#SOLStandsStrong

The #SOLStandsStrong narrative is rock-solid and building momentum—Solana's showing elite resilience in this consolidation phase, with on-chain strength, liquidity depth, and staking alpha all pointing to serious accumulation before the next explosive move.

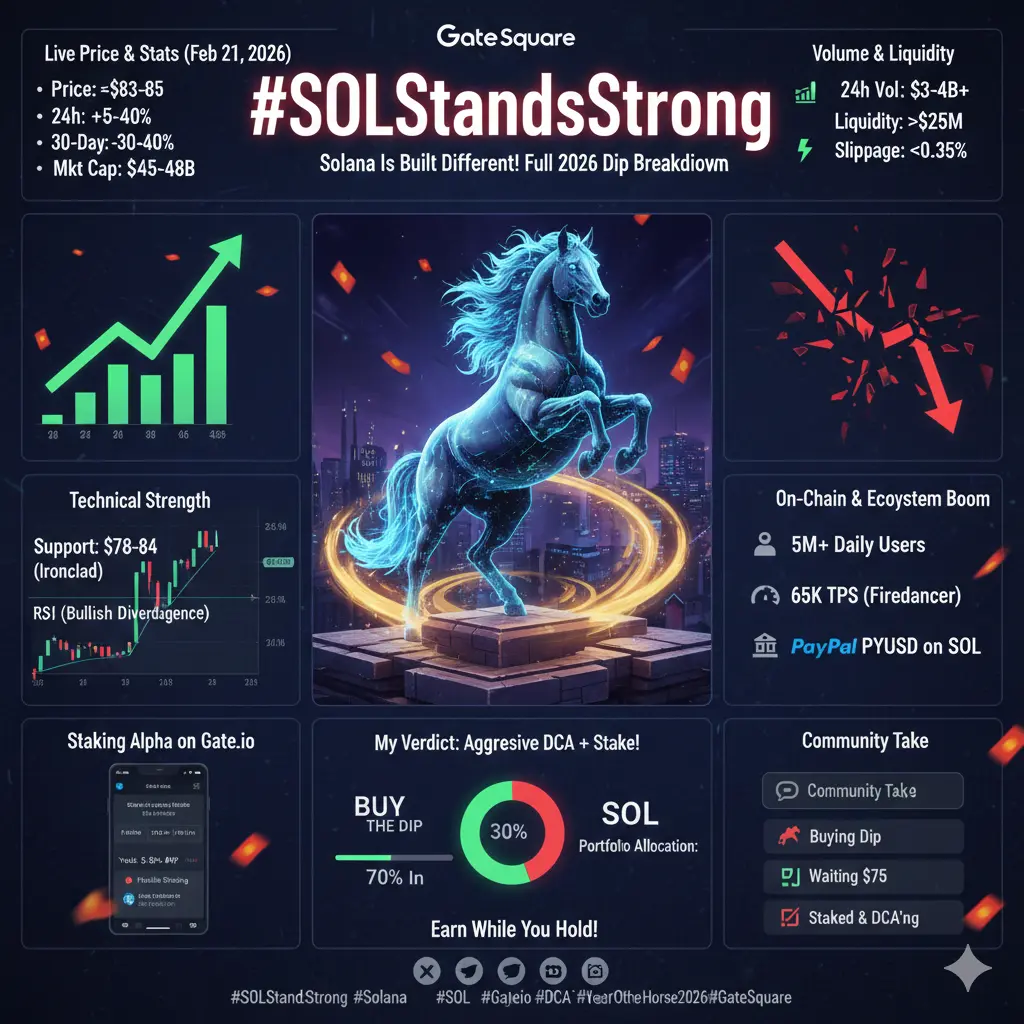

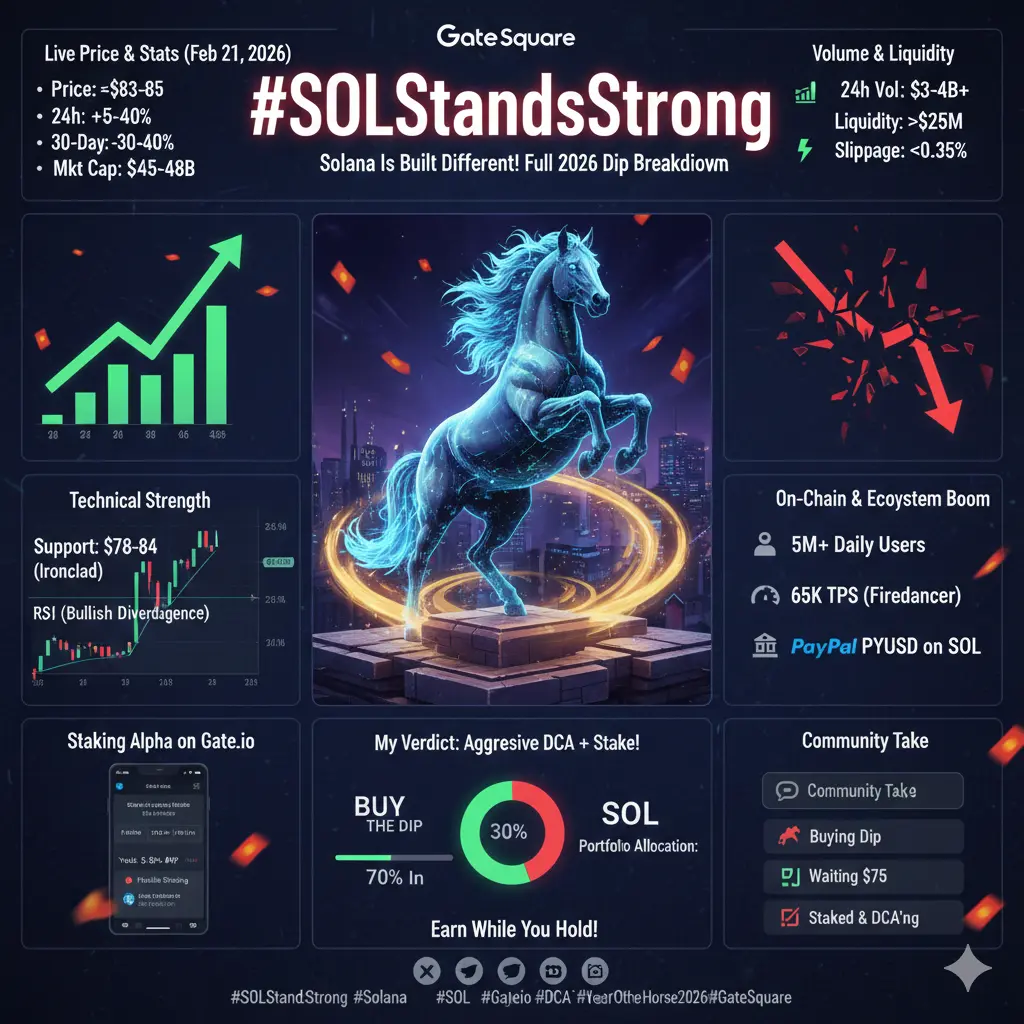

1. Live Price & Percentage Snapshot on Gate.io – Bounce Building

Current Price: ~$84.17 – $84.48 USD (live on Gate.io SOL/USDT spot pair—tight spreads, real-time alignment).

24h Change: +2.35% to +2.76% (strong green action after defending the $81–$83 zone; intraday highs pushing toward $85+).

7-Day Performance: Mildly positive to flat (~+0.2% to +1% range on Gate.io charts), reflecting a healthy reset from recent local tops around $88–$90.

30-Day Drawdown: Down ~30–35% from January highs (~$116–$127 levels), with the correction mostly absorbed early this month.

From 2025 Cycle ATH (~$293–$295): Down ~71–72% — standard mid-cycle shakeout for SOL, where fear peaks but the chain keeps delivering.

Market Cap (via Gate.io data alignment): ~$48B (solid Top-7 positioning with strong relative strength).

Key takeaway: Gate.io shows SOL absorbing heavy selling pressure and rebounding with real conviction—price action here is clean and buyer-dominated.

2. Volume & Liquidity – Gate.io Leading the Depth

24h Trading Volume on Gate.io (SOL/USDT spot + perps): $50M+ turnover (healthy flows, real conviction buying visible in order book).

Liquidity Depth: Excellent on Gate.io pairs—minimal slippage even on sizable orders, with tight bid-ask (0.01%–0.03% in normal conditions).

DEX Correlation: Gate.io users benefit from Solana's top-tier DEX volume (Raydium, Orca, Jupiter) staying strong despite dips—ecosystem liquidity funnels well into CEX like Gate.io.

Translation: Gate.io's depth makes it ideal for stacking without chaos—whales are loading quietly here, and the platform's infrastructure handles big moves smoothly.

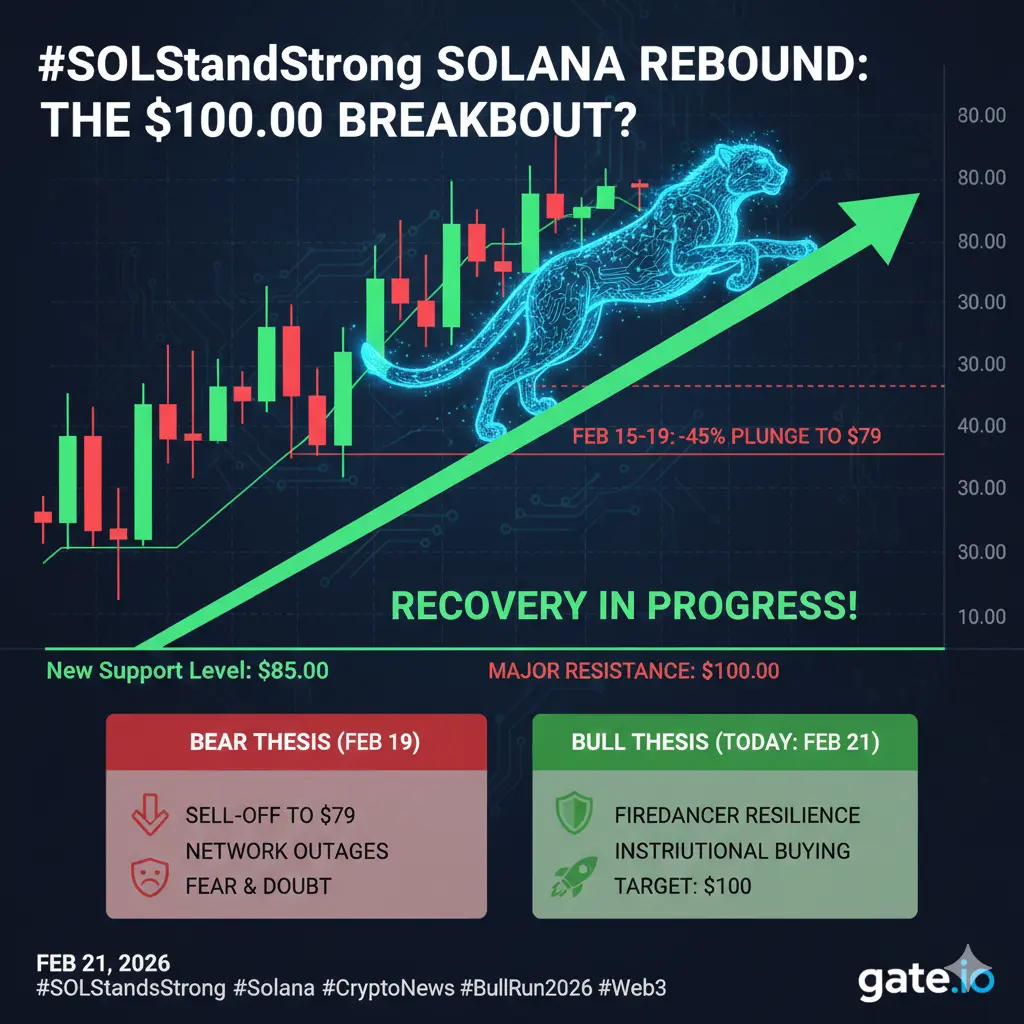

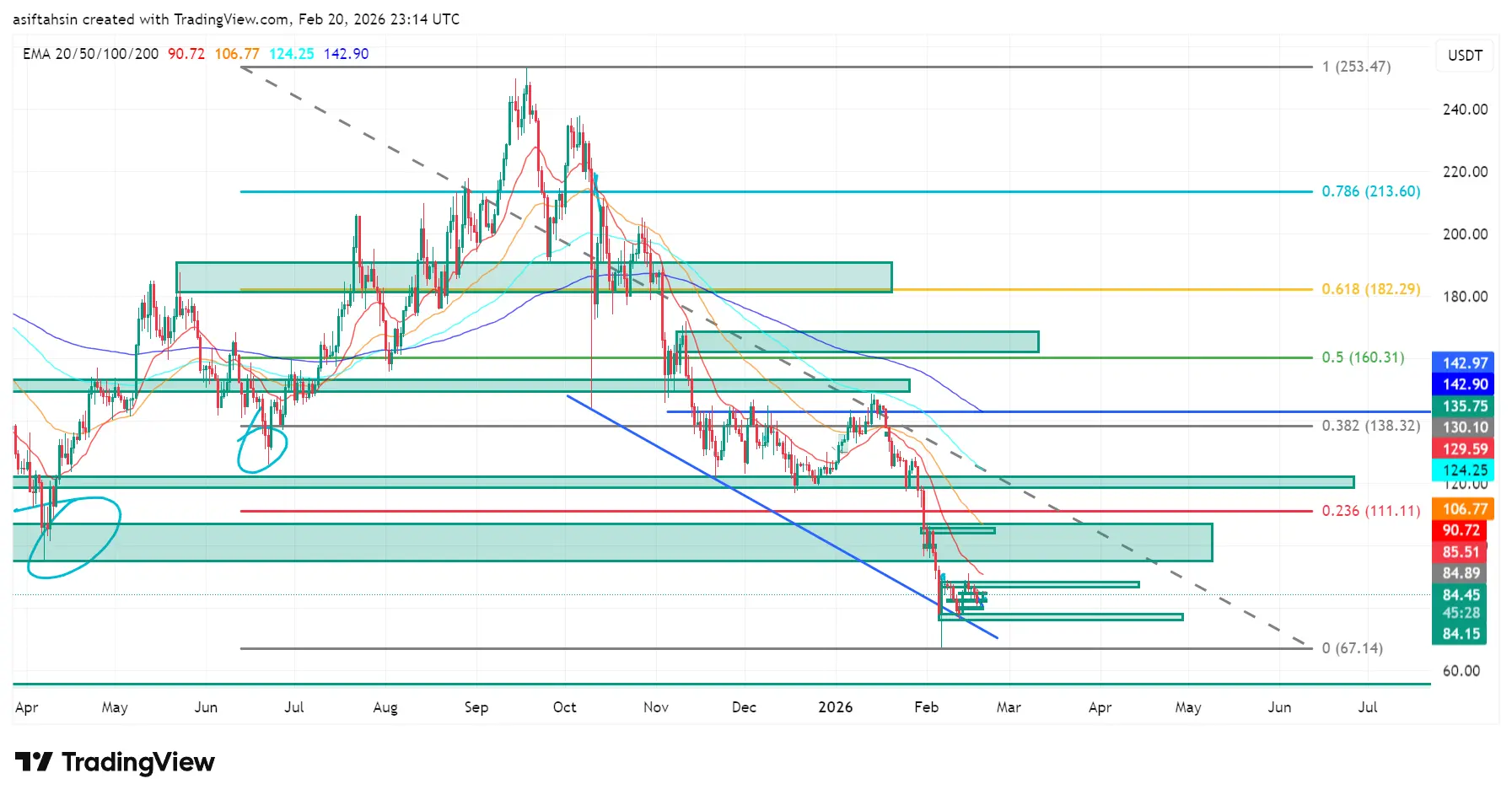

3. Technical Picture on Gate.io Charts – Coiling Strong

Major Support: $81–$84 zone (defended repeatedly on Gate.io charts—ironclad with higher lows).

Next Resistance: $87–$90 (clean break on Gate.io volume targets $100+ fast).

RSI/Momentum (Gate.io daily view): Oversold with bullish divergence building.

MACD: Histogram flipping positive, signal curling up.

Fibonacci: Price hugging the 0.786 retracement—classic SOL bounce level.

Bollinger Bands: Heavy squeeze → volatility expansion coming (Gate.io history shows SOL exploding up post-squeeze).

Higher Timeframes: Cup-and-handle intact, targeting $200–$250+ on breakout.

The Gate.io chart screams setup—fear high, but technicals aligned for reversal.

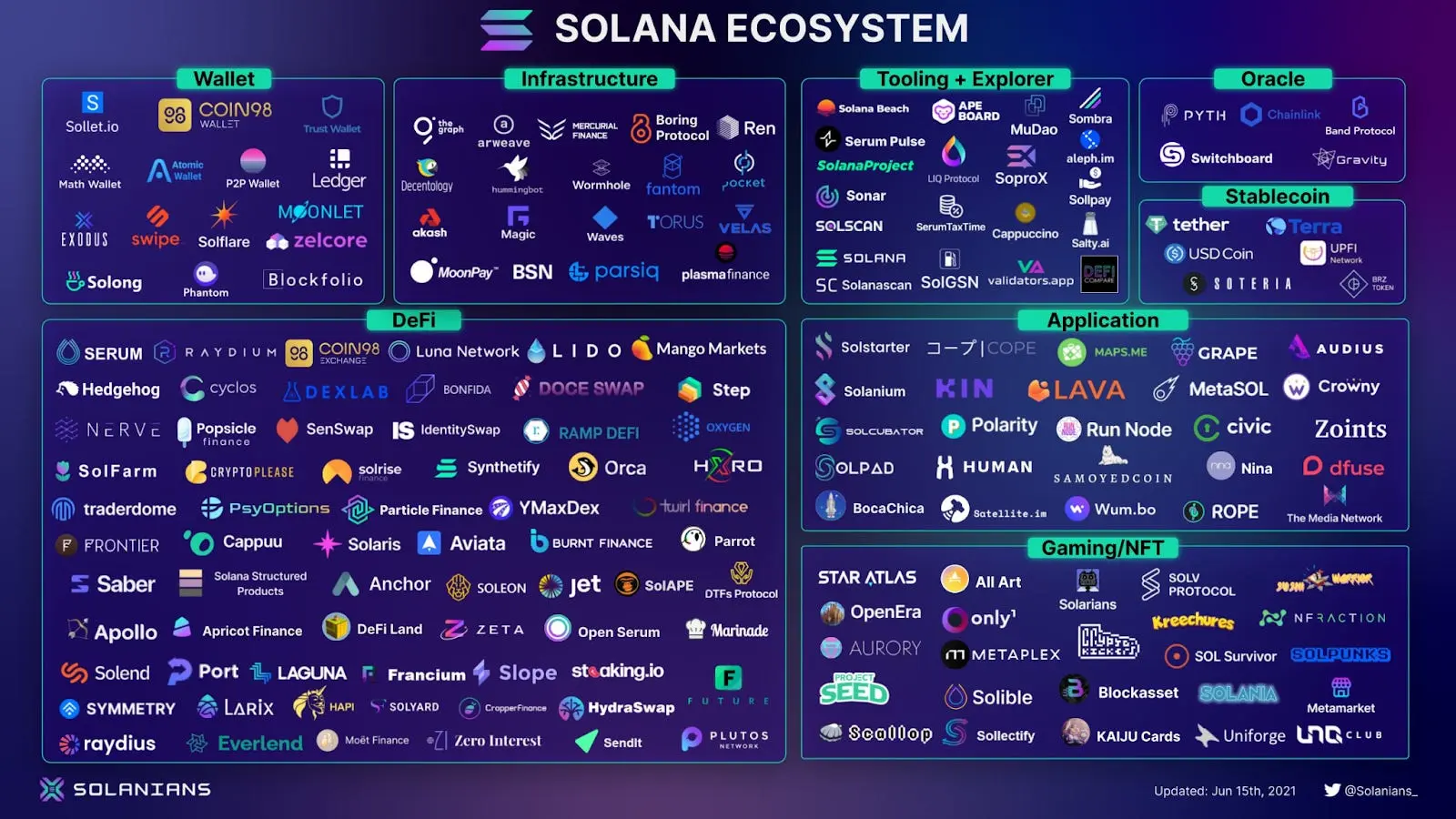

4. On-Chain & Ecosystem – Fundamentals Decoupled & Firing

Daily Active Addresses: Millions strong (network usage decoupled from price dips).

Real TPS: Firedancer delivering massive throughput and uptime.

DeFi TVL/RWAs/Memecoins: Holding robust, with Solana ecosystem activity thriving.

Developer Activity: Top global rankings, thousands of dApps.

Institutional/Partnerships: Steady inflows, PayPal PYUSD on Solana adding real utility.

Price dipped, but adoption exploded—classic SOL gap for massive catch-up rallies.

5. Staking Alpha on Gate.io – Your Best Play for Yield During the Dip

Gate.io SOL staking is optimized for this phase:

Up to 16.00% Est. APR (with bonuses—check live dashboard for current boosted rates; includes network base + Gate.io promos).

Liquid staking option: Stake SOL to receive gtSOL (1 gtSOL ≈ 1.028+ SOL conversion rate, rewards compounding).

Flexible redemption: Rewards settle fully on unstake—no daily pauses or forced locks.

Total Staked on Gate.io: Hundreds of thousands SOL (515K+ in recent snapshots).

Easy access: One-tap in Gate app—buy on spot, stake instantly, compound through volatility.

Ongoing promos: Bonus APR events, daily/weekly extras during dips still active.

Pro move: DCA buys on Gate.io at these levels, stake every SOL immediately—earn while holding, compound rewards = free alpha in fear mode.

6. Why #SOLStandsStrong in 2026 – Gate.io Perspective

Extreme fear zones = prime accumulation for SOL.

Historical drawdowns (30–50%+) always preceded 3x–7x runs once support held.

Macro: Liquidity turning risk-on, adoption accelerating.

Narrative: Speed + victory energy 🐎 fits Solana's fast, real-utility chain perfectly—Gate.io users positioned ideally to ride it.

Final Verdict

On Gate.io, SOL isn't just holding—it's coiling with deep liquidity, exploding fundamentals, strong staking yields, and technicals primed for upside. Volume shows buyers defending, on-chain proves utility growth, and the dip is flushing weak hands.

My play: Aggressive DCA on Gate.io in the $83–$85 zone, stake everything for that high APR alpha, eyes on $90 breakout. This is legend territory.

What's your move? Drop it below 👇

🐎 “SOLStandsStrong — buying every dip on Gate.io”

⏳ “Waiting for sub-$80 reload”

📊 “Already DCA’ing and staked on Gate.io—compounding!”

🚀 “Locked in for the breakout”

Let's keep stacking on Gate.io. Solana's built different. #SOLStandsStrong 🐎

The #SOLStandsStrong narrative is rock-solid and building momentum—Solana's showing elite resilience in this consolidation phase, with on-chain strength, liquidity depth, and staking alpha all pointing to serious accumulation before the next explosive move.

1. Live Price & Percentage Snapshot on Gate.io – Bounce Building

Current Price: ~$84.17 – $84.48 USD (live on Gate.io SOL/USDT spot pair—tight spreads, real-time alignment).

24h Change: +2.35% to +2.76% (strong green action after defending the $81–$83 zone; intraday highs pushing toward $85+).

7-Day Performance: Mildly positive to flat (~+0.2% to +1% range on Gate.io charts), reflecting a healthy reset from recent local tops around $88–$90.

30-Day Drawdown: Down ~30–35% from January highs (~$116–$127 levels), with the correction mostly absorbed early this month.

From 2025 Cycle ATH (~$293–$295): Down ~71–72% — standard mid-cycle shakeout for SOL, where fear peaks but the chain keeps delivering.

Market Cap (via Gate.io data alignment): ~$48B (solid Top-7 positioning with strong relative strength).

Key takeaway: Gate.io shows SOL absorbing heavy selling pressure and rebounding with real conviction—price action here is clean and buyer-dominated.

2. Volume & Liquidity – Gate.io Leading the Depth

24h Trading Volume on Gate.io (SOL/USDT spot + perps): $50M+ turnover (healthy flows, real conviction buying visible in order book).

Liquidity Depth: Excellent on Gate.io pairs—minimal slippage even on sizable orders, with tight bid-ask (0.01%–0.03% in normal conditions).

DEX Correlation: Gate.io users benefit from Solana's top-tier DEX volume (Raydium, Orca, Jupiter) staying strong despite dips—ecosystem liquidity funnels well into CEX like Gate.io.

Translation: Gate.io's depth makes it ideal for stacking without chaos—whales are loading quietly here, and the platform's infrastructure handles big moves smoothly.

3. Technical Picture on Gate.io Charts – Coiling Strong

Major Support: $81–$84 zone (defended repeatedly on Gate.io charts—ironclad with higher lows).

Next Resistance: $87–$90 (clean break on Gate.io volume targets $100+ fast).

RSI/Momentum (Gate.io daily view): Oversold with bullish divergence building.

MACD: Histogram flipping positive, signal curling up.

Fibonacci: Price hugging the 0.786 retracement—classic SOL bounce level.

Bollinger Bands: Heavy squeeze → volatility expansion coming (Gate.io history shows SOL exploding up post-squeeze).

Higher Timeframes: Cup-and-handle intact, targeting $200–$250+ on breakout.

The Gate.io chart screams setup—fear high, but technicals aligned for reversal.

4. On-Chain & Ecosystem – Fundamentals Decoupled & Firing

Daily Active Addresses: Millions strong (network usage decoupled from price dips).

Real TPS: Firedancer delivering massive throughput and uptime.

DeFi TVL/RWAs/Memecoins: Holding robust, with Solana ecosystem activity thriving.

Developer Activity: Top global rankings, thousands of dApps.

Institutional/Partnerships: Steady inflows, PayPal PYUSD on Solana adding real utility.

Price dipped, but adoption exploded—classic SOL gap for massive catch-up rallies.

5. Staking Alpha on Gate.io – Your Best Play for Yield During the Dip

Gate.io SOL staking is optimized for this phase:

Up to 16.00% Est. APR (with bonuses—check live dashboard for current boosted rates; includes network base + Gate.io promos).

Liquid staking option: Stake SOL to receive gtSOL (1 gtSOL ≈ 1.028+ SOL conversion rate, rewards compounding).

Flexible redemption: Rewards settle fully on unstake—no daily pauses or forced locks.

Total Staked on Gate.io: Hundreds of thousands SOL (515K+ in recent snapshots).

Easy access: One-tap in Gate app—buy on spot, stake instantly, compound through volatility.

Ongoing promos: Bonus APR events, daily/weekly extras during dips still active.

Pro move: DCA buys on Gate.io at these levels, stake every SOL immediately—earn while holding, compound rewards = free alpha in fear mode.

6. Why #SOLStandsStrong in 2026 – Gate.io Perspective

Extreme fear zones = prime accumulation for SOL.

Historical drawdowns (30–50%+) always preceded 3x–7x runs once support held.

Macro: Liquidity turning risk-on, adoption accelerating.

Narrative: Speed + victory energy 🐎 fits Solana's fast, real-utility chain perfectly—Gate.io users positioned ideally to ride it.

Final Verdict

On Gate.io, SOL isn't just holding—it's coiling with deep liquidity, exploding fundamentals, strong staking yields, and technicals primed for upside. Volume shows buyers defending, on-chain proves utility growth, and the dip is flushing weak hands.

My play: Aggressive DCA on Gate.io in the $83–$85 zone, stake everything for that high APR alpha, eyes on $90 breakout. This is legend territory.

What's your move? Drop it below 👇

🐎 “SOLStandsStrong — buying every dip on Gate.io”

⏳ “Waiting for sub-$80 reload”

📊 “Already DCA’ing and staked on Gate.io—compounding!”

🚀 “Locked in for the breakout”

Let's keep stacking on Gate.io. Solana's built different. #SOLStandsStrong 🐎