📈💻💹💰📊 Description of my trading operation on the cryptocurrency market (futures).

1. General context of the agreement.

I executed the trading operation independently on the futures market of the Gate cryptocurrency exchange in the trading pair BTC/USDT. Position type — short (short).

The decision to trade was made considering the high volatility of Bitcoin and my current level of experience. My main priority is risk control and capital preservation, rather than aggressive profit growth.

2. Logic of entering a position.

I entered a short position at the price of 88,967.6 USDT.

The decision to open a position was based on the expectation of a short-term price movement and the possibility of securing a moderate profit without holding the trade for an extended period. I consciously chose a short position, as I do not consider it advisable at this stage to hold long positions without a sufficiently deep market analysis.

3. The logic of exiting a position.

I exited the position at a price of 89,531.5 USDT.

The deal closure occurred immediately after profit appeared, without attempts to hold the position in anticipation of maximum price movement. This approach is related to the understanding of the high volatility of the cryptocurrency market and the reluctance to expose capital to additional risk.

My strategy involves securing the result upon reaching the planned minimum profit, even if the potential for price movement has not yet been exhausted. A bird in the hand is worth two in the bush!

4. Risk Management and Strategic Approach.

In my trading, I adhere to a short-term futures strategy with conservative risk management, which includes:

•independent decision-making in trading without copying others' trades;

•rejection of excessive risk and inflated expectations;

•focus on a stable, albeit small, positive result;

•avoiding prolonged retention of positions in an unstable market environment.

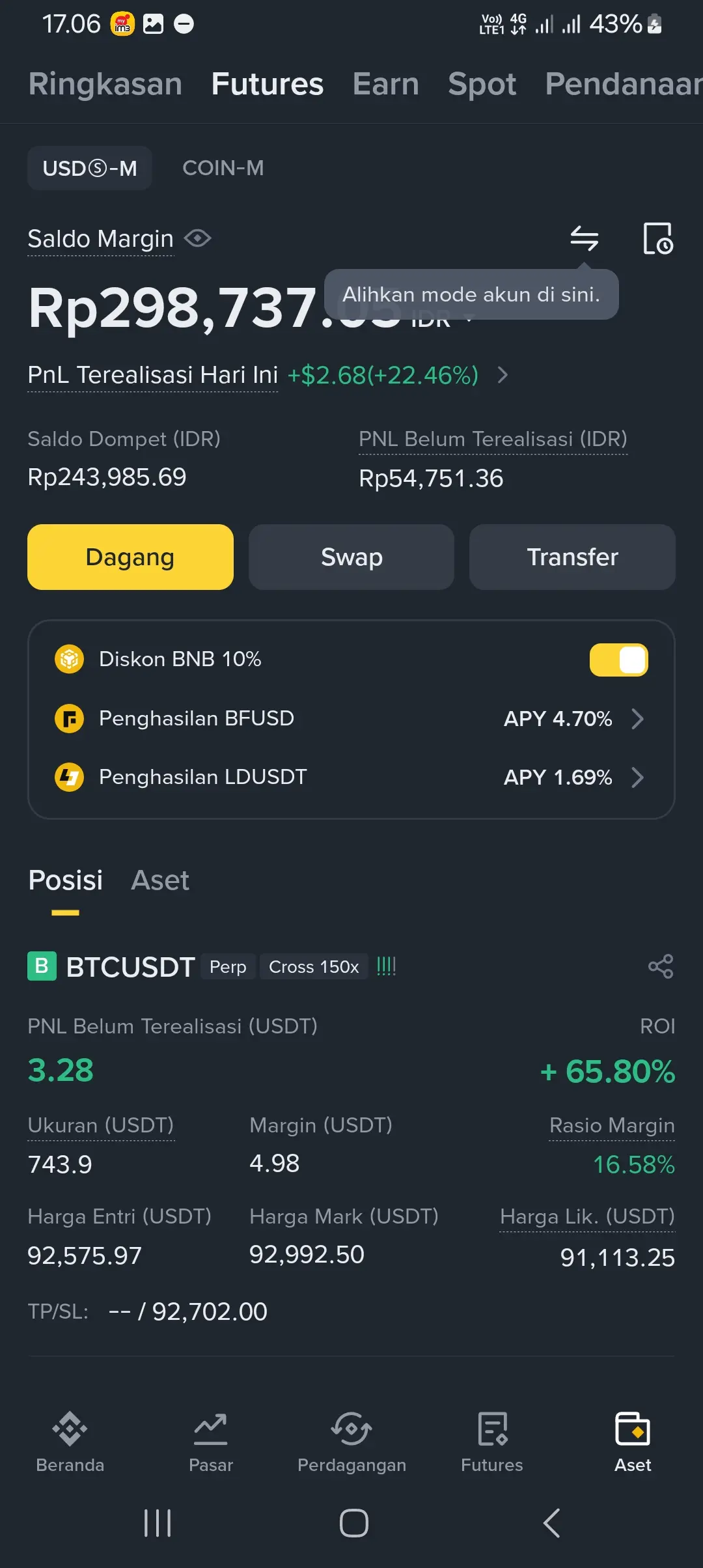

5. Result and PnL.

According to the results of this agreement, I recorded a positive PnL.

The profit was moderate, yet it fully met my trading goals and the chosen strategy, the main objective of which is gradual and controlled growth of trading capital.

6. Conclusions and Lessons Learned.

This agreement confirmed for me the prudence of a cautious approach to futures trading:

•Discipline and timely profit realization are key elements of successful trading;

•not every market movement is worth "pushing" to the maximum;

•Preserving capital is more important than chasing large but unstable profits.

7. Disclaimer.

The trading operation described by me is presented solely for the purpose of sharing experiences and is not financial advice. Each trader is solely responsible for their own trading decisions.

Terminology Guide:

1) Disclaimer — an official notice in which the author informs that the provided information is for informational purposes only and is not a call to action or financial advice. In trading, a disclaimer is needed to emphasize that each market participant is solely responsible for their decisions.

2) Futures are financial contracts that allow you to open positions on the rise or fall of an asset's price without actual ownership of it. Profit or loss depends on the price change.

3) Short ( short position ) is a type of trading position where profit is made when the price of the asset decreases.

4) Long ( long position ) — a type of trading position where profit is made when the price of the asset increases.

5) BTC/USDT — trading pair where Bitcoin (BTC) is traded against the stablecoin USDT.

6) PnL ( Profit and Loss ) — the financial result of a transaction, that is, the profit or loss after its closure.

7) Volatility is the degree of price change of an asset over a certain period of time. High volatility means sharp and frequent price fluctuations.

8) Risk Management ( — a set of rules and approaches aimed at limiting potential losses and preserving trading capital.

Profit taking — closing a position with a positive result in order to preserve the income already received.

)

)

#GateChristmasVibes #ShareMyTrade $BTC

$BTC