#BuyTheDipOrWaitNow?

Buy the Dip or Wait Now? — Full Crypto Market Analysis (BTC $69,036 | ETH $2,050)

Crypto traders are facing the classic dilemma: “Should I buy the dip or wait for further declines?” With Bitcoin (BTC) at $69,036 and Ethereum (ETH) near $2,050, the market shows both opportunity and risk. Understanding this dynamic requires looking at price action, liquidity, volume, technicals, macro factors, and market psychology.

1️⃣ Understanding the Scenario

Buy the Dip: Entering positions after a price drop, anticipating a rebound. Traders rely on support levels, oversold signals, and macro catalysts.

Wait Now: Holding off to see if prices fall further before committing, minimizing risk in case the downtrend continues.

The decision is about timing, risk management, and market context.

2️⃣ BTC Market Overview

Current Price: $69,036

Recent Range: $66,000–$69,500 over the past week.

Key Support Levels: $66,500–$67,000

Key Resistance Levels: $69,500–$70,000

Volume & Liquidity:

Spikes in trading volumes occur during dips, indicating active retail and institutional participation.

Futures open interest is elevated, suggesting leveraged positions could amplify volatility.

Interpretation:

BTC is holding near a critical psychological zone. A sustained hold above $69K signals continued buyer confidence.

A break below support may trigger a short-term pullback, making “wait” strategies safer.

3️⃣ ETH & Top-Cap Altcoins

ETH Current Price: $2,050

ETH and other altcoins mirror BTC’s movements, but can swing 5–12% faster due to lower liquidity.

Volume & Liquidity:

High trading volumes during dips indicate strong participation, but liquidity may tighten, creating sharp moves.

Altcoins: Top-cap altcoins tend to follow BTC trends but remain more volatile — careful entry points are crucial.

4️⃣ Market Psychology & Behavioral Factors

Fear vs. FOMO: Dips trigger short-term fear, while long-term holders see accumulation opportunities.

Herd Behavior: BTC dips often drag altcoins down, amplifying volatility.

Sentiment Analysis: Metrics like the Fear & Greed Index, social media chatter, and trading sentiment help gauge whether a dip is temporary or the start of a deeper downtrend.

5️⃣ Technical Analysis Considerations

Indicators to Watch:

RSI: Currently near neutral; oversold conditions (<40) may signal a potential buying opportunity.

MACD: Crossovers indicate momentum changes.

Moving Averages: 50-day MA support is critical for BTC and ETH trend stability.

Support & Resistance:

BTC: $66,500–$67,000 (support), $69,500–$70,000 (resistance)

ETH: $2,000–$2,030 (support), $2,100–$2,120 (resistance)

6️⃣ Macro Factors Impacting Decisions

CPI, NFP, and Fed Policy: Economic data affects risk appetite and liquidity.

Global Financial News: Geopolitical events or market stress can trigger sharp dips.

Crypto-Specific Catalysts: Network upgrades, staking rewards, and ecosystem news can cause localized price spikes or dips.

7️⃣ Strategy & Risk Management

Buy the Dip Strategy:

Enter near strong support levels ($66,500 BTC / $2,000 ETH).

Use staggered buys to average positions if the market dips further.

Confirm macro and technical signals before taking large positions.

Wait Strategy:

Hold if price approaches resistance or macro uncertainty is high.

Wait for confirmation of trend reversal — higher lows, bullish candlestick patterns, or volume spikes.

Use stop-losses to manage downside risk, especially during low liquidity periods.

Liquidity Awareness:

Tight liquidity can exaggerate dips.

Futures and leveraged markets can amplify short-term volatility — monitor funding rates and open interest.

8️⃣ Key Takeaways

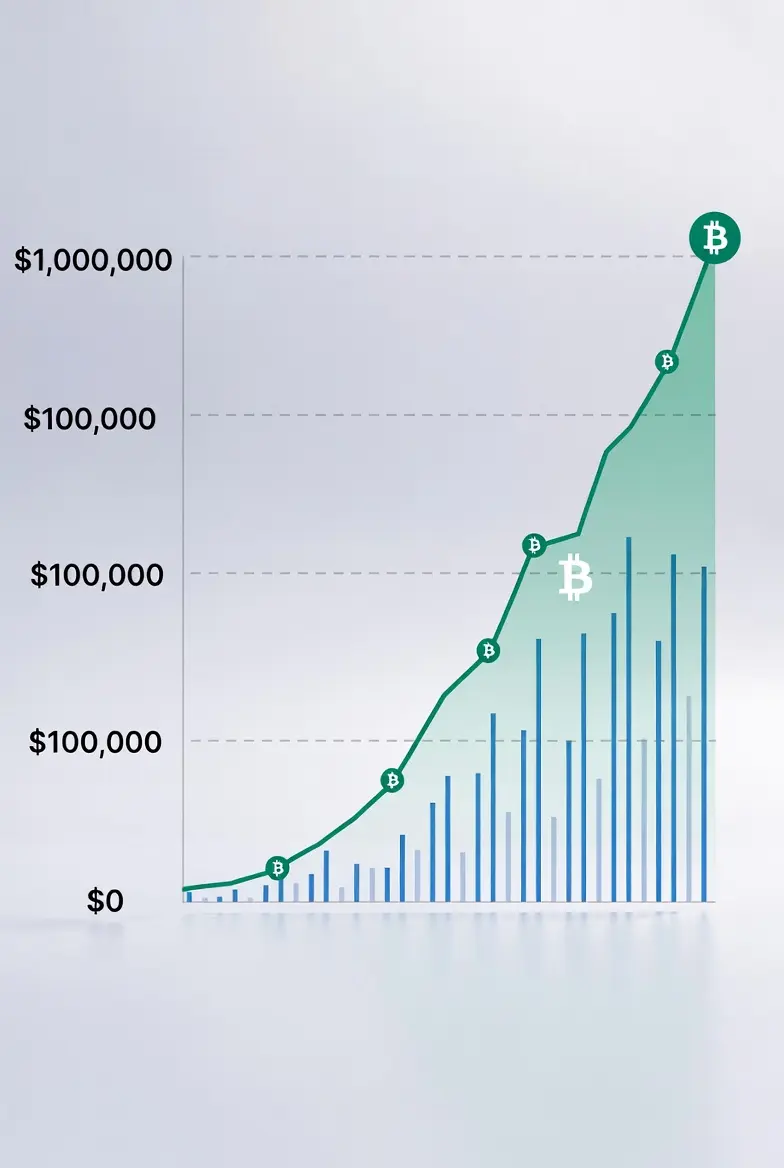

BTC at $69,036 and ETH at $2,050 are near psychologically and technically significant levels.

If support holds, buy-the-dip opportunities exist.

If support breaks, a cautious “wait” strategy reduces risk.

Macro and technical indicators are critical for timing entries.

Altcoins are volatile and closely follow BTC trends — manage exposure carefully.

Bottom Line:

The “Buy the Dip or Wait Now?” decision depends on:

Price levels and support/resistance zones

Volume, liquidity, and trading participation

Macro data and Fed outlook

Technical indicators (RSI, MACD, moving averages)

Market psychology and risk appetite

BTC and ETH remain the anchors of the crypto market. Opportunistic traders can capitalize on dips if supported by technical and macro confirmation, while patient investors may prefer to wait for a clearer trend. Proper risk management is essential to navigate the current volatility.

Buy the Dip or Wait Now? — Full Crypto Market Analysis (BTC $69,036 | ETH $2,050)

Crypto traders are facing the classic dilemma: “Should I buy the dip or wait for further declines?” With Bitcoin (BTC) at $69,036 and Ethereum (ETH) near $2,050, the market shows both opportunity and risk. Understanding this dynamic requires looking at price action, liquidity, volume, technicals, macro factors, and market psychology.

1️⃣ Understanding the Scenario

Buy the Dip: Entering positions after a price drop, anticipating a rebound. Traders rely on support levels, oversold signals, and macro catalysts.

Wait Now: Holding off to see if prices fall further before committing, minimizing risk in case the downtrend continues.

The decision is about timing, risk management, and market context.

2️⃣ BTC Market Overview

Current Price: $69,036

Recent Range: $66,000–$69,500 over the past week.

Key Support Levels: $66,500–$67,000

Key Resistance Levels: $69,500–$70,000

Volume & Liquidity:

Spikes in trading volumes occur during dips, indicating active retail and institutional participation.

Futures open interest is elevated, suggesting leveraged positions could amplify volatility.

Interpretation:

BTC is holding near a critical psychological zone. A sustained hold above $69K signals continued buyer confidence.

A break below support may trigger a short-term pullback, making “wait” strategies safer.

3️⃣ ETH & Top-Cap Altcoins

ETH Current Price: $2,050

ETH and other altcoins mirror BTC’s movements, but can swing 5–12% faster due to lower liquidity.

Volume & Liquidity:

High trading volumes during dips indicate strong participation, but liquidity may tighten, creating sharp moves.

Altcoins: Top-cap altcoins tend to follow BTC trends but remain more volatile — careful entry points are crucial.

4️⃣ Market Psychology & Behavioral Factors

Fear vs. FOMO: Dips trigger short-term fear, while long-term holders see accumulation opportunities.

Herd Behavior: BTC dips often drag altcoins down, amplifying volatility.

Sentiment Analysis: Metrics like the Fear & Greed Index, social media chatter, and trading sentiment help gauge whether a dip is temporary or the start of a deeper downtrend.

5️⃣ Technical Analysis Considerations

Indicators to Watch:

RSI: Currently near neutral; oversold conditions (<40) may signal a potential buying opportunity.

MACD: Crossovers indicate momentum changes.

Moving Averages: 50-day MA support is critical for BTC and ETH trend stability.

Support & Resistance:

BTC: $66,500–$67,000 (support), $69,500–$70,000 (resistance)

ETH: $2,000–$2,030 (support), $2,100–$2,120 (resistance)

6️⃣ Macro Factors Impacting Decisions

CPI, NFP, and Fed Policy: Economic data affects risk appetite and liquidity.

Global Financial News: Geopolitical events or market stress can trigger sharp dips.

Crypto-Specific Catalysts: Network upgrades, staking rewards, and ecosystem news can cause localized price spikes or dips.

7️⃣ Strategy & Risk Management

Buy the Dip Strategy:

Enter near strong support levels ($66,500 BTC / $2,000 ETH).

Use staggered buys to average positions if the market dips further.

Confirm macro and technical signals before taking large positions.

Wait Strategy:

Hold if price approaches resistance or macro uncertainty is high.

Wait for confirmation of trend reversal — higher lows, bullish candlestick patterns, or volume spikes.

Use stop-losses to manage downside risk, especially during low liquidity periods.

Liquidity Awareness:

Tight liquidity can exaggerate dips.

Futures and leveraged markets can amplify short-term volatility — monitor funding rates and open interest.

8️⃣ Key Takeaways

BTC at $69,036 and ETH at $2,050 are near psychologically and technically significant levels.

If support holds, buy-the-dip opportunities exist.

If support breaks, a cautious “wait” strategy reduces risk.

Macro and technical indicators are critical for timing entries.

Altcoins are volatile and closely follow BTC trends — manage exposure carefully.

Bottom Line:

The “Buy the Dip or Wait Now?” decision depends on:

Price levels and support/resistance zones

Volume, liquidity, and trading participation

Macro data and Fed outlook

Technical indicators (RSI, MACD, moving averages)

Market psychology and risk appetite

BTC and ETH remain the anchors of the crypto market. Opportunistic traders can capitalize on dips if supported by technical and macro confirmation, while patient investors may prefer to wait for a clearer trend. Proper risk management is essential to navigate the current volatility.