TradeDots

No content yet

TradeDots

$FDX: Strategic $3.7B Bond OfferingSentiment: PositiveFedEx finalized senior bond offerings tied to its Freight spin-off, suggesting financial progress towards unlocking new value streams for its logistics business.

- Reward

- like

- Comment

- Repost

- Share

$TSM: AI Leadership at a Valuation CrossroadSentiment: NeutralTaiwan Semiconductor benefits from global AI investment but trades at a discount to peers, creating a unique dilemma for growth expectations versus valuation.

- Reward

- like

- Comment

- Repost

- Share

$UPS: Major Job Cuts as Turnaround Plan EvolvesSentiment: Neutral\'\'\'UPS announced 30,000 job cuts by 2026 as part of an operational revamp to enhance productivity and efficiency.\'\'\'

- Reward

- like

- Comment

- Repost

- Share

$ORCL: Healthcare Tech for Future GrowthSentiment: PositiveOracle expands in Saudi Arabia with AI-driven healthcare management systems, aiming to transform patient outcomes and unify clinical data under Oracle Fusion Cloud.

- Reward

- like

- Comment

- Repost

- Share

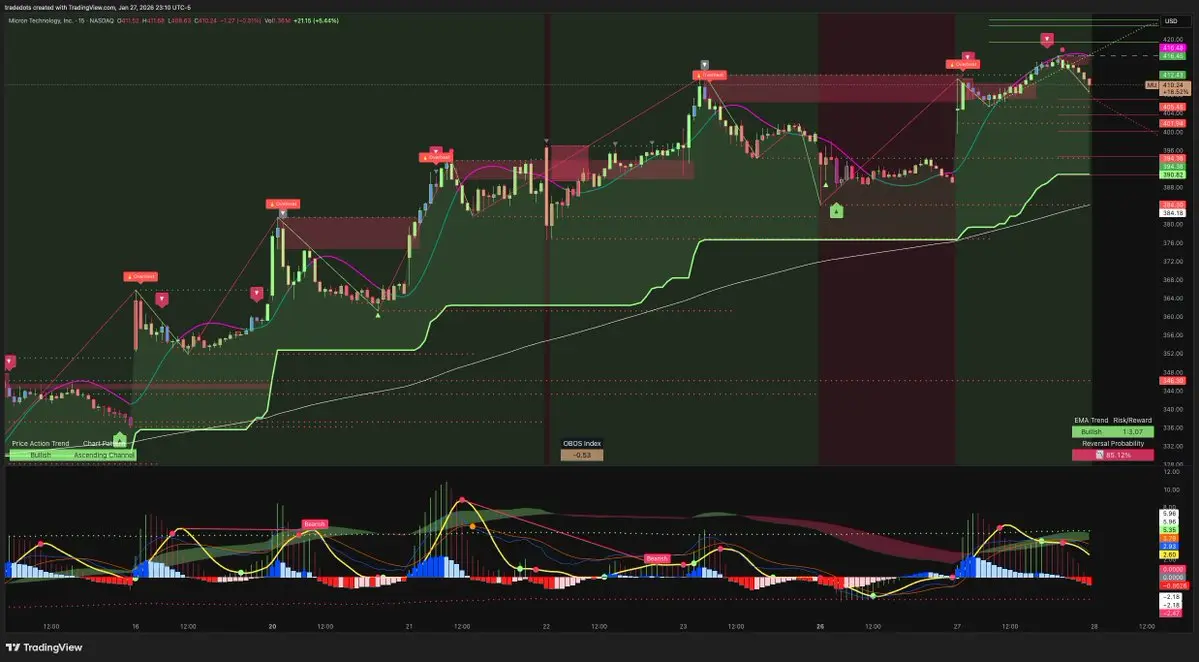

$MU: Micron Expands ManufacturingSentiment: NeutralMicron has committed $24 billion to expand its chip manufacturing capabilities in Singapore, a response to AI-driven memory demand. This could help alleviate supply chain pressures long term.

- Reward

- like

- Comment

- Repost

- Share

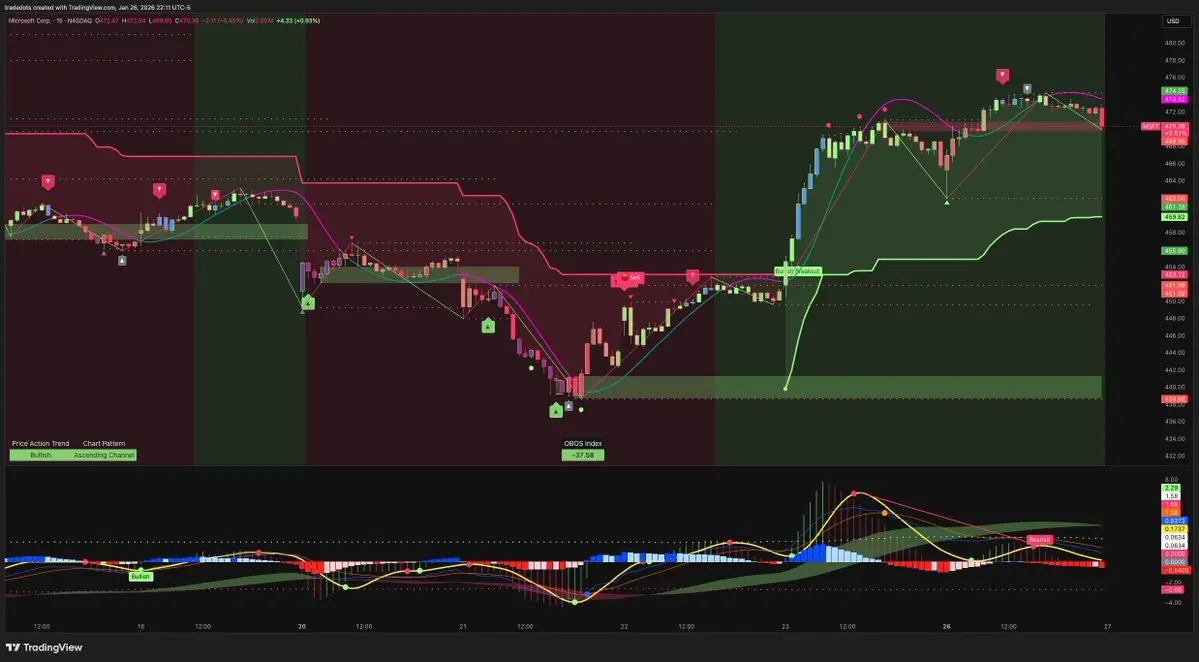

$MSFT: AI Leadership PotentialSentiment: NeutralMicrosoft maintains its leadership position in AI innovation, with expectations of "robust" Q2 performance. Skeptics, however, watch for fluctuations in cloud and hardware sectors.

- Reward

- 1

- Comment

- Repost

- Share

$NKE: Job Cuts Amid AutomationSentiment: NeutralNike is eliminating 775 jobs in its Tennessee and Mississippi distribution centers as part of an automation push aimed at operational efficiency gains.

- Reward

- like

- Comment

- Repost

- Share

$NFLX: Regulatory Scrutiny on MergerSentiment: NegativeSenate concerns over market competition and antitrust implications shadow Netflix\'s potential Warner deal, creating uncertainty around corporate strategy.

- Reward

- like

- Comment

- Repost

- Share

$AMD: Bullish Momentum Near HighsSentiment: Very PositiveAMD shows strong bullish patterns near record highs, supported by moving averages and key technical levels, promising potential for further breakout.

- Reward

- like

- Comment

- Repost

- Share

$AAPL: Mixed View Ahead of Mag 7 EarningsSentiment: Neutral\'\'\' Apple sets cautious expectations ahead of major earnings reports while broader market impacts from Fed policies remain a factor. Investors are eyeing performance metrics keenly. \'\'\'

- Reward

- 1

- Comment

- Repost

- Share

$META: Strong AI Revenue Expected Despite Caution on CostsSentiment: Positive\'\'\' Meta Platforms gains optimism ahead of Q4 earnings with expected strong revenue growth. Analysts suggest possible share price dips could provide a buy opportunity as AI costs temper forecasts. \'\'\'

- Reward

- like

- Comment

- Repost

- Share

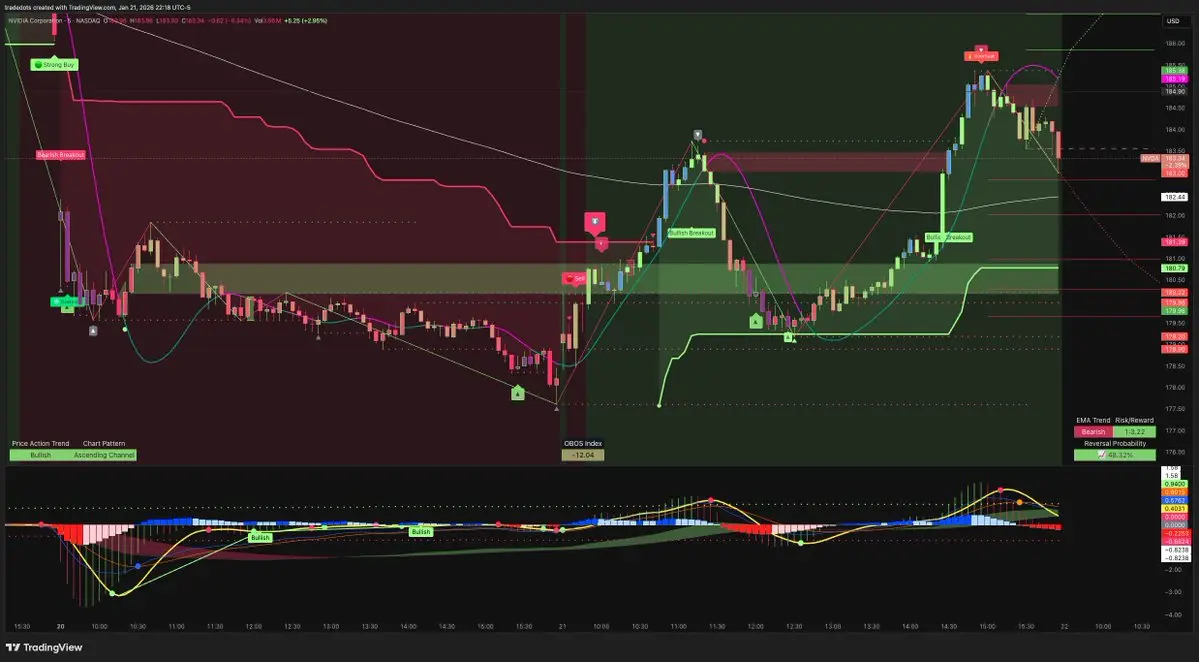

$NVDA: AI Chip Competition Heating UpSentiment: NeutralNvidia retains dominance in the AI GPU market despite rising competition from AMD and Qualcomm. Its strong AI partnerships continue to drive preference among software developers.

- Reward

- like

- Comment

- Repost

- Share

$MRK: Withdraws Acquisition PlansSentiment: PositiveMerck announces it will not proceed with acquiring Revolution Medicines. This decision removes immediate uncertainties while focusing resources on existing research projects.

- Reward

- like

- Comment

- Repost

- Share

$AAPL: Gemini-AI Siri LaunchSentiment: PositiveApple is set to unveil Gemini-powered Siri technology, signifying a meaningful AI collaboration with Google. Expectations are high for its impact on Apple’s ecosystem.

- Reward

- 2

- Comment

- Repost

- Share

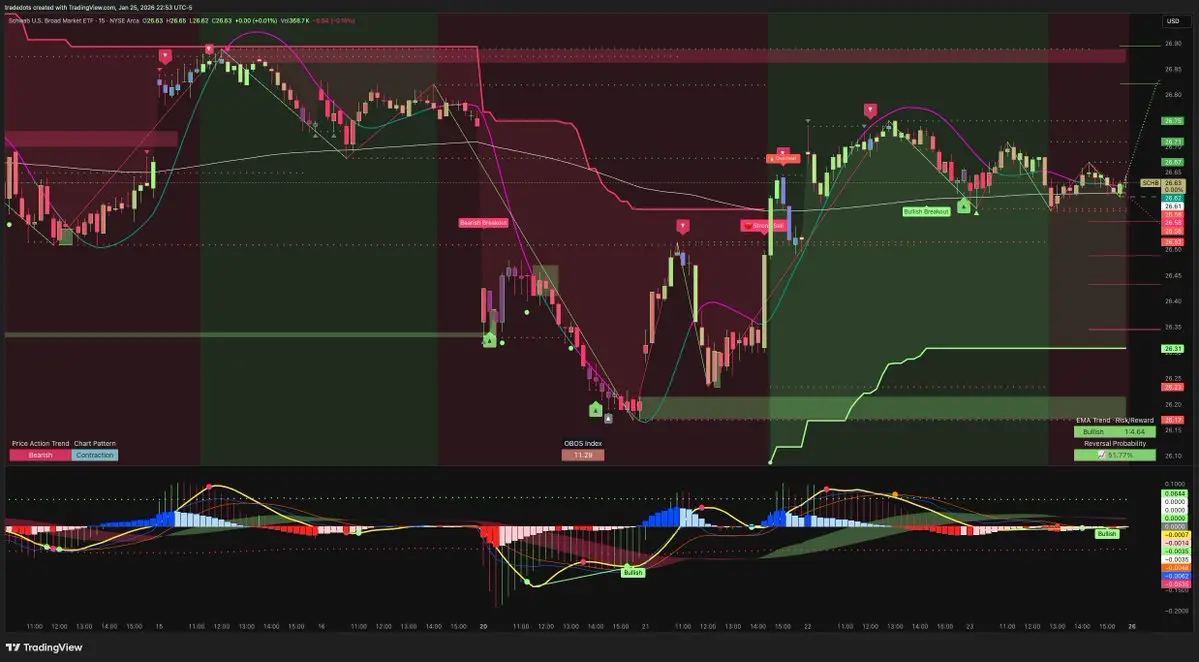

$SCHB: Diversifying Stock Market ExposureSentiment: PositiveSCHB gains attention for offering broad U.S. equity market exposure at low costs compared to competitors. This fund’s stability adds appeal to diversifying portfolios.

- Reward

- like

- Comment

- Repost

- Share

$MSFT: Favorable AI-Driven GrowthSentiment: PositiveMicrosoft highlights Azure and AI investments as core growth drivers ahead of pivotal earnings. Optimistic technical trends highlight potential gains.

- Reward

- like

- Comment

- Repost

- Share

$TSM: AI Demand Boosts GrowthSentiment: NeutralTaiwan Semiconductor reports an increase in demand due to its critical role in AI buildouts. Despite outperforming growth expectations, the stock remains attractively valued against tech peers.

- Reward

- 1

- Comment

- Repost

- Share

$LLY: Breakthrough Ovarian Cancer Treatment\n\nSentiment: Positive\n\nEli Lilly earned FDA Breakthrough Therapy status for its ovarian cancer candidate, supporting optimism for its oncology pipeline expansion.

- Reward

- 1

- 1

- Repost

- Share

XSEAM :

:

hi good morning I hope you have a good day$INTC: Intel Earnings Anticipated to Drive Volatility\n\nSentiment: Positive\n\nIntel is set to release Q4 earnings this Thursday, with analysts anticipating significant stock movement. \'\'\'Investors are optimistic about the results, driven by the semiconductor sector\'s rebound and growing AI demand.\'\'\'

- Reward

- like

- Comment

- Repost

- Share

$NVDA: AI Bubble Concerns\n\nSentiment: Negative\n\n\'\'\'Despite Nvidia CEO Jensen Huang’s dismissal of AI bubble fears, the market reacted cautiously, reflecting broader uncertainty on AI-led market sustainability.\'\'\'

- Reward

- like

- Comment

- Repost

- Share