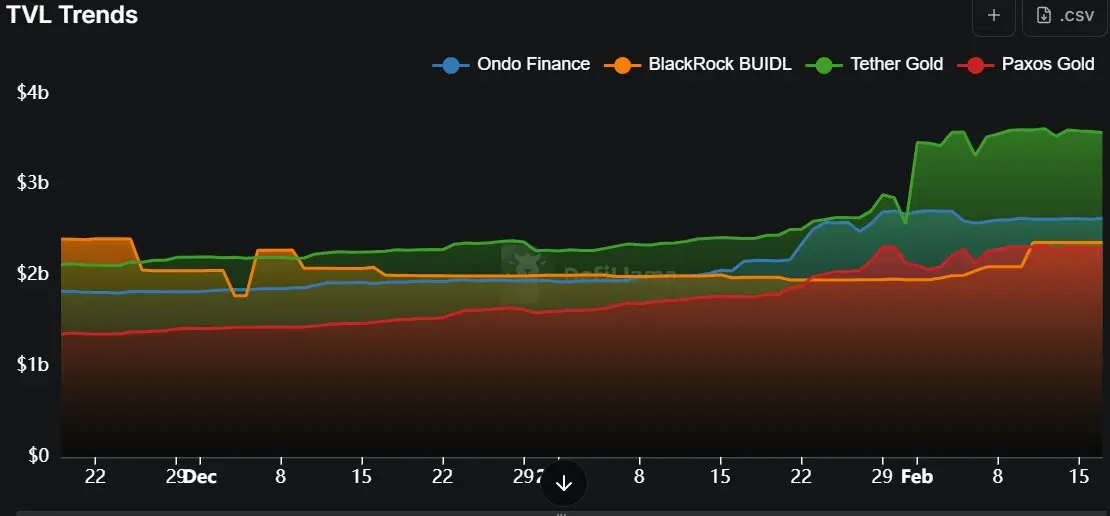

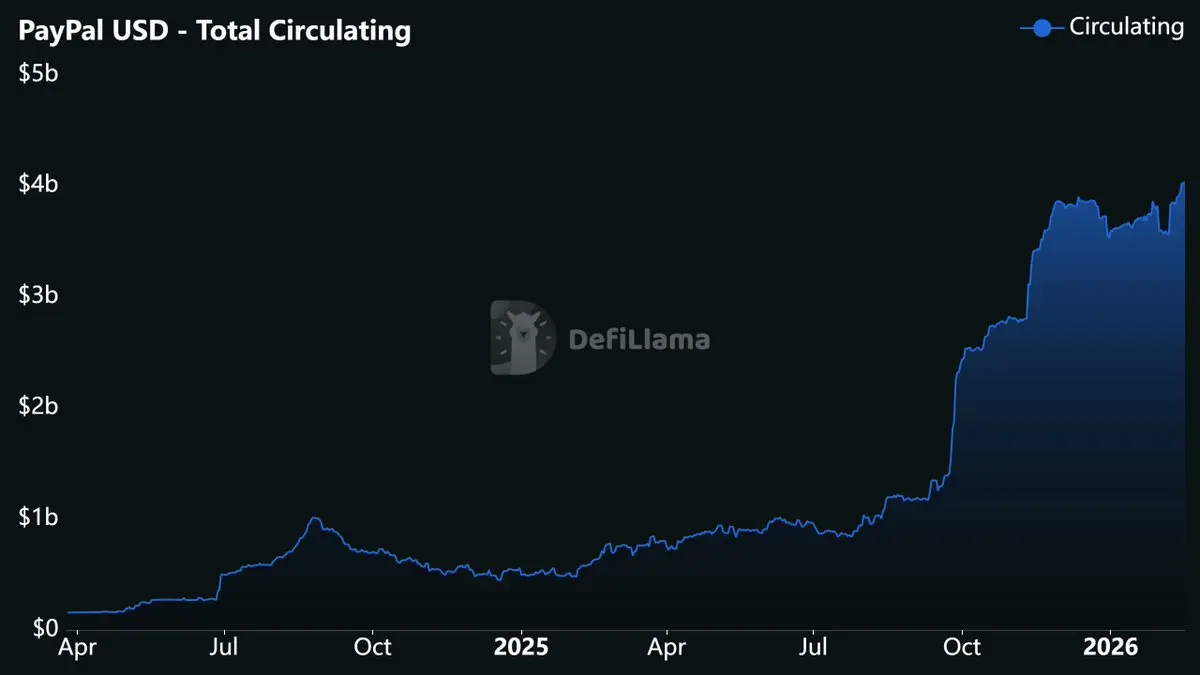

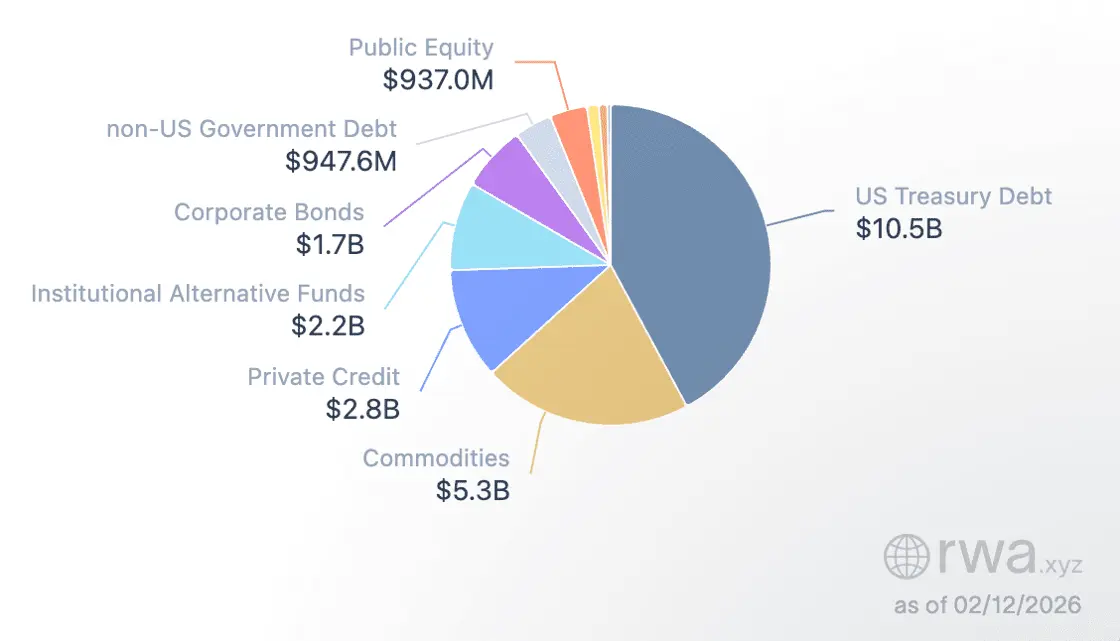

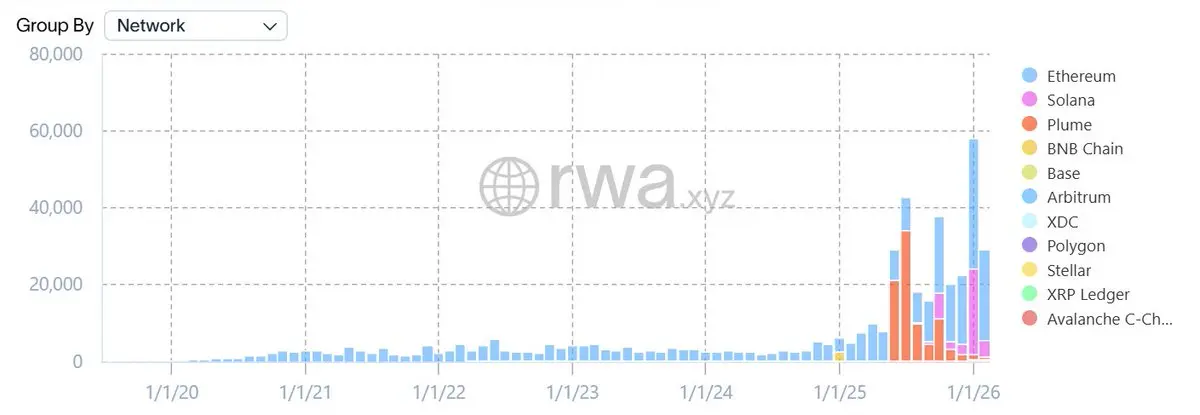

RWA momentum continued as two of the world’s largest traditional asset managers, BlackRock and Apollo Global Management, moved to deep infrastructure integration.

We break it down in our latest newsletter👇

We break it down in our latest newsletter👇

- Reward

- like

- Comment

- Repost

- Share

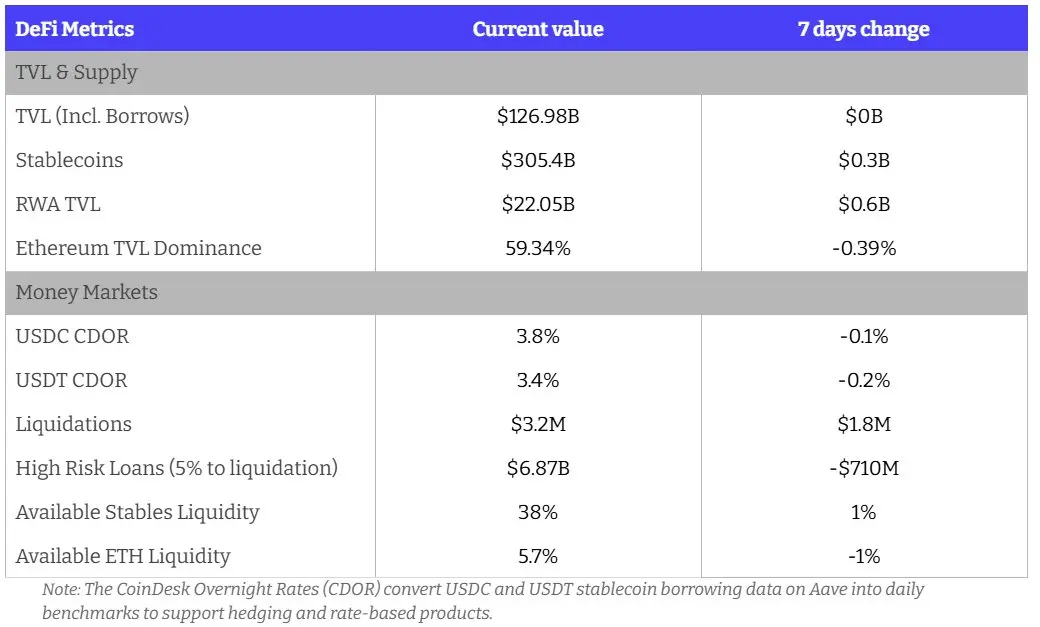

Here are this week's key DeFi metrics👇

Major takeaways:

✔️TVL and supply remains flat as markets continue to chop

✔️$700M decrease in high-risk loans, driven by repayments in leveraged restaking

Major takeaways:

✔️TVL and supply remains flat as markets continue to chop

✔️$700M decrease in high-risk loans, driven by repayments in leveraged restaking

- Reward

- 1

- Comment

- Repost

- Share

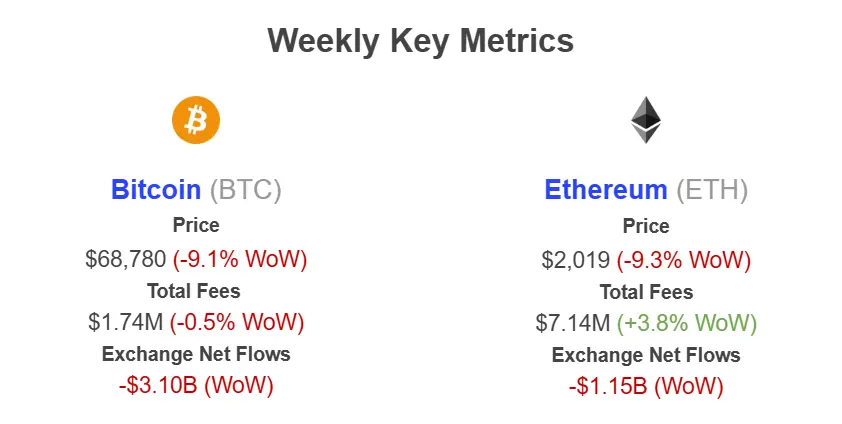

Total Ethereum fees saw a drastic 70% decline this week, signaling a lull in high-velocity DeFi activity

ETH0,79%

- Reward

- like

- Comment

- Repost

- Share

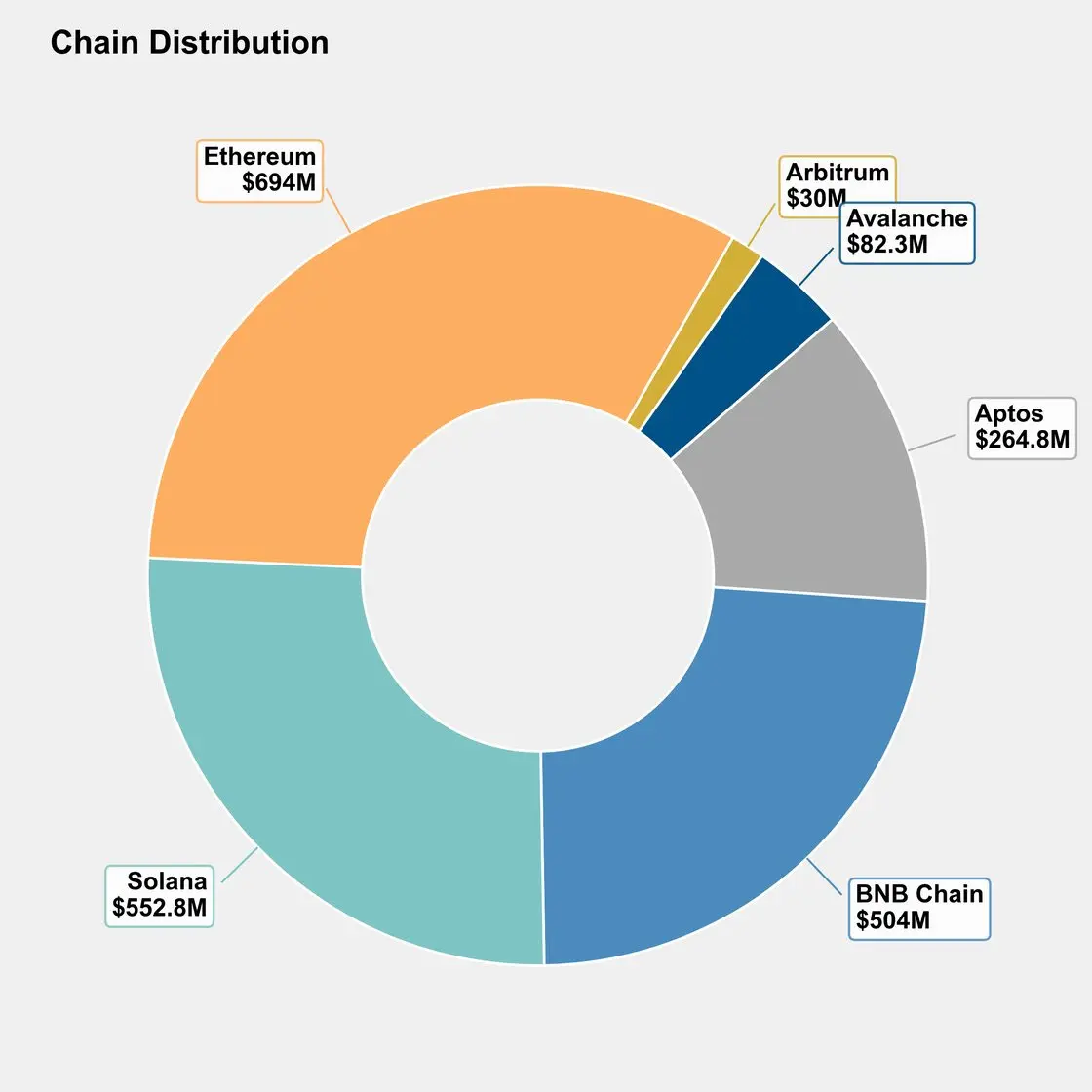

Monthly active addresses for tokenized commodities have climbed over 95% in the last 30 days.

Despite the relatively small holder base of ~230k adresses, the sector has reached $6.86B in market capitalization and more than $18B in monthly transfer volume.

Despite the relatively small holder base of ~230k adresses, the sector has reached $6.86B in market capitalization and more than $18B in monthly transfer volume.

- Reward

- like

- 1

- Repost

- Share

Lions_Lionish :

:

EXCLUSIVE LATEST COIN & MARKET UPDATES on GATE SQUARE ✅ FOLLOW ME NOW 🔥💰💵Risk curation is quickly becoming foundational to DeFi infrastructure.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

Join our next webinar to learn how curation works, why it’s essential, and how it strengthens on-chain markets.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Supervised loans are a cornerstone of institutional DeFi.

Here’s what they are, how they work, and why they matter 👇

Here’s what they are, how they work, and why they matter 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Our next webinar will unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

This week: tokenization is gaining momentum in markets, and we’re unpacking what’s happening with DeFi rates 👇

DEFI-0,28%

- Reward

- like

- Comment

- Repost

- Share

Both Bitcoin and Ether saw significant outflows from exchange wallets this week, hinting at ongoing accumulation amid price weakness.

BTC0,96%

- Reward

- like

- Comment

- Repost

- Share

DeFi has moved from “Can we build it?” to “Can we run it safely at scale?” and a key part of that move is risk curation.

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

In our next webinar, we’ll unpack different approaches to curation, risk management and strategy design.

Sign up below 👇

- Reward

- like

- Comment

- Repost

- Share