Dragon_fly2

No content yet

dragon_fly2

#CelebratingNewYearOnGateSquare 🐎 Gallop Into the Year of the Horse with Gate Plaza!

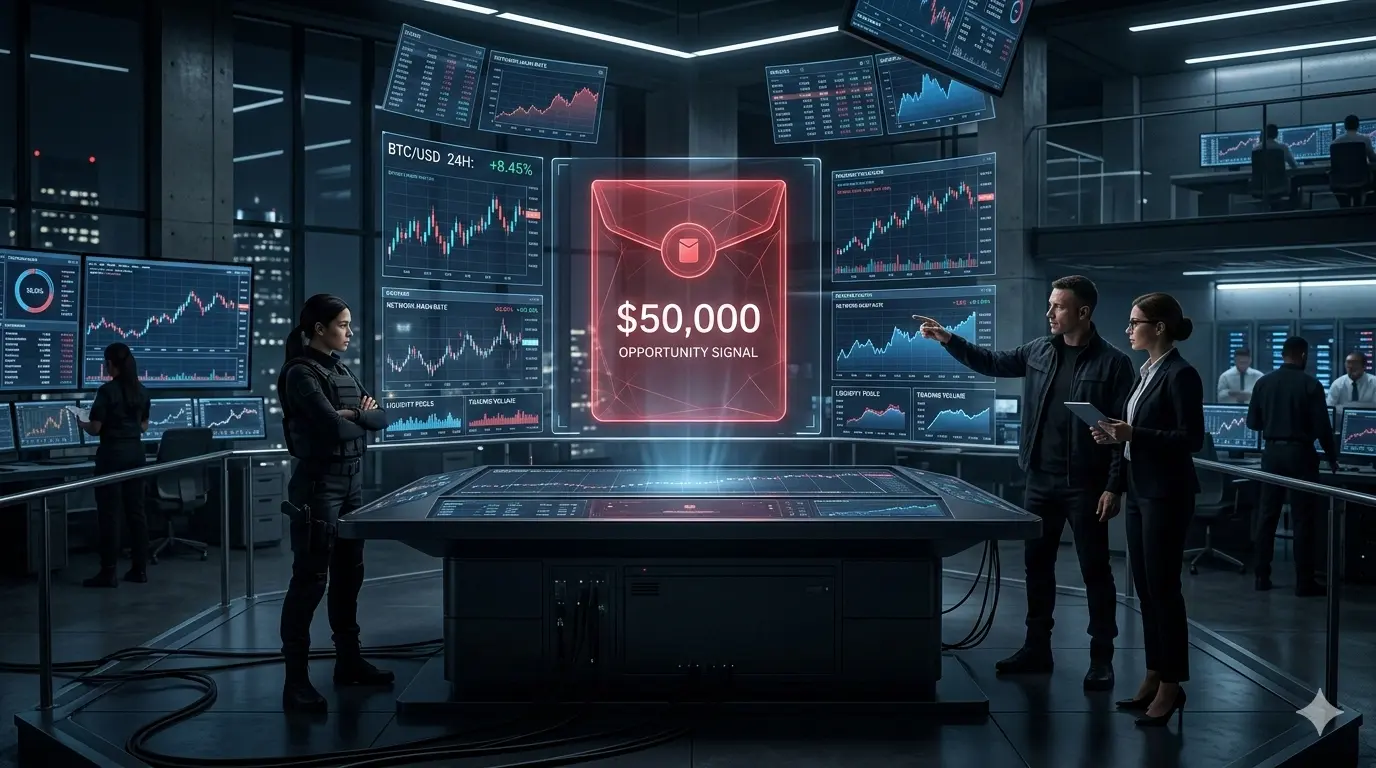

The new year isn’t just a date—it’s a surge of opportunity, energy, and momentum. Gate Plaza wishes you a Happy New Year in advance, and to kick things off, we’re unleashing a $50,000 Red Envelope Rain—your first wave of wealth in 2026!

💥 Here’s how you ride the wave:

1️⃣ $50,000 Red Envelope Rain – Simply post to receive rewards. 100% chance for new users, with up to 28 GT per post.

2️⃣ Year of the Horse Lucky Fish – Post with #我在Gate广场过新年 to enter a draw. One lucky winner will grab 50 GT + a Spring Festiva

The new year isn’t just a date—it’s a surge of opportunity, energy, and momentum. Gate Plaza wishes you a Happy New Year in advance, and to kick things off, we’re unleashing a $50,000 Red Envelope Rain—your first wave of wealth in 2026!

💥 Here’s how you ride the wave:

1️⃣ $50,000 Red Envelope Rain – Simply post to receive rewards. 100% chance for new users, with up to 28 GT per post.

2️⃣ Year of the Horse Lucky Fish – Post with #我在Gate广场过新年 to enter a draw. One lucky winner will grab 50 GT + a Spring Festiva

GT-2,1%

- Reward

- 4

- 9

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

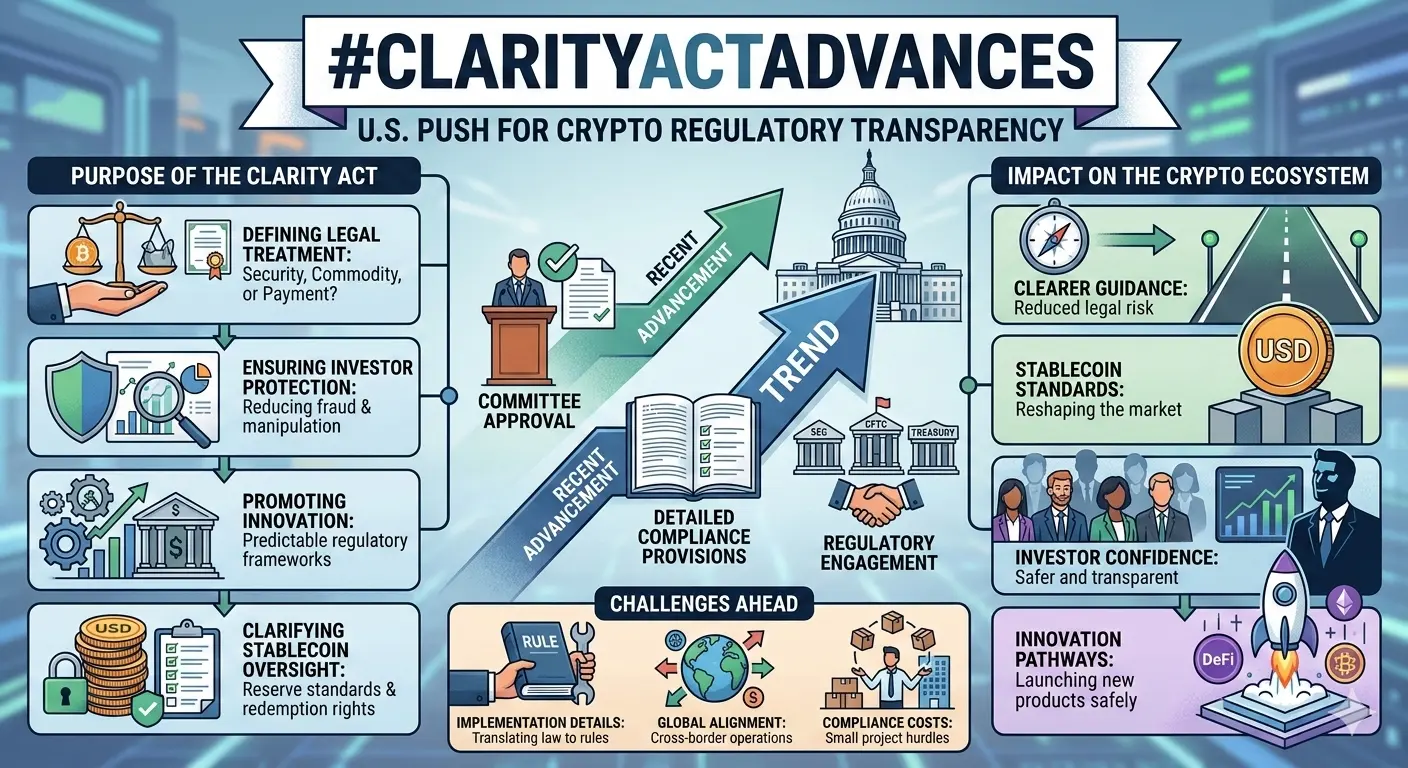

#CLARITYActAdvances The U.S. Just Changed Crypto Forever

The crypto world has been waiting for rules. And the U.S. may finally deliver. #CLARITYActAdvances is more than a bill — it’s a roadmap for the next decade of digital finance.

Why It Matters Now

For years, crypto projects and investors have been navigating murky waters: Is this token a security? Is this stablecoin safe? Ambiguity has killed innovation and scared institutions away. The CLARITY Act is designed to cut through that fog, giving everyone a clear legal compass.

What’s Inside the Act

Token Classification: Clear rules on whether

The crypto world has been waiting for rules. And the U.S. may finally deliver. #CLARITYActAdvances is more than a bill — it’s a roadmap for the next decade of digital finance.

Why It Matters Now

For years, crypto projects and investors have been navigating murky waters: Is this token a security? Is this stablecoin safe? Ambiguity has killed innovation and scared institutions away. The CLARITY Act is designed to cut through that fog, giving everyone a clear legal compass.

What’s Inside the Act

Token Classification: Clear rules on whether

DEFI7,72%

- Reward

- 7

- 9

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

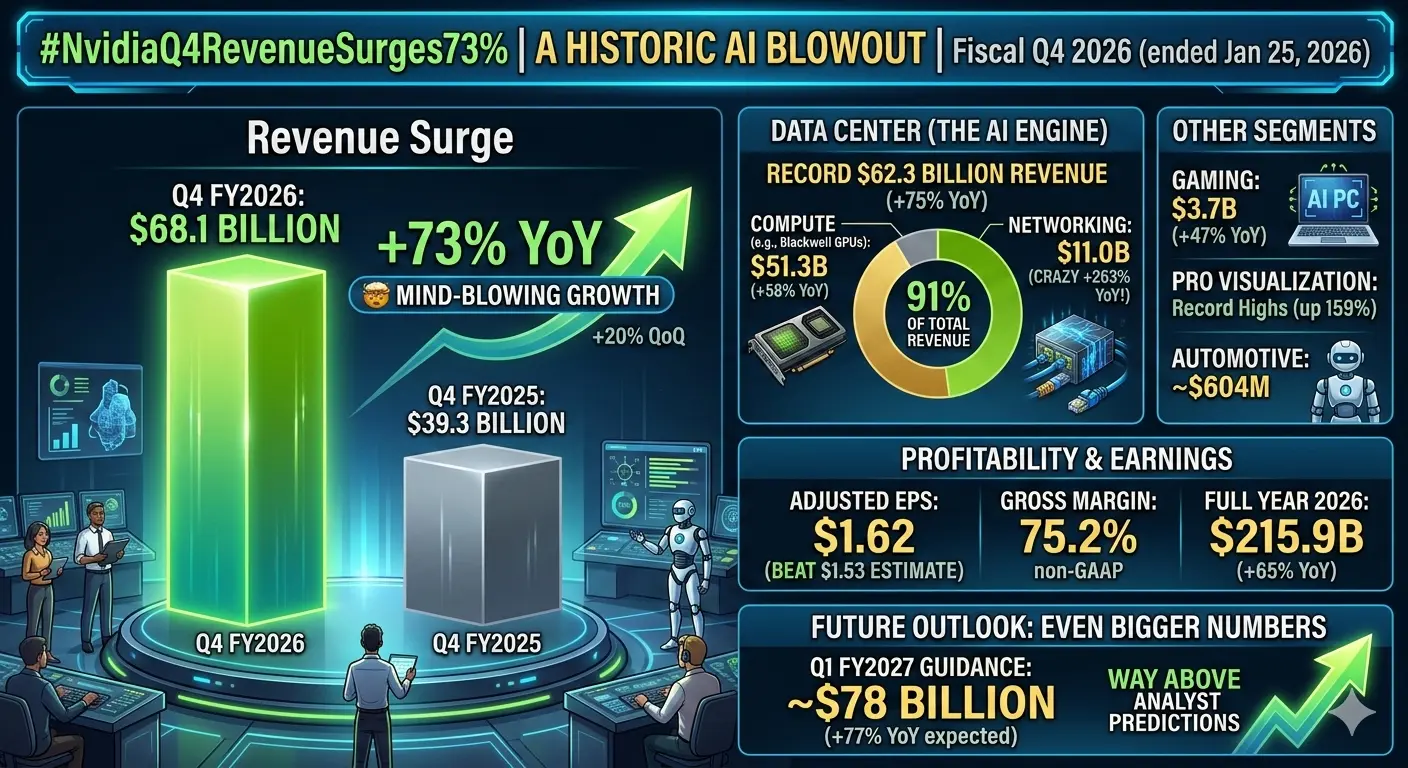

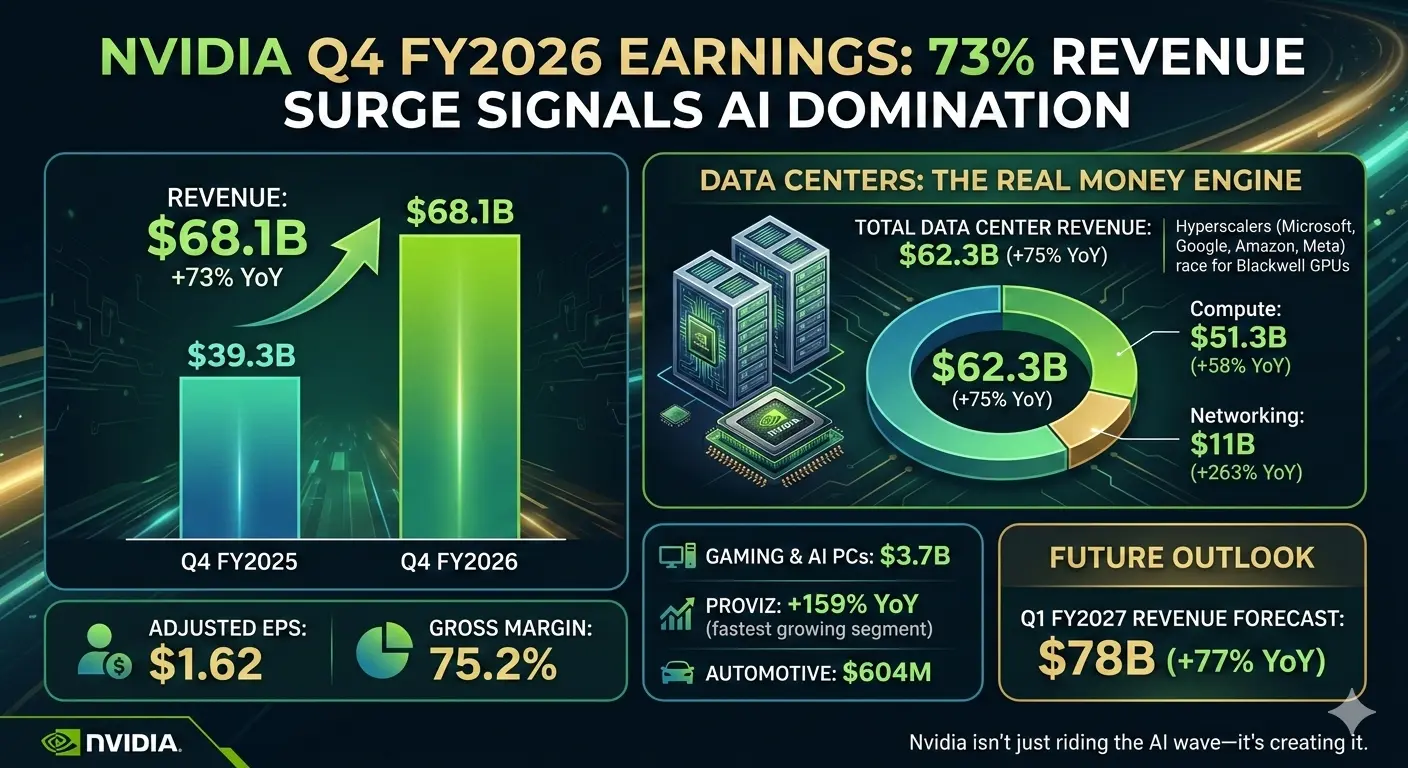

#NvidiaQ4RevenueSurges73% 💥 Nvidia Q4 FY2026 Earnings: 73% Revenue Surge Signals AI Domination #NvidiaQ4RevenueSurges73%

February 25, 2026, marks a historic moment in tech and AI: Nvidia just released its Q4 FY2026 earnings, and the numbers are nothing short of explosive. Revenue surged 73% year-over-year to $68.1 billion, smashing records and proving one thing: the AI revolution isn’t coming — it’s here, and Nvidia is running it.

1️⃣ The Headlines That Matter

Q4 FY2025 revenue: $39.3B → Q4 FY2026 revenue: $68.1B (+73% YoY, +20% QoQ).

Adjusted EPS: $1.62 vs Wall Street expectation $1.53. GAAP

February 25, 2026, marks a historic moment in tech and AI: Nvidia just released its Q4 FY2026 earnings, and the numbers are nothing short of explosive. Revenue surged 73% year-over-year to $68.1 billion, smashing records and proving one thing: the AI revolution isn’t coming — it’s here, and Nvidia is running it.

1️⃣ The Headlines That Matter

Q4 FY2025 revenue: $39.3B → Q4 FY2026 revenue: $68.1B (+73% YoY, +20% QoQ).

Adjusted EPS: $1.62 vs Wall Street expectation $1.53. GAAP

- Reward

- 4

- 7

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

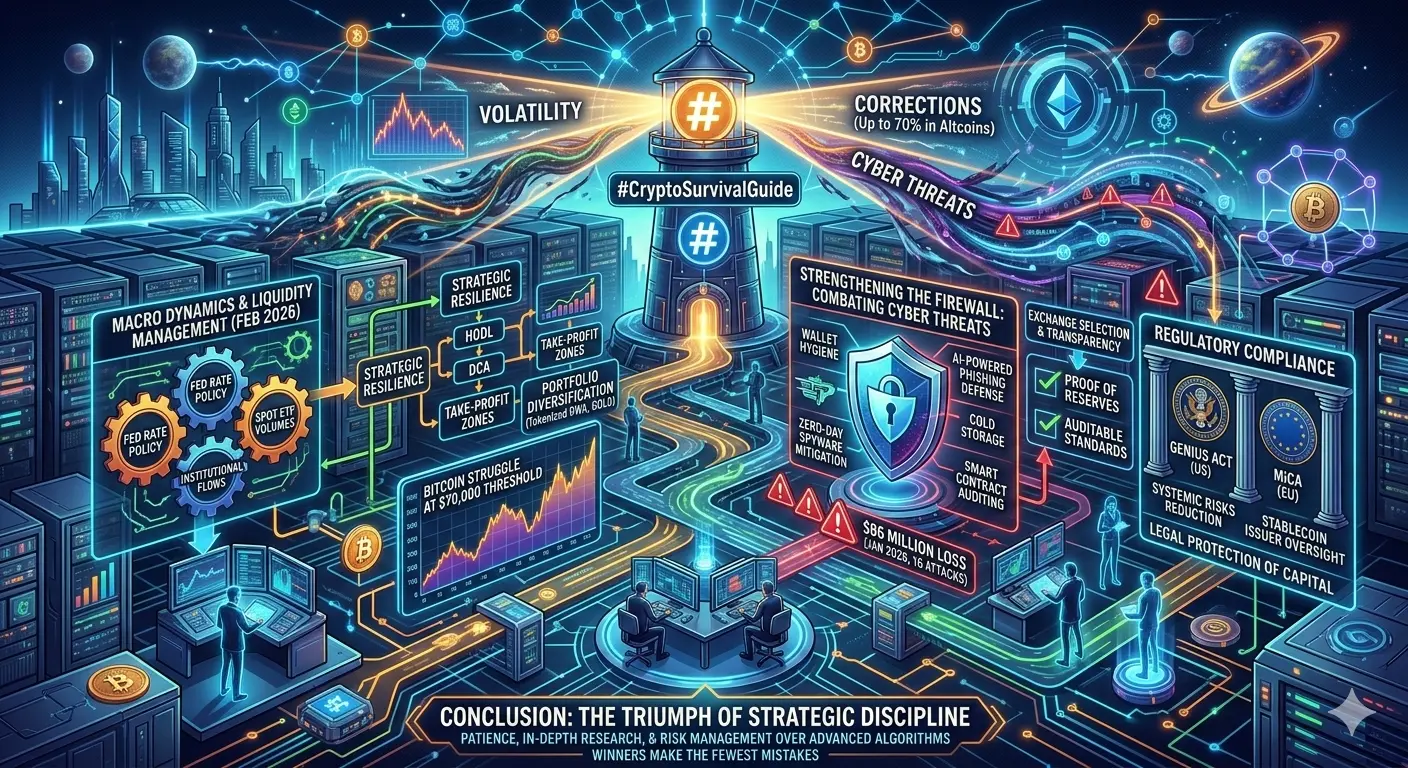

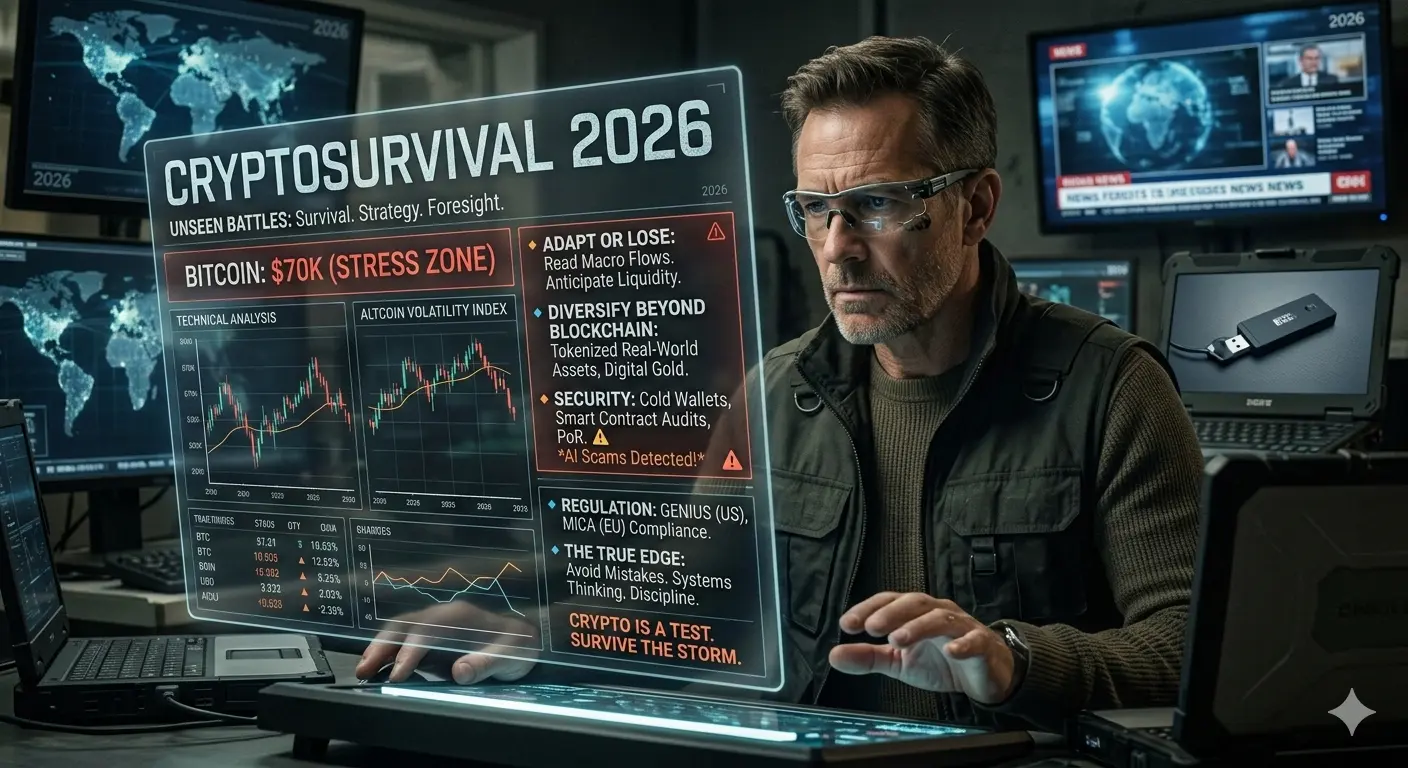

#CryptoSurvivalGuide The Unseen Battles of the 2026 Crypto World

2026 isn’t about hype—it’s about survival, strategy, and foresight. The market isn’t just fluctuating; it’s evolving. Bitcoin struggles to hold $70K, altcoins swing wildly, and every digital wallet is a potential battlefield. If you’re still trading like it’s 2021, you’re already behind.

🔹 Adapt or Lose

Retail plays, pump signals, and FOMO-driven trades are no longer enough. Market dominance now belongs to those who read macro flows, anticipate liquidity shifts, and act with surgical precision.

🔹 Diversify Beyond the Blockchain

2026 isn’t about hype—it’s about survival, strategy, and foresight. The market isn’t just fluctuating; it’s evolving. Bitcoin struggles to hold $70K, altcoins swing wildly, and every digital wallet is a potential battlefield. If you’re still trading like it’s 2021, you’re already behind.

🔹 Adapt or Lose

Retail plays, pump signals, and FOMO-driven trades are no longer enough. Market dominance now belongs to those who read macro flows, anticipate liquidity shifts, and act with surgical precision.

🔹 Diversify Beyond the Blockchain

BTC-2,2%

- Reward

- 5

- 7

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#TrumpAnnouncesNewTariffs #🚀 | BTC Rebounds: Numbers, Trends, and What Comes Next

February 27, 2026 — Bitcoin staged one of the most impressive rebounds in months, moving from $65,000 to a 24-hour high of $69,483, currently hovering around $69,192. This move represents one of the strongest daily performances since the brutal 50% drawdown began last year and signals a shift in market sentiment that demands attention.

📊 The Numbers Behind the Rebound

Institutional flows played a major role today. Net inflows into spot ETFs totaled $257.7M, breaking a five-week streak of consistent redemptions.

February 27, 2026 — Bitcoin staged one of the most impressive rebounds in months, moving from $65,000 to a 24-hour high of $69,483, currently hovering around $69,192. This move represents one of the strongest daily performances since the brutal 50% drawdown began last year and signals a shift in market sentiment that demands attention.

📊 The Numbers Behind the Rebound

Institutional flows played a major role today. Net inflows into spot ETFs totaled $257.7M, breaking a five-week streak of consistent redemptions.

BTC-2,2%

- Reward

- 3

- 3

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#USOCCIssuesNewStablecoinRules OCC’s Bold Move Signals a New Era for Stablecoins

On February 25, 2026, the Office of the Comptroller of the Currency (OCC) released a transformative proposal under the GENIUS Act, redefining how stablecoins operate within the U.S. financial system. For years, stablecoins were seen as experimental digital assets, often operating on the fringes of regulation. Today, the message is clear: the era of loosely regulated stablecoins is over, and both issuers and investors must adapt—or risk being left behind.

Key Provisions in the Proposal

The framework outlines rigoro

On February 25, 2026, the Office of the Comptroller of the Currency (OCC) released a transformative proposal under the GENIUS Act, redefining how stablecoins operate within the U.S. financial system. For years, stablecoins were seen as experimental digital assets, often operating on the fringes of regulation. Today, the message is clear: the era of loosely regulated stablecoins is over, and both issuers and investors must adapt—or risk being left behind.

Key Provisions in the Proposal

The framework outlines rigoro

DEFI7,72%

- Reward

- 5

- 5

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#ETHMarketAnalysis #ETHMarketAnalysis

Current Price: $1,920 USD

Intraday Range: $1,912 – $2,060

24h Change: -0.05%

Ethereum is at a critical pivot. Trading at $1,920, ETH is testing market nerves. Whales are actively buying dips, institutional flows are creeping in, and each move is a tactical battle. This is not just consolidation—it’s accumulation with high stakes.

1️⃣ Price Action & Technical Overview

Trend Analysis: ETH remains in a descending corrective channel from late 2025 highs. Momentum is fading, signaling potential accumulation.

Support Zones:

$1,900–$1,920 → crucial near-term floo

Current Price: $1,920 USD

Intraday Range: $1,912 – $2,060

24h Change: -0.05%

Ethereum is at a critical pivot. Trading at $1,920, ETH is testing market nerves. Whales are actively buying dips, institutional flows are creeping in, and each move is a tactical battle. This is not just consolidation—it’s accumulation with high stakes.

1️⃣ Price Action & Technical Overview

Trend Analysis: ETH remains in a descending corrective channel from late 2025 highs. Momentum is fading, signaling potential accumulation.

Support Zones:

$1,900–$1,920 → crucial near-term floo

- Reward

- 4

- 6

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#BitcoinBouncesBack 🔥 Bitcoin Bounce or Bear Trap? Late Feb 2026 Deep Dive

Bitcoin is clawing back from February’s lows, showing signs of short-term recovery—but don’t mistake this relief rally for full-blown bullish momentum. Here’s what’s happening right now:

Current Price Snapshot

BTC: ~$67,300 (Feb 27, 2026 UTC)

Recent Swing: $63,900 → $69,000+ in just 48 hours

Volatility: 24-hour moves spiking 3–5%, testing resistance near $68,800

The jump erased some February pain, but BTC remains ~46% below its Oct 2025 ATH ($126k–$127k). The big question: is this a real reversal or just a dead-cat bou

Bitcoin is clawing back from February’s lows, showing signs of short-term recovery—but don’t mistake this relief rally for full-blown bullish momentum. Here’s what’s happening right now:

Current Price Snapshot

BTC: ~$67,300 (Feb 27, 2026 UTC)

Recent Swing: $63,900 → $69,000+ in just 48 hours

Volatility: 24-hour moves spiking 3–5%, testing resistance near $68,800

The jump erased some February pain, but BTC remains ~46% below its Oct 2025 ATH ($126k–$127k). The big question: is this a real reversal or just a dead-cat bou

BTC-2,2%

- Reward

- 5

- 6

- Repost

- Share

MrFlower_XingChen :

:

To The Moon 🌕View More

#CircleHits$90 #CircleHits$90 — This Isn’t a Pump. It’s a Power Shift.

Retail is screaming “overbought.”

Smart money is quietly recalculating exposure.

While timelines are flooded with dopamine traders chasing meme candles, Circle at $90 is telling a far more uncomfortable truth: the market is repricing infrastructure, not speculation.

Let’s get one thing straight — this move didn’t happen because of hype.

It happened because capital is rotating from noise to necessity.

Circle isn’t just another fintech ticker. It sits at the intersection of regulation, liquidity, and digital dollar dominance.

Retail is screaming “overbought.”

Smart money is quietly recalculating exposure.

While timelines are flooded with dopamine traders chasing meme candles, Circle at $90 is telling a far more uncomfortable truth: the market is repricing infrastructure, not speculation.

Let’s get one thing straight — this move didn’t happen because of hype.

It happened because capital is rotating from noise to necessity.

Circle isn’t just another fintech ticker. It sits at the intersection of regulation, liquidity, and digital dollar dominance.

USDC-0,01%

- Reward

- 2

- 3

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

#GateSquare$50KRedPacketGiveaway The $50,000 Is the Smallest Part of This Giveaway

Most people completely misunderstand what #GateSquare$50KRedPacketGiveaway actually represents.

They see a number.

They think “free money.”

They rush in with zero strategy, zero awareness, zero edge.

That mindset is exactly why most participants will walk away with nothing meaningful — even if they win.

Let’s break it down properly.

When a platform like Gate.io deploys a $50,000 red packet campaign, it’s not generosity. It’s market engineering.

This is a controlled stress test of user behavior:

Who reacts fast?

Most people completely misunderstand what #GateSquare$50KRedPacketGiveaway actually represents.

They see a number.

They think “free money.”

They rush in with zero strategy, zero awareness, zero edge.

That mindset is exactly why most participants will walk away with nothing meaningful — even if they win.

Let’s break it down properly.

When a platform like Gate.io deploys a $50,000 red packet campaign, it’s not generosity. It’s market engineering.

This is a controlled stress test of user behavior:

Who reacts fast?

- Reward

- 2

- 4

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

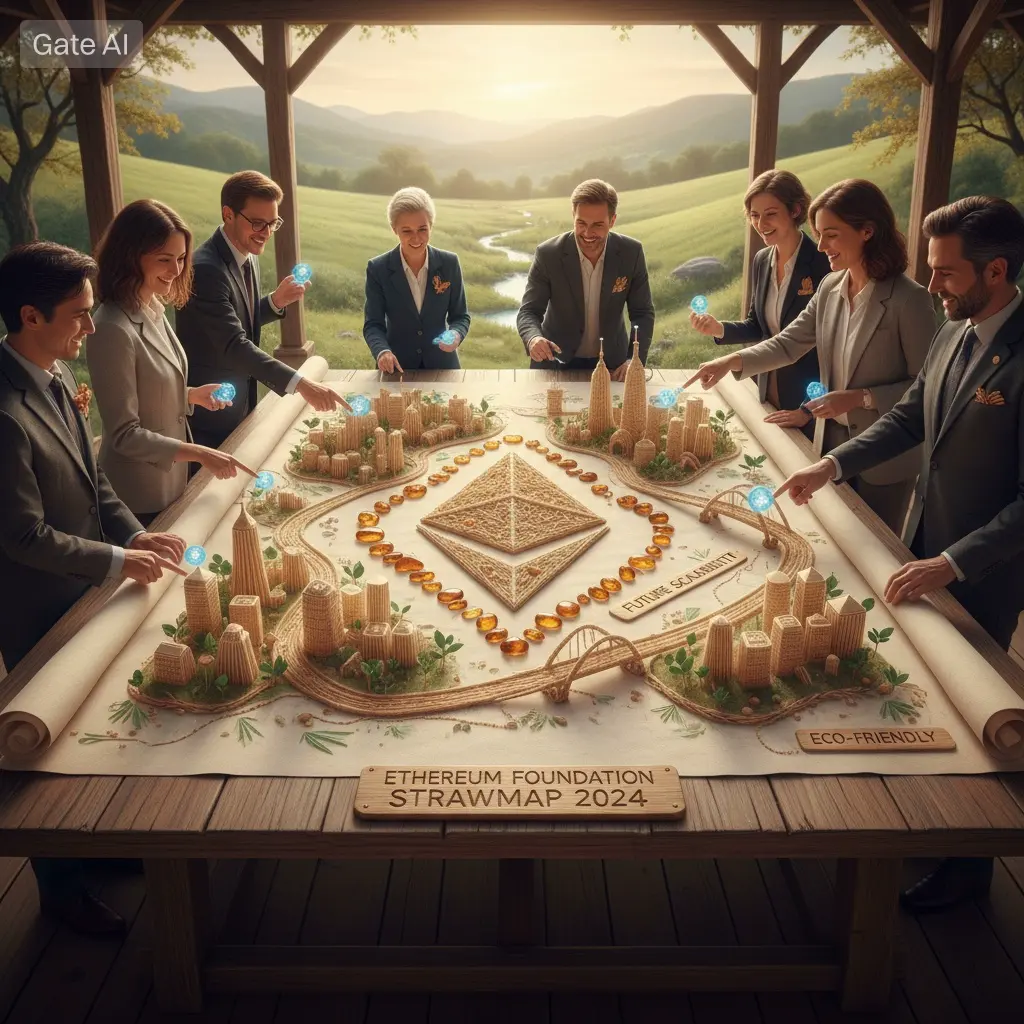

#EthereumFoundationUnveilsItsStrawmap This Isn’t a Roadmap. It’s a Warning Shot.

Everyone’s calling it a “vision document.”

That’s lazy.

What the Ethereum Foundation just dropped isn’t a promise — it’s a stress test for Ethereum’s future relevance.

A Strawmap is, by definition, fragile. And that’s the point.

Ethereum isn’t pretending certainty anymore. In a market obsessed with fake confidence, that honesty is disruptive.

Let’s break what actually matters — without the sugar.

1️⃣ The Foundation Is Admitting Ethereum Is At Risk

Read between the lines.

Scalability pressure.

Centralization concer

Everyone’s calling it a “vision document.”

That’s lazy.

What the Ethereum Foundation just dropped isn’t a promise — it’s a stress test for Ethereum’s future relevance.

A Strawmap is, by definition, fragile. And that’s the point.

Ethereum isn’t pretending certainty anymore. In a market obsessed with fake confidence, that honesty is disruptive.

Let’s break what actually matters — without the sugar.

1️⃣ The Foundation Is Admitting Ethereum Is At Risk

Read between the lines.

Scalability pressure.

Centralization concer

ETH-4,7%

- Reward

- 2

- 3

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

#JaneStreet10AMSellOff #JaneStreet10AMSellOff ⚡ Crypto Shake-Up Alert

Yesterday, the market flipped $170B in a single rebound. BTC smashes past $70K, ETH +13%, SOL +15%—and the 10 AM sell-off ghost seems gone.

Why? All eyes on Jane Street. A lawsuit might have snapped the invisible hand that suppressed Bitcoin for months. Traders whisper: “The brakes are off.”

No receipts yet. No proof of daily dumps. But sentiment is king, and right now, fear turned into full-blown FOMO.

💡 The question: Is this a real reversal or just a short-term relief rally?

📊 One thing’s certain: the 10 AM pattern might

Yesterday, the market flipped $170B in a single rebound. BTC smashes past $70K, ETH +13%, SOL +15%—and the 10 AM sell-off ghost seems gone.

Why? All eyes on Jane Street. A lawsuit might have snapped the invisible hand that suppressed Bitcoin for months. Traders whisper: “The brakes are off.”

No receipts yet. No proof of daily dumps. But sentiment is king, and right now, fear turned into full-blown FOMO.

💡 The question: Is this a real reversal or just a short-term relief rally?

📊 One thing’s certain: the 10 AM pattern might

- Reward

- 2

- 4

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

#ZachXBTExposesTheAxiomIncident 🚨💥

The crypto market isn’t forgiving, and ZachXBT just reminded us why. The so-called Axiom Incident isn’t just a rumor or a meme—it’s a masterclass in market manipulation, liquidity pressure, and strategic positioning. Here’s everything traders need to know before they get caught on the wrong side.

🔹 The Incident Breakdown:

According to ZachXBT, a coordinated sequence of high-frequency trades, hidden liquidity pulls, and targeted liquidation cascades quietly unfolded. Retail investors saw price fluctuations and panic, while the whales were already adjusting

The crypto market isn’t forgiving, and ZachXBT just reminded us why. The so-called Axiom Incident isn’t just a rumor or a meme—it’s a masterclass in market manipulation, liquidity pressure, and strategic positioning. Here’s everything traders need to know before they get caught on the wrong side.

🔹 The Incident Breakdown:

According to ZachXBT, a coordinated sequence of high-frequency trades, hidden liquidity pulls, and targeted liquidation cascades quietly unfolded. Retail investors saw price fluctuations and panic, while the whales were already adjusting

- Reward

- 2

- 4

- Repost

- Share

LittleQueen :

:

LFG 🔥View More

#DeepCreationCamp #🚀 #DeepCreationCamp: Redefining Creativity with AI, Art & Crypto

The world of creation has changed. Ideas alone no longer cut it. Today, creativity is measured by your ability to merge vision with technology, craft assets that hold real-world value, and experiment beyond traditional boundaries.

Deep Creation Camp is not a workshop, it’s an intensive journey into the future of digital creation. It’s where art, AI, blockchain, and immersive technologies collide — designed for creators who want to go beyond surface-level content and emerge with market-ready, crypto-enabled pro

The world of creation has changed. Ideas alone no longer cut it. Today, creativity is measured by your ability to merge vision with technology, craft assets that hold real-world value, and experiment beyond traditional boundaries.

Deep Creation Camp is not a workshop, it’s an intensive journey into the future of digital creation. It’s where art, AI, blockchain, and immersive technologies collide — designed for creators who want to go beyond surface-level content and emerge with market-ready, crypto-enabled pro

- Reward

- 4

- 5

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow? #BuyTheDipOrWaitNow?

Most traders are trapped between two lies:

Lie #1: “The bottom is in, buy everything.”

Lie #2: “The crash isn’t over, stay out completely.”

Both are lazy thinking.

The market doesn’t reward extremes — it rewards those who understand phases.

Right now, Bitcoin is not screaming strength, and it’s not begging for mercy either.

This is the most dangerous zone: the boredom zone.

Here’s what history teaches (and most ignore):

• Real bottoms form when volatility dies, not when panic peaks.

• Price moves sideways long enough to make bulls doubt and bears overc

Most traders are trapped between two lies:

Lie #1: “The bottom is in, buy everything.”

Lie #2: “The crash isn’t over, stay out completely.”

Both are lazy thinking.

The market doesn’t reward extremes — it rewards those who understand phases.

Right now, Bitcoin is not screaming strength, and it’s not begging for mercy either.

This is the most dangerous zone: the boredom zone.

Here’s what history teaches (and most ignore):

• Real bottoms form when volatility dies, not when panic peaks.

• Price moves sideways long enough to make bulls doubt and bears overc

BTC-2,2%

- Reward

- 1

- 3

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

#CanBitcoinReclaim$70K? Gate Plaza | 2/27 Today's Topic: #BTC能否重返7万美元?

After the seismic shock of the lawsuit, a familiar pattern has broken—our once-predictable "10 o’clock dump" has gone silent. BTC now hovers around $67K, but this could be a crucial inflection point. The question everyone is asking: can BTC break back to $70K and sustain a rally?

Let’s go deep:

1️⃣ Is the lawsuit responsible for the "10 o’clock selling" disappearing? There’s a strong case. Previously, institutional traders used that precise time to offload large positions—creating a repeated wave of downward pressure. Now,

After the seismic shock of the lawsuit, a familiar pattern has broken—our once-predictable "10 o’clock dump" has gone silent. BTC now hovers around $67K, but this could be a crucial inflection point. The question everyone is asking: can BTC break back to $70K and sustain a rally?

Let’s go deep:

1️⃣ Is the lawsuit responsible for the "10 o’clock selling" disappearing? There’s a strong case. Previously, institutional traders used that precise time to offload large positions—creating a repeated wave of downward pressure. Now,

BTC-2,2%

- Reward

- 2

- 3

- Repost

- Share

LittleQueen :

:

LFG 🔥View More

To help new users kickstart their ETF trading journey, Gate is launching the ETF First Trade Bonus Giveaway. During the event, eligible new ETF users can claim exclusive rewards. Complete your first ETF trade and receive a random 5–25 USDT cash bonus. Limited spots available — first come, first served. https://www.gate.com/campaigns/4144?ref=VLRAVV5XAG&ref_type=132

- Reward

- 2

- 3

- Repost

- Share

LittleQueen :

:

Ape In 🚀View More

Gate Live Lantern Festival Carnival · Split the $10,000 Prize Pool https://www.gate.com/campaigns/4136?ref=VLRAVV5XAG&ref_type=132

- Reward

- 2

- 1

- Repost

- Share

Discovery :

:

To The Moon 🌕#CryptoRelatedStocksRallyBroadly

This rally isn’t retail hype.

It’s capital repositioning.

While most traders are still glued to BTC and ETH charts, smart money has already shifted one layer up—into crypto-related equities. Not because they’re “safer,” but because they offer leveraged exposure with institutional legitimacy.

Here’s what the crowd is missing:

Institutions don’t need to hold coins to bet on crypto anymore. Spot ETF inflows reopened the gateway, but the real play is companies that profit whether price moves fast or slow.

Take Coinbase. This isn’t just an exchange—it’s becoming fi

This rally isn’t retail hype.

It’s capital repositioning.

While most traders are still glued to BTC and ETH charts, smart money has already shifted one layer up—into crypto-related equities. Not because they’re “safer,” but because they offer leveraged exposure with institutional legitimacy.

Here’s what the crowd is missing:

Institutions don’t need to hold coins to bet on crypto anymore. Spot ETF inflows reopened the gateway, but the real play is companies that profit whether price moves fast or slow.

Take Coinbase. This isn’t just an exchange—it’s becoming fi

- Reward

- 7

- 5

- Repost

- Share

Yunna :

:

Ape In 🚀View More