Post content & earn content mining yield

placeholder

PARON

0

0

$USDG $USD1

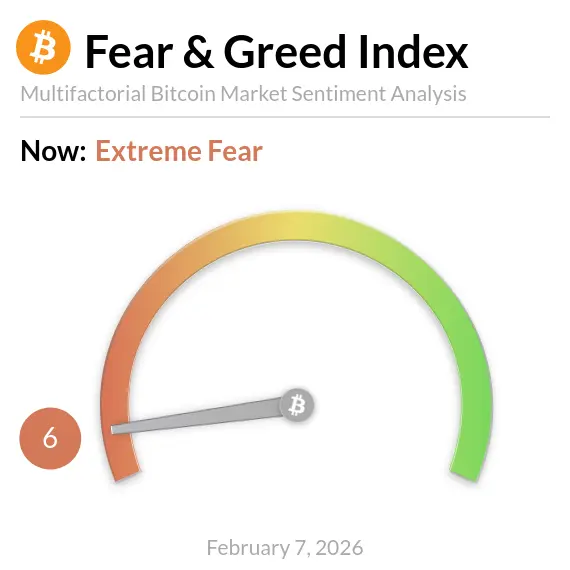

The Bitcoin Fear and Greed Index has reached 6

Currently, from my point of view, the idea is to bounce. Where do I think it will go? As long as Bitcoin stays below $80,000, there’s nothing new, and we’re expecting lower numbers.

If it goes back above $85,000, then I will be very positive!

But until now, there are more very negative signals from my perspective, and even to turn positive again, I’m waiting for $50,000.

View OriginalThe Bitcoin Fear and Greed Index has reached 6

Currently, from my point of view, the idea is to bounce. Where do I think it will go? As long as Bitcoin stays below $80,000, there’s nothing new, and we’re expecting lower numbers.

If it goes back above $85,000, then I will be very positive!

But until now, there are more very negative signals from my perspective, and even to turn positive again, I’m waiting for $50,000.

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

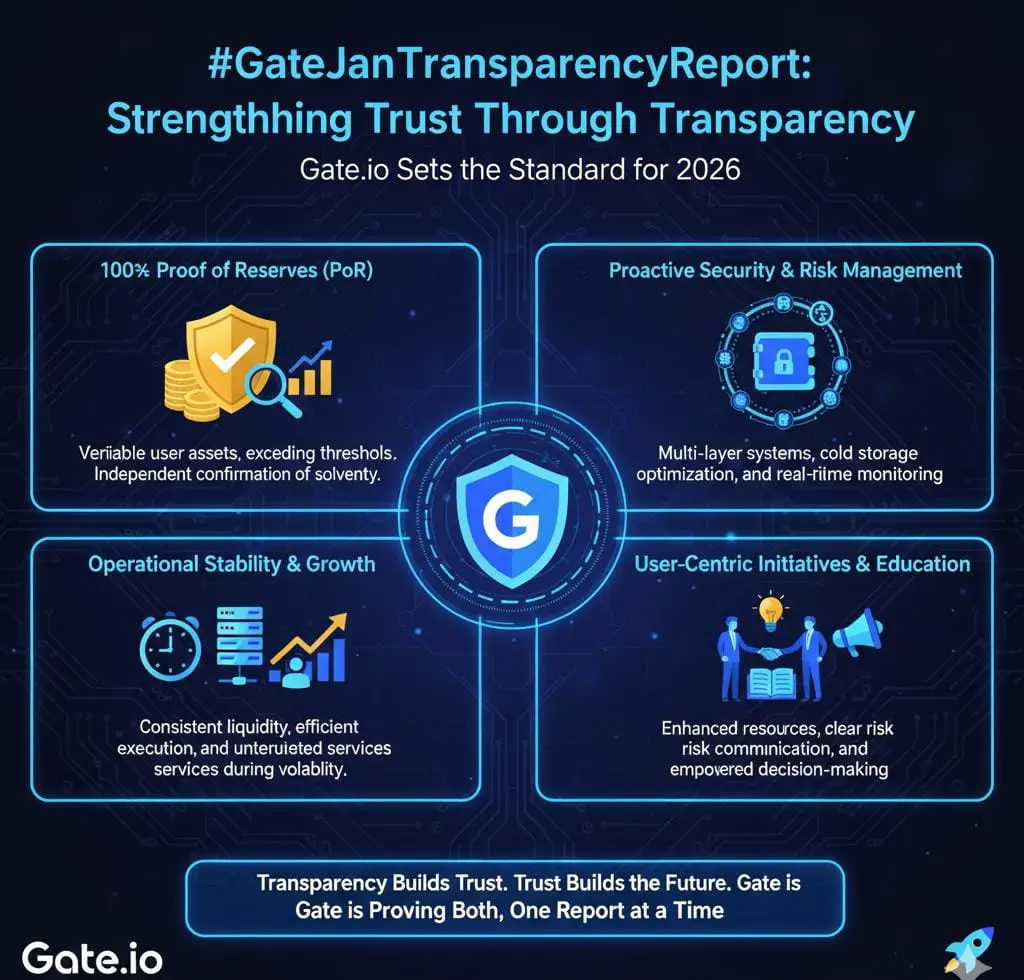

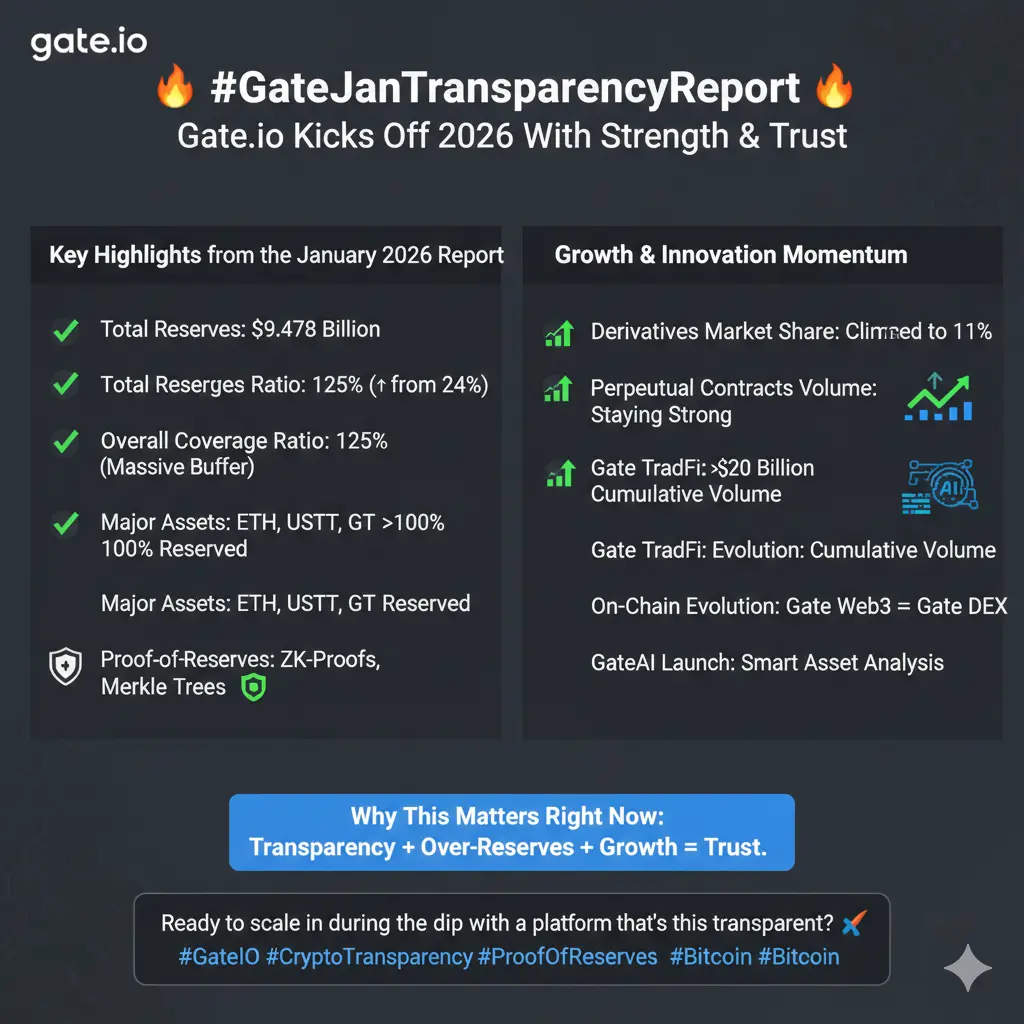

#GateJanTransparencyReport #GateJanTransparencyReport

Gate.io has released its January transparency report, offering a detailed view of exchange operations, user activity, and token flows. Transparency reports have become a key tool for assessing the integrity and accountability of cryptocurrency exchanges. By disclosing data on withdrawals, reserves, trading volume, and asset custody, exchanges build trust with users and regulators while providing a clearer picture of market health.

According to the report, Gate.io has continued to demonstrate robust operational controls and a focus on risk m

Gate.io has released its January transparency report, offering a detailed view of exchange operations, user activity, and token flows. Transparency reports have become a key tool for assessing the integrity and accountability of cryptocurrency exchanges. By disclosing data on withdrawals, reserves, trading volume, and asset custody, exchanges build trust with users and regulators while providing a clearer picture of market health.

According to the report, Gate.io has continued to demonstrate robust operational controls and a focus on risk m

- Reward

- 3

- 7

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#TopCoinsRisingAgainsttheTrend

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

- Reward

- 7

- 7

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

BUT

BUT

Created By@DreamyRain

Subscription Progress

0.00%

MC:

$0

Create My Token

35X on $LIQUID$40K to $1.55MIL MCAPPRINTING SEASON BABY got loads more coming!!!🍿

- Reward

- like

- Comment

- Repost

- Share

Whales are still buying: BitMine-linked addresses scoop up another 20,000 ETH, worth over $40 million

- Reward

- like

- Comment

- Repost

- Share

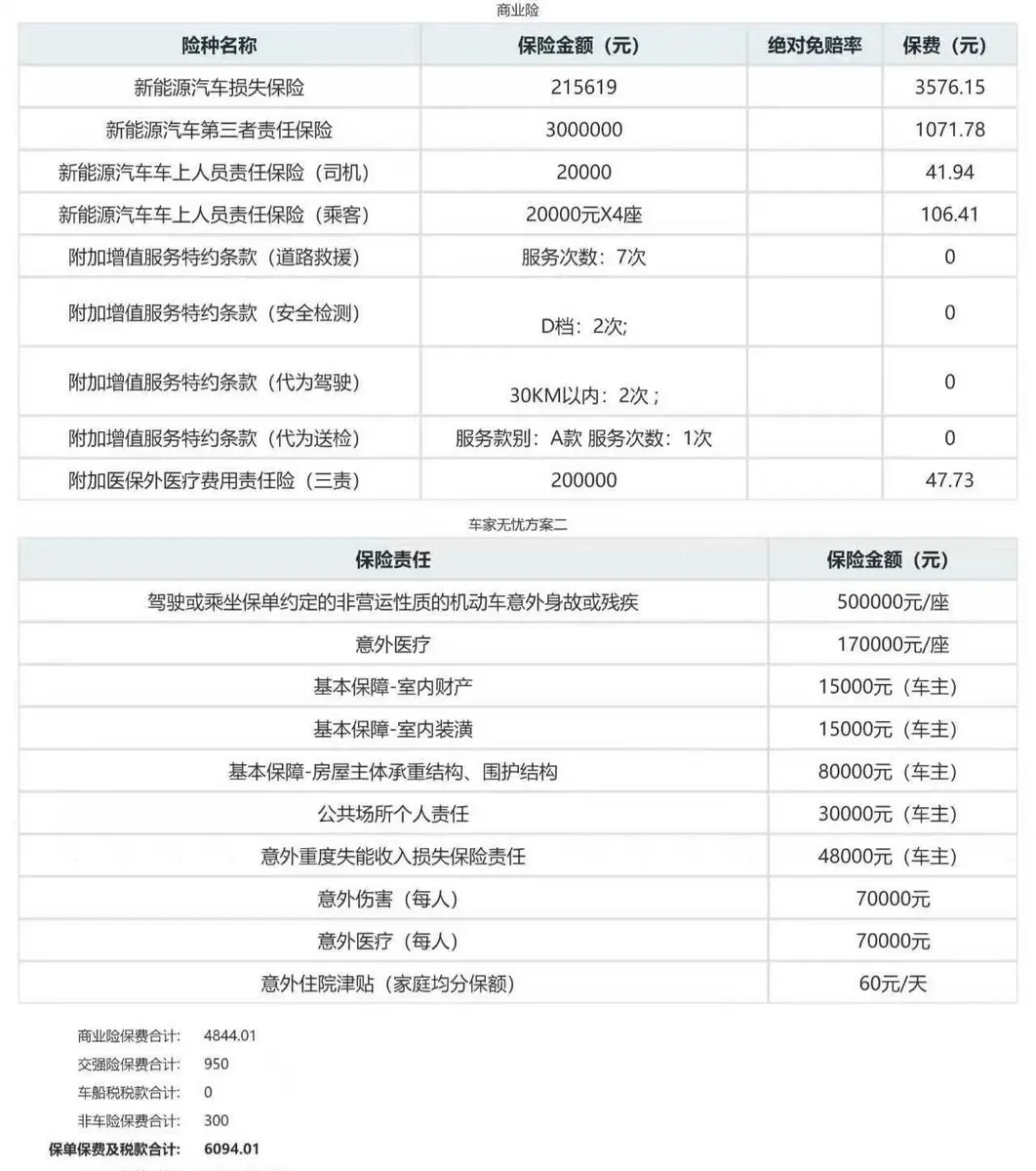

It was already a less-than-wealthy family, and things got worse when the car insurance expired. The quote was 6100 yuan, and the usual net price was about 4000 yuan. Last year, on a dark and stormy night with heavy rain, I stubbornly went to play PUBG and ended up crashing into a person and a car in the parking lot, damaging the headlights. The insurance payout was 23,000 yuan, which caused the net price of the car insurance this year to be 5400 yuan. The salesperson said, "Sis, next time you crash, try to control it a bit. Usually, if it's within 15,000 yuan, it won't affect the price the fol

View Original

- Reward

- like

- Comment

- Repost

- Share

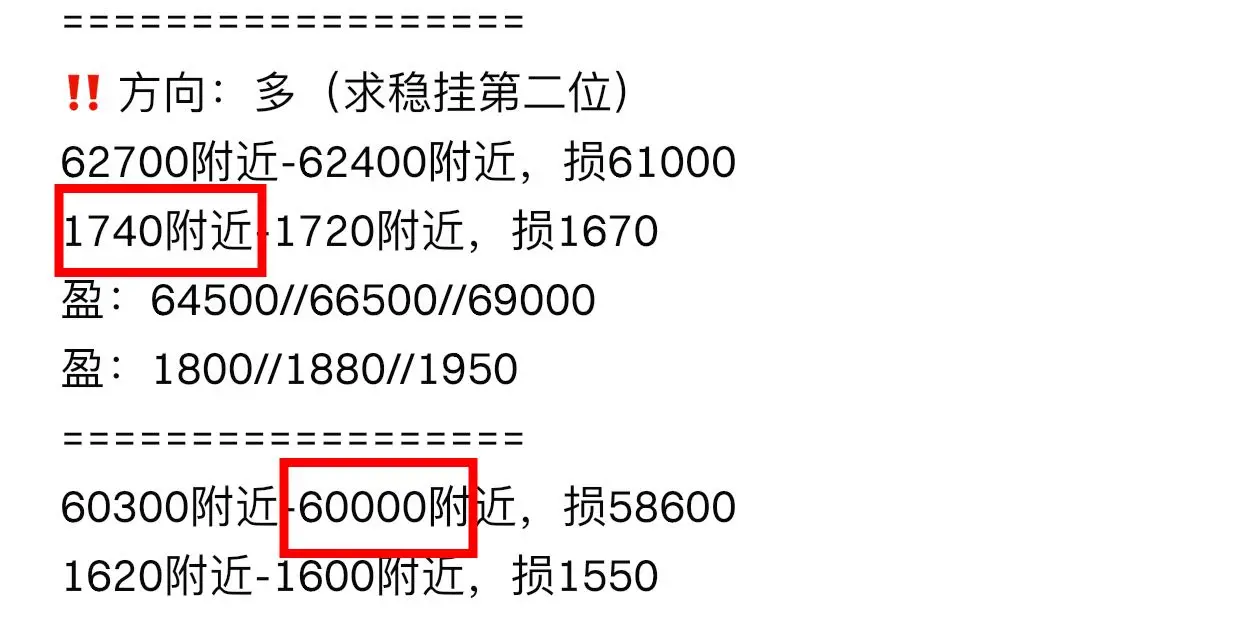

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

Give me some USDT PLEASE Please Please 🥺

https://www.gate.com/referral/registry?ref=VQNFXAXBUQ&ref_type=103&page=superRebate

#BuyTheDipOrWaitNow? #CryptoMarketPullback #GateJanTransparencyReport

https://www.gate.com/referral/registry?ref=VQNFXAXBUQ&ref_type=103&page=superRebate

#BuyTheDipOrWaitNow? #CryptoMarketPullback #GateJanTransparencyReport

- Reward

- like

- Comment

- Repost

- Share

Live Trading and Learning with Chillzzz

- Reward

- like

- Comment

- Repost

- Share

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/4020?ref=UFRFAQ0M&ref_type=132

- Reward

- 2

- 2

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

BTC closes green and suddenly life makes sense.#Crypto #NFTs

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

汗血宝马

汗血宝马

Created By@gatefunuser_22b1

Listing Progress

100.00%

MC:

$8.03K

Create My Token

#GateJanTransparencyReport (//(?//?//??//??/(/!/؟/ Rethink and reconsider the previous message, as it appears to contain random characters and incomplete words.

View Original

- Reward

- like

- Comment

- Repost

- Share

【$BREV Signal】Long | Healthy Pullback After Volume Breakout

$BREV After experiencing a strong surge of over 15%, it is currently consolidating in a narrow range below the previous high resistance zone. The 4H chart shows a volume breakout followed by a volume contraction, which is a typical healthy reset rather than a top distribution.

🎯Direction: Long

🎯Entry: 0.1640 - 0.1660

🛑Stop Loss: 0.1590 (Rigid Stop Loss)

🚀Target 1: 0.1800

🚀Target 2: 0.1900

Hardcore Logic: 1) Price Action (PA): After a volume-driven bullish candle breakout, the retracement low is higher than the previous mid-range

View Original$BREV After experiencing a strong surge of over 15%, it is currently consolidating in a narrow range below the previous high resistance zone. The 4H chart shows a volume breakout followed by a volume contraction, which is a typical healthy reset rather than a top distribution.

🎯Direction: Long

🎯Entry: 0.1640 - 0.1660

🛑Stop Loss: 0.1590 (Rigid Stop Loss)

🚀Target 1: 0.1800

🚀Target 2: 0.1900

Hardcore Logic: 1) Price Action (PA): After a volume-driven bullish candle breakout, the retracement low is higher than the previous mid-range

- Reward

- like

- Comment

- Repost

- Share

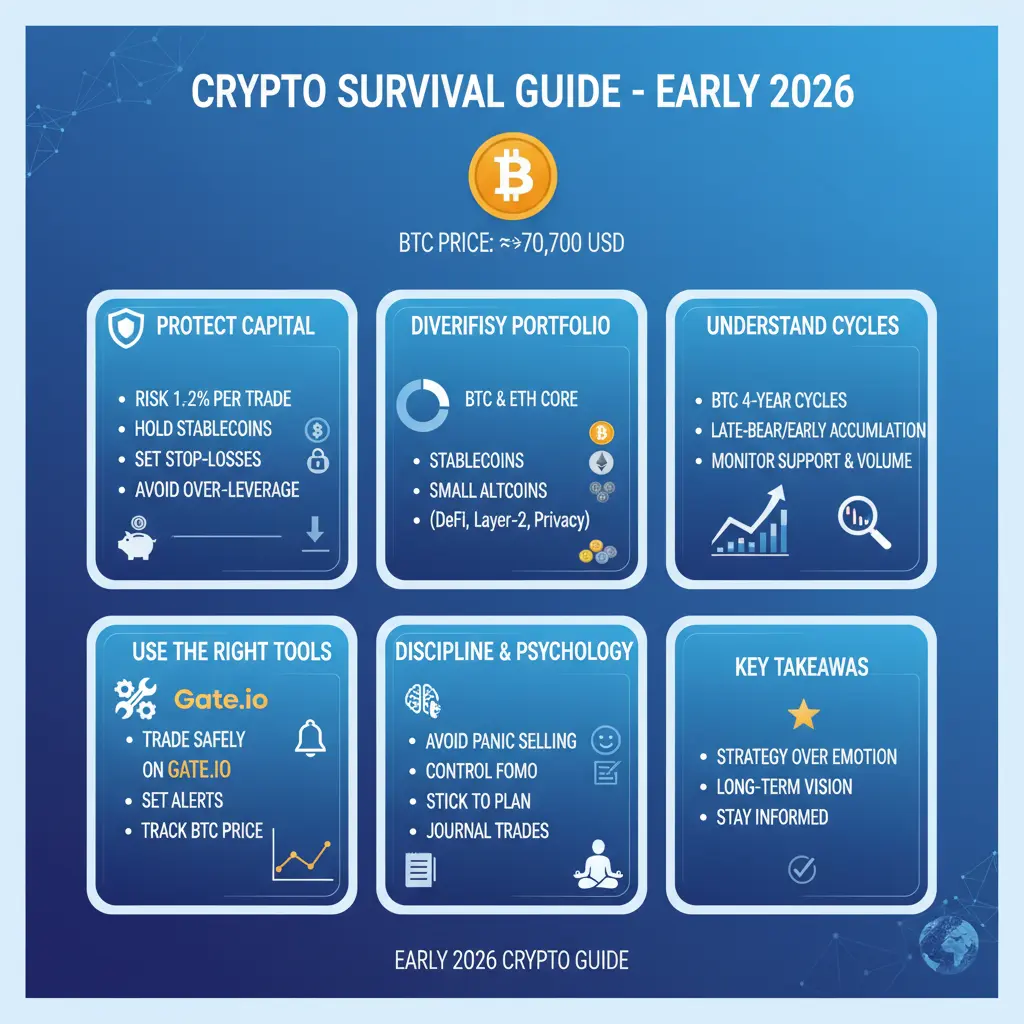

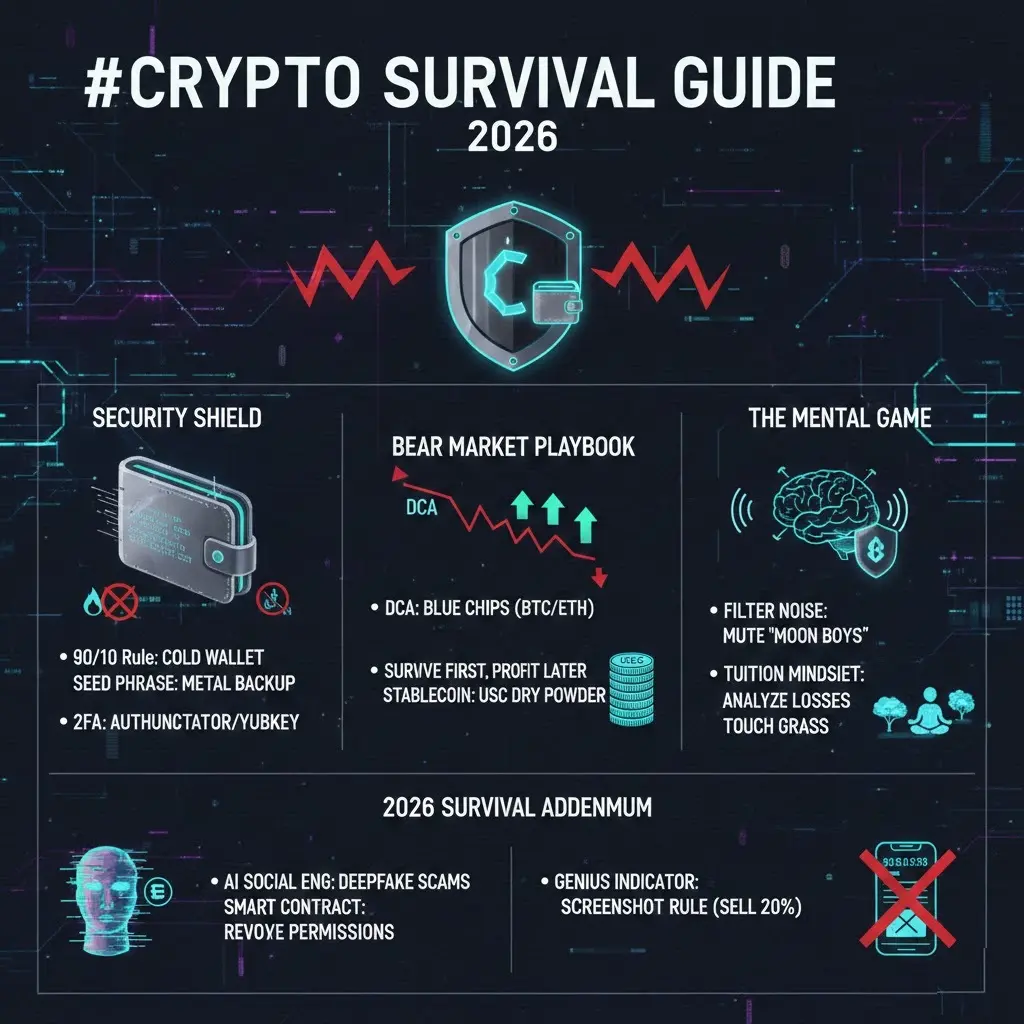

#CryptoSurvivalGuide #CryptoSurvivalGuide

Navigating the cryptocurrency market requires more than just technical knowledge or luck. The market is volatile, complex, and constantly evolving. A survival guide for crypto investors and traders is not simply about picking coins or timing the market; it is about understanding cycles, managing risk, and maintaining discipline in an environment where emotion can drive extreme outcomes.

The first principle of survival in crypto is understanding volatility. Prices can swing dramatically in a matter of hours. What may appear as a crash can quickly become

Navigating the cryptocurrency market requires more than just technical knowledge or luck. The market is volatile, complex, and constantly evolving. A survival guide for crypto investors and traders is not simply about picking coins or timing the market; it is about understanding cycles, managing risk, and maintaining discipline in an environment where emotion can drive extreme outcomes.

The first principle of survival in crypto is understanding volatility. Prices can swing dramatically in a matter of hours. What may appear as a crash can quickly become

- Reward

- 5

- 9

- Repost

- Share

ybaser :

:

New Year Wealth Explosion 🤑View More

#BitcoinDropsBelow$65K #BitcoinDropsBelow$65K

Bitcoin has slipped below the key psychological level of sixty-five thousand dollars, triggering a wave of reactions across markets, newsfeeds, trading desks, and investor portfolios. This move has drawn attention not only because of the price level itself but because of what it represents in the broader context of market sentiment, macro uncertainty, and the evolving narrative around digital assets.

The decline reflects a complex interplay of supply and demand dynamics, wider risk appetite shifts, and the psychological impact of breaking an import

Bitcoin has slipped below the key psychological level of sixty-five thousand dollars, triggering a wave of reactions across markets, newsfeeds, trading desks, and investor portfolios. This move has drawn attention not only because of the price level itself but because of what it represents in the broader context of market sentiment, macro uncertainty, and the evolving narrative around digital assets.

The decline reflects a complex interplay of supply and demand dynamics, wider risk appetite shifts, and the psychological impact of breaking an import

- Reward

- 4

- 7

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#btc$btc As narrative fades, value emerges: the market is completing a critical “stress test”

Key dynamic insights:

1. Is the “digital gold” narrative collapsing? No, it’s the “speculative bubble” being squeezed out.

◦ Increased correlation indicates that crypto assets are being officially priced by global capital markets, a necessary step toward maturity. Each reconfiguration of correlation is a process of long-term value anchoring.

2. Is there a massive withdrawal of institutional funds? No, it’s a “liquidity pressure release” in the short term.

◦ The phased outflow from ETFs is a normal

Key dynamic insights:

1. Is the “digital gold” narrative collapsing? No, it’s the “speculative bubble” being squeezed out.

◦ Increased correlation indicates that crypto assets are being officially priced by global capital markets, a necessary step toward maturity. Each reconfiguration of correlation is a process of long-term value anchoring.

2. Is there a massive withdrawal of institutional funds? No, it’s a “liquidity pressure release” in the short term.

◦ The phased outflow from ETFs is a normal

BTC-1,68%

- Reward

- 6

- 8

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

【$QNT Signal】Short position + Rebound meets resistance, main force's intention unclear

$QNT shows a technical rebound after a sharp decline, but the price encounters resistance in the key zone (65.6-65.7), and the rebound is accompanied by stable open interest and Taker selling, indicating it is not a healthy accumulation signal.

🎯 Direction: Short

Market logic: The price violently rebounded from 56.68 to 65.7, but the 4H chart shows consecutive long upper shadows, indicating heavy selling pressure above. Key data: 1) OI trend is stable, suggesting the rebound is not driven by new long posi

View Original$QNT shows a technical rebound after a sharp decline, but the price encounters resistance in the key zone (65.6-65.7), and the rebound is accompanied by stable open interest and Taker selling, indicating it is not a healthy accumulation signal.

🎯 Direction: Short

Market logic: The price violently rebounded from 56.68 to 65.7, but the 4H chart shows consecutive long upper shadows, indicating heavy selling pressure above. Key data: 1) OI trend is stable, suggesting the rebound is not driven by new long posi

- Reward

- like

- Comment

- Repost

- Share

#CMEGroupPlansCMEToken 🏦 CME Group Plans Proprietary Digital Token — “CME Token” Could Power 24/7 Crypto Trading & Tokenized Collateral

In a major signal of traditional finance embracing blockchain infrastructure, CME Group, the world’s largest derivatives marketplace, is exploring the launch of a proprietary digital token, informally dubbed the “CME Token”. The news emerged during CME’s Q4 2025 earnings call in early February 2026, where Chairman and CEO Terrence Duffy highlighted initiatives to modernize post-trade processes through tokenized cash and decentralized settlement systems.

Duffy

In a major signal of traditional finance embracing blockchain infrastructure, CME Group, the world’s largest derivatives marketplace, is exploring the launch of a proprietary digital token, informally dubbed the “CME Token”. The news emerged during CME’s Q4 2025 earnings call in early February 2026, where Chairman and CEO Terrence Duffy highlighted initiatives to modernize post-trade processes through tokenized cash and decentralized settlement systems.

Duffy

- Reward

- 1

- 6

- Repost

- Share

Peacefulheart :

:

1000x VIbes 🤑View More

- Reward

- 6

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More146.42K Popularity

34.52K Popularity

393.24K Popularity

15.02K Popularity

13.54K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreOverview of popular cryptocurrencies on February 8, 2026, with the top three in popularity being: SIREN, BREV, PTB

9 m

Arthur Hayes: There is no secret conspiracy behind the crypto market crash. The collapse was driven by a combination of factors including regulatory crackdowns, market overleveraging, and macroeconomic pressures. Many believe that the downturn was a natural correction after a period of excessive speculation, rather than the result of any hidden plot. Investors should remain cautious and focus on fundamentals rather than conspiracy theories.

10 m

Arthur Hayes: There is no secret conspiracy causing crashes in the cryptocurrency market

16 m

Trend Research Sells Additional 20,770 ETH Worth $43.57M, Retains Only 10,303 ETH

33 m

Market Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

1 h

Pin