Jamesvanst

No content yet

Over the last 24 hours, Bitcoin is up on bad news.

This environment is nothing like 2022.

This environment is nothing like 2022.

BTC-2,19%

- Reward

- 1

- Comment

- Repost

- Share

As of yesterday, the Bitcoin miner capitulation was over.

It was the second longest on record (3 months), suggesting the worst is over for price.

However, let's see how much hashrate, if any, goes offline from the Middle East attacks.

Now trying to work out what "new news" could take Bitcoin lower from here (Black Monday meh).

Bitcoin tends to make its low within the first 10 days of a month; it did so again (February 6).

The first ten days should be choppy, but based on probability, March should be green.

Bitcoin eventually bottoms when price doesn't go down on bad news. Just like when it doe

It was the second longest on record (3 months), suggesting the worst is over for price.

However, let's see how much hashrate, if any, goes offline from the Middle East attacks.

Now trying to work out what "new news" could take Bitcoin lower from here (Black Monday meh).

Bitcoin tends to make its low within the first 10 days of a month; it did so again (February 6).

The first ten days should be choppy, but based on probability, March should be green.

Bitcoin eventually bottoms when price doesn't go down on bad news. Just like when it doe

BTC-2,19%

- Reward

- 1

- Comment

- Repost

- Share

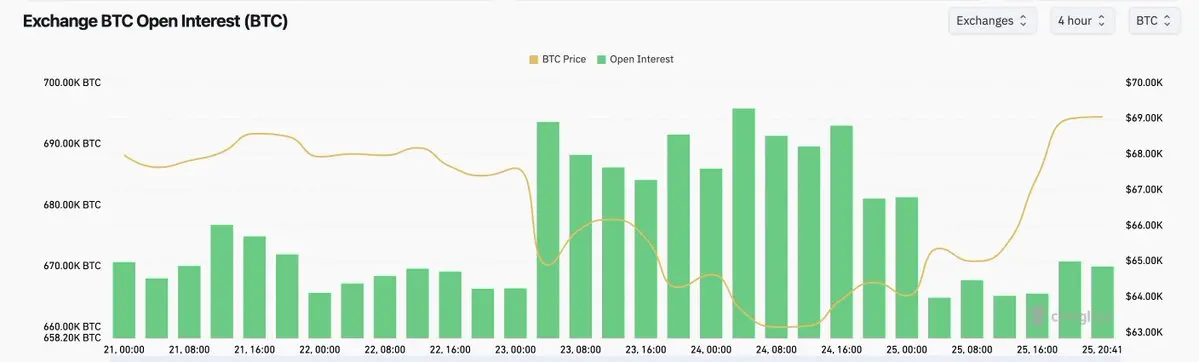

You can see all puts being bought on Deribit, march 1 and March 2.

Funding deeply negative, OI flying higher, sentiment extreme fear.

Surely, it takes btc back to 60k, surely.

Funding deeply negative, OI flying higher, sentiment extreme fear.

Surely, it takes btc back to 60k, surely.

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share

Another weekend where macro analysts call Bitcoin useless but keep watching it over the weekend to maintain edge or some alpha to prep them for Monday

BTC-2,19%

- Reward

- 2

- Comment

- Repost

- Share

One of the biggest impacts AI will have is on aggregate wages, which will be deflationary in nominal terms.

There will always be jobs maybe not at the pay you would like, but there will always be jobs.

There will always be jobs maybe not at the pay you would like, but there will always be jobs.

- Reward

- like

- Comment

- Repost

- Share

The U.S. economy is re-accelerating.

The business cycle is starting to expand.

Liquidity has bottomed (U.S. Treasury securities on the Fed balance sheet are now back at November 2024 levels, i.e., QE but not QE).

Rotation from extremely concentrated U.S. tech to cyclical stocks is broadening the overall market.

Look at all stocks globally.

Bitcoin has its own unique issues and will eventually participate to the upside.

Coinbase premium + ETF inflows starting to emerge.

The business cycle is starting to expand.

Liquidity has bottomed (U.S. Treasury securities on the Fed balance sheet are now back at November 2024 levels, i.e., QE but not QE).

Rotation from extremely concentrated U.S. tech to cyclical stocks is broadening the overall market.

Look at all stocks globally.

Bitcoin has its own unique issues and will eventually participate to the upside.

Coinbase premium + ETF inflows starting to emerge.

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share

Hardware rotation back into software

NVIDIA -5%

IGV +2%

BTC correlated 1:1 with software

NVIDIA -5%

IGV +2%

BTC correlated 1:1 with software

BTC-2,19%

- Reward

- 1

- Comment

- Repost

- Share

Back in 2022, MSTR fell almost 60% below its 200WMA and stayed below it for 17 months.

Currently, it is 8% away from its 200WMA, after being as much as 30% away.

This confirms that the majority of the price pain is behind us, while much more time pain lies ahead.

Currently, it is 8% away from its 200WMA, after being as much as 30% away.

This confirms that the majority of the price pain is behind us, while much more time pain lies ahead.

- Reward

- 1

- Comment

- Repost

- Share

So what happens when bitcoin dumps at 10am?

Who we blaming?

Who we blaming?

BTC-2,19%

- Reward

- 1

- Comment

- Repost

- Share

Open interest down over past 24 hours

Funding rate negative

Shorts are covering which is driving the move

Need continued spot buying to squeeze higher

Funding rate negative

Shorts are covering which is driving the move

Need continued spot buying to squeeze higher

- Reward

- 2

- Comment

- Repost

- Share

Where is the 10am slam?

- Reward

- like

- Comment

- Repost

- Share

Embrace the volatility.

Embrace the critics.

Embrace the noise.

Always learn.

Stay the course, it’s always worth it.

Embrace the critics.

Embrace the noise.

Always learn.

Stay the course, it’s always worth it.

- Reward

- like

- Comment

- Repost

- Share

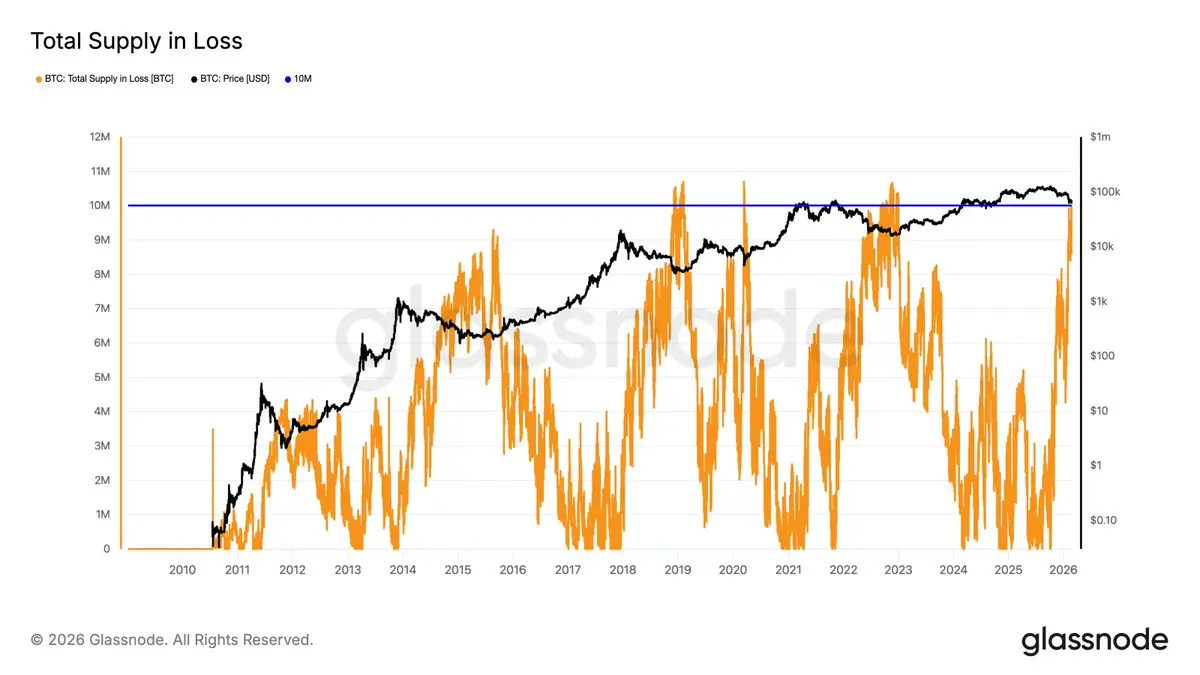

BTC supply in loss just hit 10M coins, the fourth-highest reading ever.

A further 70K coins are in loss from purchases between Feb. 6 and today.

Circulating supply hits 20M BTC next week, that’s 50% in loss.

History suggests that’s enough capital destruction for a bear market bottom.

A further 70K coins are in loss from purchases between Feb. 6 and today.

Circulating supply hits 20M BTC next week, that’s 50% in loss.

History suggests that’s enough capital destruction for a bear market bottom.

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share

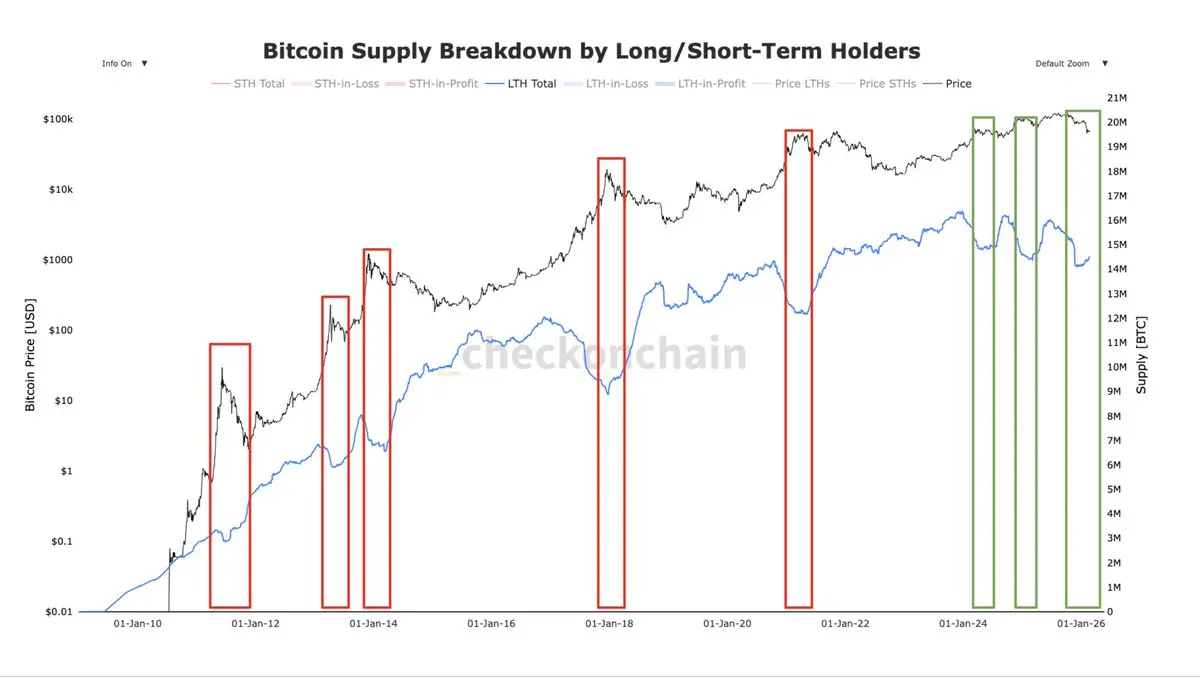

The two time frames bitcoin is acting the closest to is January 2015 and December 2018.

People comparing it to 2022 haven't been in bitcoin long enough

People comparing it to 2022 haven't been in bitcoin long enough

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share

The two time frames bitcoin is acting the closest to is January 2015 and December 2018.

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share

MSTR/IBIT ratio is up 12% year to date

Up a further 1.5% today

Up a further 1.5% today

- Reward

- like

- Comment

- Repost

- Share

It’s time to re-test the lows for Bitcoin.

The best outcome would be IV not ripping while this happens.

The best outcome would be IV not ripping while this happens.

BTC-2,19%

- Reward

- 1

- Comment

- Repost

- Share

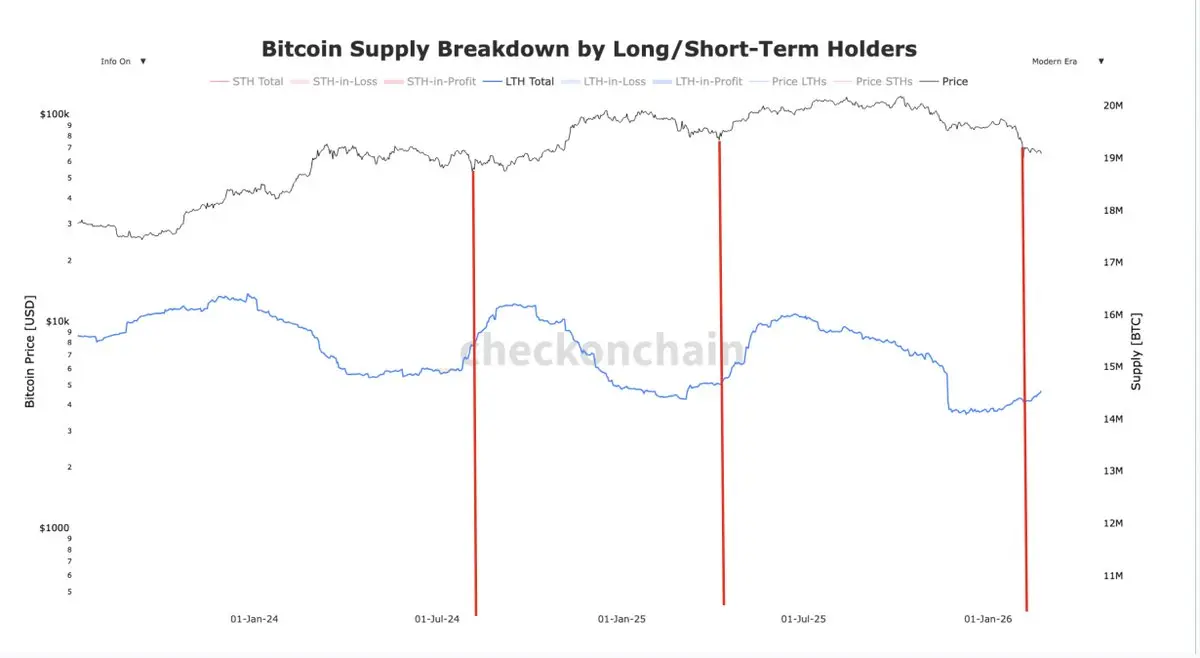

Long-term holder supply has increased by 400k BTC since November 23rd.

LTH behaviour changed post-ETF, as clearly seen in the supply structure (first image).

Zooming in on the two previous LTH supply drawdowns (Yen carry & Liberation Day tariffs).

The bottom had already occurred by the time LTH supply started increasing (second image).

LTH behaviour changed post-ETF, as clearly seen in the supply structure (first image).

Zooming in on the two previous LTH supply drawdowns (Yen carry & Liberation Day tariffs).

The bottom had already occurred by the time LTH supply started increasing (second image).

BTC-2,19%

- Reward

- like

- Comment

- Repost

- Share